An $80 Billion Estate & Gift Tax Valuation Update

3 Things to Do When Selecting a Business Appraiser

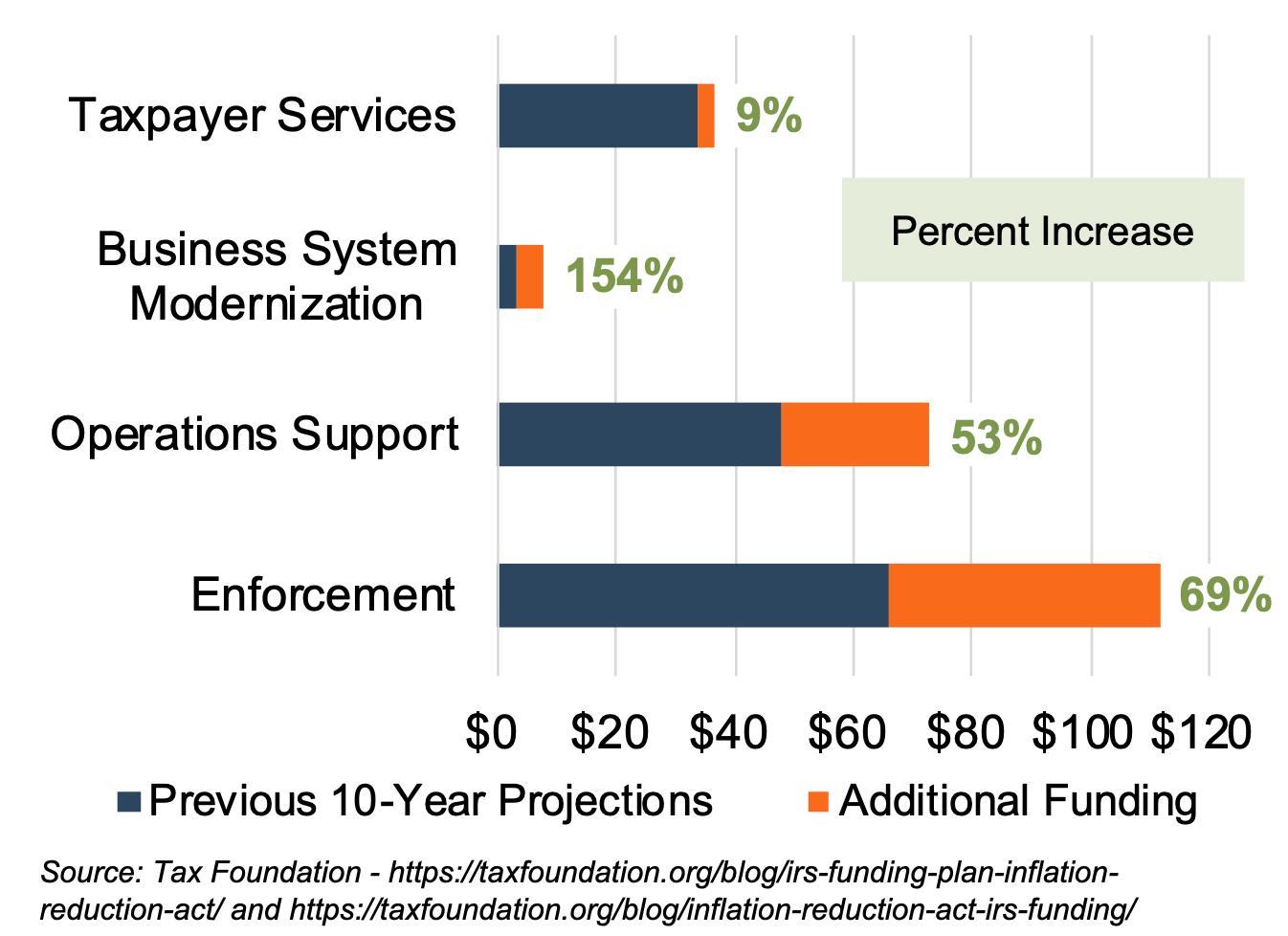

How would you spend $80 billion in new funding? Much politicking and articles have been written about the Inflation Reduction Act. One piece of that legislation that will impact every taxpayer is an increased IRS of roughly $80 billion over the next ten years. The Tax Foundation analyzed how the IRS plans to deploy additional funding, as shown in Figure 1.

