Dividend Reminders

Takeaways from General Electric

The recent announcement that General Electric is slashing its shareholder payouts by more than 90% has put dividends in the headlines in recent days. The news coverage provides an opportunity for family business directors to re-visit dividend policy at their own companies. While we wouldn’t want to suggest that the GE dividend news tells savvy family business directors anything they didn’t already know, a few reminders about dividend basics seem fitting.

Reminder #1: In the Long Run, Earnings Must Support Dividends

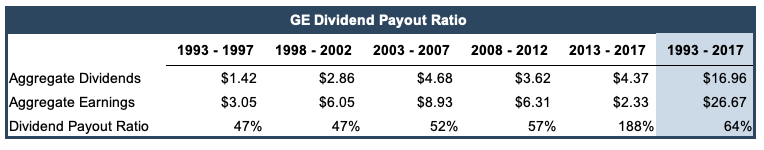

Despite the often breathless reporting of the GE dividend cut, it really should not have been too surprising in the context of earnings struggles at the conglomerate over the past several years. While the potential stability of dividends is often lauded, only profitable companies can sustain dividends. The relationship between earnings and dividends is called the dividend payout ratio. While a company may pay a dividend in excess of earnings in any given year, on a cumulative basis, the dividend payout ratio cannot exceed 100%. The following table summarizes the dividend payout ratio at General Electric over the past twenty-five years.

During the first ten years of our sample period (corresponding roughly to the peak of the Jack Welch era), General Electric paid out 47% of earnings to shareholders, retaining the rest for reinvestment. Over the next decade, the dividend payout ratio increased to 57%. This can be interpreted in one of two ways. Either the company was retaining less in response to a more difficult investing environment, or earnings simply did not keep pace with dividends. Where things become unsustainable is when dividends exceed earnings, as they did in the most recent five year period. Sustained dividends in excess of earnings means that new investors are providing returns to existing investors, and that’s called a Ponzi scheme.

What is your family business’s dividend payout ratio? Is it trending in a particular direction? If so, is that intentional, or simply a matter of drift that eventually will need to be corrected?

Reminder #2: Dividends Mitigate Shareholder Risk

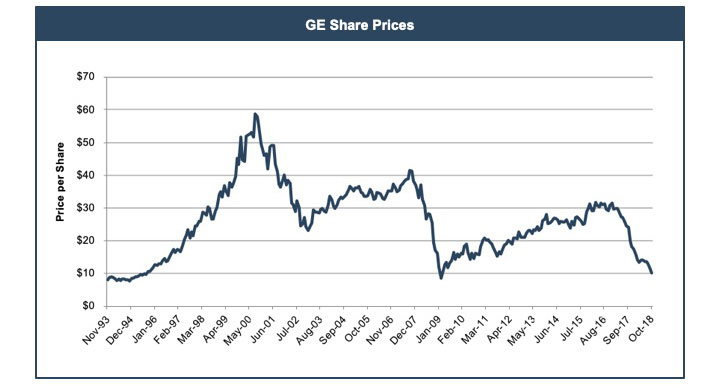

Corporate finance texts tend to emphasize the role and function of dividends from the company’s perspective, and downplay or ignore the shareholders’ perspective. In family businesses, dividends are often viewed solely as a means of providing current income to finance shareholder consumption (and that’s not a bad thing – everybody likes a little mailbox money). However, too many family business directors tend to ignore the role of dividends in mitigating the risk of shareholder returns. On the far side of all the earnings turbulence described above, the GE share price is essentially unchanged over the past twenty-five years. Despite having traded as high as $60 per share in 2000, GE shares are currently changing hands at about $10 per share, compared to about $8 per share in 1993. For a buy-and-hold investor, capital appreciation has been negligible. However, over that same period, shareholders have collected nearly $17 per share in dividends, and no amount of future market gyrations can take that away.

Business value accrues slowly, but can evaporate quickly. Even at good companies, like GE. Even at stable family businesses. When I was in business school in the late 90’s, GE was the epitome of a well-run company, and it would have been unthinkable to my cohorts and me that the company might decrease in value over the next two decades. All businesses are susceptible to future decreases in value, whether of the slow-drip or sudden “black swan” variety. For family business shareholders, who often don’t have the luxury of diversified portfolio holdings, dividend payments can provide a needed cushion to returns in the event of a material decrease in share value.

Where have the returns to your family shareholders come from: dividends or capital appreciation? What do your family shareholders’ personal balance sheets look like? Can they withstand a sudden (and sustained) decrease in share value?

Reminder #3: Dividends Are a Signaling Device

Not only do dividends provide current income and mitigate shareholder risk, but they are also an efficient means of signaling the board’s outlook for the company to shareholders. The dividend cut at GE provides at least two important signals to investors. First, the dramatic reduction signals to shareholders that there is no easy way out from the current mess. GE is in capital preservation mode – the dividend is not being cut to fund suddenly abundant investment opportunities, but because the board expects earnings to remain depressed for some time. Foregoing dividend payments will help shore up GE’s balance sheet and enhance the company’s ability to undertake the restructuring necessary for long-term sustainability. Second, the GE board’s decision to preserve a $0.01 per share dividend signals to shareholders that the company remains on a shareholder-first footing. Once the mess is cleaned up, shareholders should expect the dividend to increase. If GE had cut the dividend entirely, shareholders may well wonder if the board would ever be inclined to bring it back.

Business value accrues slowly, but can evaporate quickly.

For family shareholders, the signaling effect of dividends may be even more pronounced. Public company shareholders receive detailed financial reports every quarter, and the stock market provides a daily assessment of forward expectations for the company. For many family shareholders, in contrast, the most tangible “report” they ever receive on the health of the family business is their dividend check. Even if financial statements are available, many family shareholders don’t really know how to read them, or have the inclination to try. But everyone knows how this year’s dividend check compared to last year’s.

What is your current dividend signaling to your family shareholders? If you were to change the dividend, what signal would that send? How effective is your shareholder relations program? Do your family shareholders know the company’s core strategy and how dividend policy interacts with that strategy, at least in broad outline?

Reminder #4 – Dividends Are Not a “Cost” to the Company

This one may be a touch pedantic, but we think it is important. Various news outlets – including the Wall Street Journal – have discussed how much money the divided cut will “save” the company, as if cutting the dividend were akin to finding a new, cheaper source for office supplies. Dividends are not an expense: they represent one of only two forms of returns to shareholders. Shareholders are not vendors: they own the company.

Dividends are not an expense: they represent one of only two forms of returns to shareholders.

We often observe a similar phenomenon in family businesses. Shareholders (especially those in younger generations) may be treated as if they don’t have a legitimate claim on the company, and a desire for dividends is seen as impertinent or selfish. It may or may not make sense for a given family business to pay a dividend, but in no case are dividends a “cost” to the family business.

Is your family business’s dividend policy rooted in an economic assessment of the available investment opportunities, or is withholding dividends a not-so-subtle strategy for manipulating and controlling family shareholders?

In our experience, dividend policy is the most vexing financial issue facing family business directors. If you need some help asking the right questions about your dividend policy, give one of our professionals a call to discuss your situation in confidence.

Family Business Director

Family Business Director