Recession, Expectations & Value

The uncertain macroeconomic environment is causing corporate managers to consider how a recession would influence their businesses. Last week, the Wall Street Journal published comments from eleven public company CFOs discussing their expectations for how their businesses would fare if the expected economic downturn occurs.

Perhaps not unexpectedly, the CFOs interviewed by the Journal were generally optimistic regarding the outlook for their companies in the event of a recession.

- Some focused on how recession-resilient their industries are, including Big Lots (discount retail), Match Group (online dating), Anheuser-Busch InBev (beer), and Olaplex Holdings (beauty products). The CFO of Tripadvisor anticipated that 2+ years of pandemic-induced cabin fever will put travel at the top of consumers’ wish lists even amid a recession.

- Others highlighted actions that they have already taken, or can take, to mitigate the effects of a downturn: ClubLending has tightened credit standards for hourly workers, the CFO of Williams-Sonoma cited the ability to cut expenses and reduce inventory and capital spending, PerkinsElmer indicated that a larger base of recurring revenue will put the company in good stead, and Krispy Kreme discussed the company’s strategy of expanding distribution points.

- Finally, the CFO of Applied Materials replied that – in terms of order flow – no slowdown in demand is evident yet, while the CFO of Whirlpool believes that pandemic-related demand will continue to outpace constrained supply.

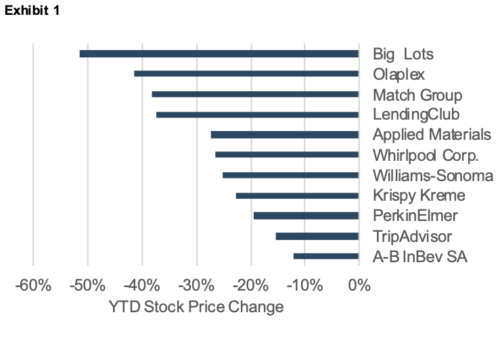

How realistic are these expectations? Only time will tell; however, since all eleven companies are publicly traded, we can see how investors are grading those expectations. Exhibit 1 summarizes year-to-date share price performance for each company.

Consistent with general stock market trends, share prices are down for each company, with Anheuser-Busch InBev faring the best (-12%) and discount retailer Big Lots feeling the most pain (-51%). Investors seem to be on board with the thesis that beer consumption is recession-proof but less convinced about the prospects for Big Lots.

Consistent with general stock market trends, share prices are down for each company, with Anheuser-Busch InBev faring the best (-12%) and discount retailer Big Lots feeling the most pain (-51%). Investors seem to be on board with the thesis that beer consumption is recession-proof but less convinced about the prospects for Big Lots.

Your family business doesn’t receive a daily grade from the market, but you do have expectations for the future. How will your family business fare if a recession sets in, and how are expectations affecting the value of your family business today? When discussing value, we find it helpful to group expectations into three primary categories: cash flow, risk & return, and growth.

Cash Flow

Value is not a “what have you done for me lately?” game – it is a “what will you do for me tomorrow?” game. How will stubbornly high inflation, tight labor markets, and persisting supply chain disruptions affect the cash flows for your family business over the next year?

- What effect will rising prices have on demand for your product or service? Are your customers net beneficiaries of rising price levels, or will rising prices put a dent in their propensity to spend on your product?

- How are labor availability and wage pressures influencing the cost of doing business for you? Are you able to pass higher operating costs along in the form of higher prices, or are your profit margins getting squeezed?

- Is maintaining an appropriate level of working capital tying up more of your cash flow? Have supply chain disruptions caused you to hold larger quantities of more expensive goods? Are any of your customers facing financial distress that could stretch out collections?

- Is the increasing cost of capital goods reducing cash flow that would otherwise be available for debt service or owner distributions?

Risk & Return

Since the end of 2021, yields on long-term treasury securities have increased from 1.94% to around 3.30%. Our colleague Brooks Hamner, CFA, ASA wrote about the inverse relationship between interest rates and valuation multiples several weeks ago. While Brooks was writing specifically about the value of investment management firms, his observations apply broadly to all companies. In short, all else equal, rising interest rates put downward pressure on the value of all financial assets.

But thinking about your family business specifically, how have expectations regarding risk evolved as the economic picture has become murkier? Like A-B InBev, do you have a compelling case that your family business really is recession-proof? Or would investors be skeptical of the strategies at your disposal to counteract the negative effects of a broader economic slowdown?

Growth

Finally, how would a prolonged recession change the ground rules for your industry and the effectiveness of your family business’s growth strategy? Would a downturn cause you to defer capital investment in support of the next growth engine for your family business? Or, would a slowdown allow you to capture market share at the expense of financially-weaker competitors? How could the structural changes that accompany economic disruptions alter the demand trajectory for your product or service?

Conclusion

Cash flows, risk & return, and growth provide a helpful framework for evaluating expectations for your family business. If the Wall Street Journal had called you last week, what would you have told them about your plans?

Family Business Director

Family Business Director