Figure 1 :: IRS Funding Increases per Inflation Reduction Act

Noticing “money sent back to my bank account” didn’t make the list, one quickly notices “Enforcement” getting the largest dollar increase over the next ten years at nearly $46 billion. The IRS lists five objectives in its 2023 strategic operations plan. One of the objectives includes: “Focus expanded enforcement on taxpayers with complex tax filings and high-dollar noncompliance to address the tax gap.” Again, from the Tax Foundation:

“Digging more into the specifics of enforcement, individual initiatives acknowledge some of the trade-offs in expanded enforcement operations. Within the third objective, dedicated to expanded enforcement, five of the seven initiatives involve expanded enforcement on certain types of taxpayers: large corporations, large partnerships, high-income and high-wealth individuals, other areas where IRS audit coverage has declined (including employment, excise, and estate and gift taxpayers), and developing areas such as digital assets.”

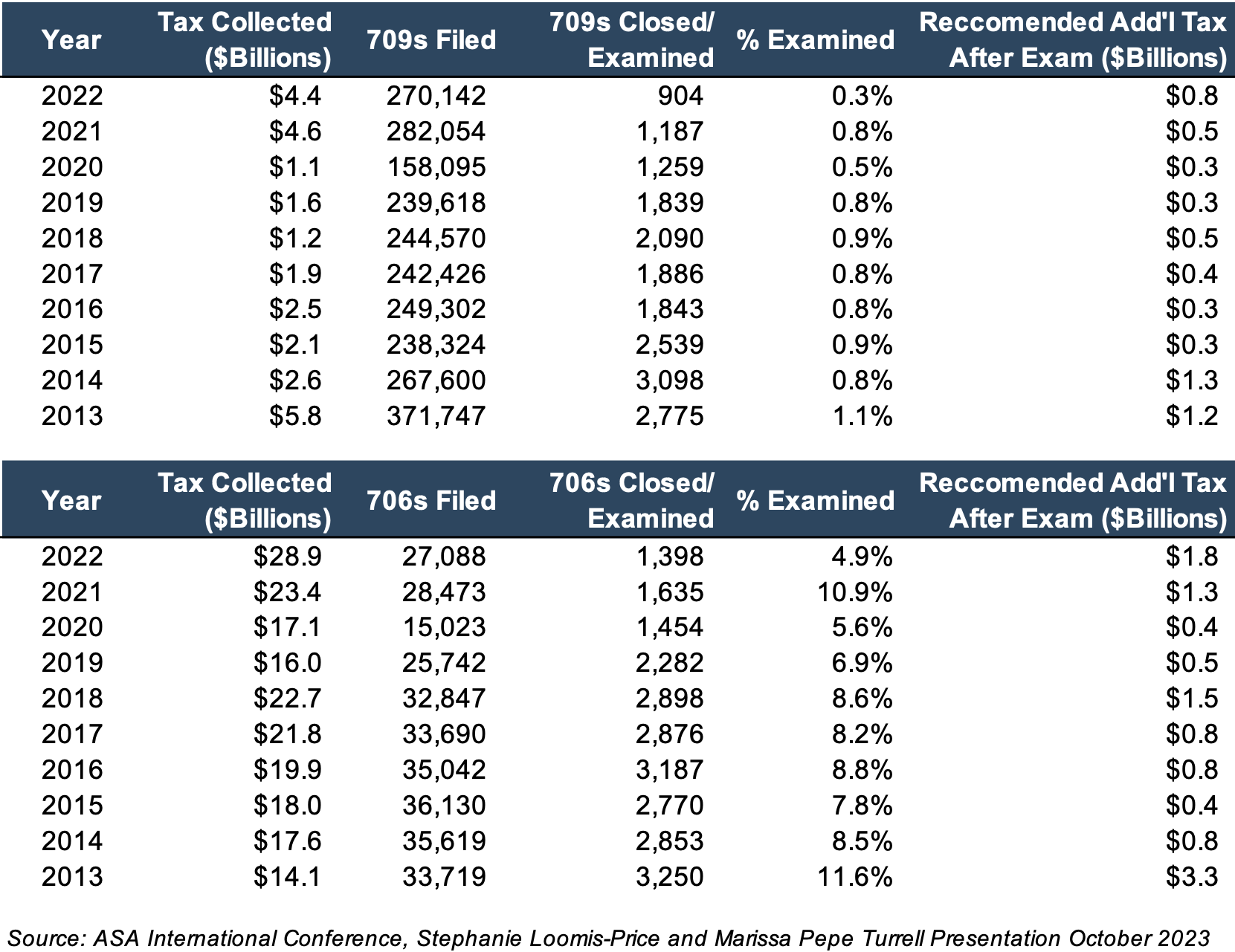

A recent presentation by Stephanie Loomis-Price and Marissa Pepe Turrell at the ASA’s International Conference summarized 709 (gift) and 706 (estate) filings and audit rates, excerpted in Figure 2 below.

Figure 2 :: Gift and Estate Tax Filings and Audit Rates

Total gift tax audits have been just under 1% for the last decade, and estate tax audits have been around 10% on average, per Figure 2. And while audit rates have remained stable overall for gift and estate tax filings, one doesn’t have to connect too many dots to see that may be changing. Much has been written on declining audit rates, and policymakers have explicitly said they plan to audit wealthier Americans. So, with plenty of dry powder to beef up enforcement and looming changes to the estate tax horizon (including a reduction in the estate and gift tax exemption), family businesses and estate planners need to be cognizant of the changing tax landscape and increased audit scrutiny.

3 Things Family Businesses Should Do When Selecting a Business Appraiser

