Bear Market Silver Lining? An Estate Planning Opportunity

As we highlighted previously in the Family Business Director blog, companies are beginning to batten down the hatches and prepare for stormy weather. The risk of a recession continues to escalate, and inflation printed a new four-decade high in May. Former Fed Chair and current Treasury Secretary, Janet Yellen, appeared before Congress to answer questions regarding inflation, which she sees as staying elevated for an extended period. Gas prices hit a nationwide average of $5 a gallon for the first time ever in the United States, and little relief is on the horizon.

The Fed expects to continue raising rates to battle inflation, and a new law was passed unanimously in the House and Senate to ban the word “transitory,” which awaits President Biden’s signature. Well, maybe the last one was just floated in committee.

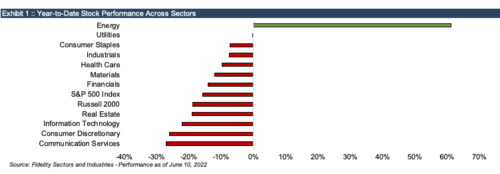

All to say, companies and consumers alike are feeling the squeeze, and markets are reflecting less-than-rosy expectations. At the time of this writing, the S&P 500 was down almost 16% year-to-date, while the Russell 2000 was down almost 19%. Outside the energy sector, stocks are bleeding red in 2022. Lower broad market pricing translates to lower valuations for family businesses.

Click here to enlarge the image

So what? Well, for family businesses undertaking long-term intrafamily transfers and gifting plans, a market downturn represents an opportunity to reduce estate and gift tax exposure by considerable margins. How? We explain below.

Fair Market Value

If you are reading this post, you are likely familiar with the gift and estate tax process in the valuation of private company stock. To consummate an intrafamily transfer (via gift or sale) companies generally must retain a business appraiser to determine the fair market value of shares. Appraisers use a two-step process:

- Appraisers estimate the value of the business as if the shares were publicly traded. In other words, they consider how public market investors would view the shares if they had the opportunity to purchase them in the stock market.

- Appraisers consider an appropriate discount, or reduction in value, to account for the fact that the shares in the family business are privately held, rather than publicly traded. All else equal, investors prefer to have liquidity. In order to accept the illiquidity inherent in private company shares, investors require a marketability discount. The size of the marketability discount depends on several factors, including the expected holding period, yield, capital appreciation, and incremental risks associated with illiquidity.

Based on the downturn in the market, the fair market value of minority shares in family businesses is likely lower today than it was just a couple of months ago. It does not matter if your family has no intention of selling the family business at a reduced value; the fact is that – if you were to sell an illiquid minority interest now – the value would reflect current market conditions. The IRS itself makes this clear in Revenue Ruling 59-60:

The fair market value of specific shares of stock will vary as general economic conditions change from ‘normal’ to ‘boom’ to ‘depression,’ that is, according to the degree of optimism or pessimism with which the investing public regards the future at the required date of appraisal. Uncertainty as to the stability or continuity of the future income from a property decreases its value by increasing the risk of loss of earnings and value in the future.

The potential silver lining to the cloud of depressed market values is that it provides an opportunity for more tax-efficient transfers of family wealth for estate planning purposes.

Long-Term Mindsets and Estate Planning

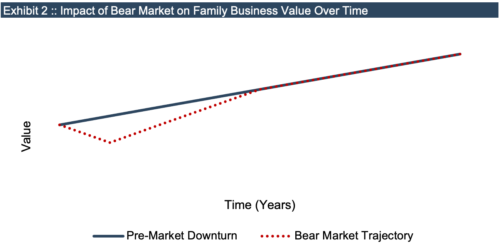

Factors leading stocks lower are real and are affecting public and private companies alike: continued supply chain bottlenecks, rising input prices and limited ability to pass along to consumers, distressed margins, and low consumer confidence all will cause pain in the short term. However, private family businesses have the benefit of time, and a resilient family business should return to form once issues plaguing markets subside. Exhibit 2 depicts the expected value trajectory for a family business, including a bear market downturn.

The immediate impact is straightforward: the magnitude of the dollar gift for the same amount of ownership or stock is reduced relative to prior periods. Exhibit 3 shows a simple example of the current market downturn on transfers of private company stock.

How does this benefit private companies engaged in estate planning?

- If the transfer is a gift, the debit against the lifetime estate and gift tax exemption of the gifting party is reduced, leaving more room to make future gifts (both estate and gift) tax-free. Since the ownership percentage transferred remains the same, the receiver’s resulting ownership percentage is unchanged.

- If the transfer is a sale, the buyer (likely a younger generation) can buy into the business at a more favorable price.

- Both of these strategies reduce the transferer’s total estate by a larger amount, assuming measurement of the estate (ie, death) comes later once the company’s valuation has recovered.

Final Thoughts – Keep an Eye on Rates and the Calendar

A couple of final thoughts you should also keep in mind related to estate planning in the current environment.

- Private Loan Rates: The IRS publishes monthly tables identifying what is known as the applicable federal rate or AFR. The AFR is significant for estate planning because it establishes the threshold interest rate for private loans. While rates have ticked up, rates are still well below commercially available rates. The Federal Reserve is, however, planning to aggressively continue hiking rates to battle inflation, making these “on-sale” prices unlikely to last.

- For family businesses and estate planners, while the transfer exemptions remain at current levels, they are still set to drop by 50% on January 1, 2026. The Treasury Department has confirmed the additional transfer tax exemption under current law is a “use it or lose it” benefit. If a taxpayer uses the “extra” exemption before it expires (by making lifetime gifts), it will not be “clawed back” to cause additional tax if the taxpayer dies after the exemption is reduced. The window to capture the current exemption is undoubtedly closing, and family businesses will likely only get so many more bites at this apple before it turns sour.

The example in this post is simple and perhaps obvious, and our reminders may be old news. However, we understand it is hard to have a long-term mindset when things take a sudden downward turn. Being opportunistic in stormy weather makes for better sunny days ahead.

Family Business Director

Family Business Director