How do business appraisers fit into this shifting gift and estate tax paradigm? If your gift tax return involves a business valuation, having a trusted and reputable valuation firm as part of your estate planning roster is more important than ever. Below are three criteria that can help you think about who you want in your corner.

- Insist on an appraiser with experience and credentials. Each business appraisal is unique, and experience counts. Most business valuation firms are generalists rather than industry specialists, but the experience gained in discussing operating results and industry constraints with a broad client base gives the appraisal firm substantial ability to understand the client’s specific situation. Credentials do not guarantee performance, but they do indicate a level of professionalism for having achieved and maintained them. Family businesses and their estate planning counsel should insist upon them.

- Involve the appraiser early on. One of the most common concerns such owners cite around long-term planning is the ability to transfer ownership of the family business to the next generation in the most tax-efficient way. Even in seemingly straightforward gift and estate tax planning, it is helpful to seek the advice of a business appraiser as part of the planning process. Understanding the finer points around fair market value, the levels of value, discounts for lack of marketability, and ultimately estimated tax liabilities are all questions a business appraiser should be able to provide feedback and guidance upon.

- Expect the best. In most cases, the fee for appraisal services is nominal compared to the dollars at risk. The marginal cost of getting the best is negligible. Family businesses can help their appraiser do the best job possible by ensuring full disclosure and expecting an independent opinion of value. The best appraisers have the experience and credentials described above but recognize the delicate balance between the inherent art and science when valuing private companies.

Mercer Capital has been performing business appraisals for over 40 years and has a long track record of delivering reasonable and supportable business valuations. Our team of professionals is ready to help you and your clients navigate your valuation challenges.

Family Business Director

Family Business Director