Double Down or Cash Out: The Reinvestment or Distribution Decision

I recently got back from the AICPA’s Forensic and Valuation Services conference in Las Vegas. While I came back richer in experience and CPE credit, the green felt of the blackjack table was less kind to my wallet.

I had the opportunity to present at the conference on implied market multiples. To save you 75 minutes, multiples in public or private markets represent composite expectations regarding two variables affecting business cash flow: expectations of growth in cash flow and the risk associated with achieving those cash flows. Pricing power, industry position, proprietary processes, and management depth funnel down to risk and growth and, ultimately, your business value.

Matching your family shareholders’ growth objectives with their relative risk tolerance is a key directive for family business directors and one that is tied directly to what your family business means to you. We highlight two corollary questions relating to growth, risk, and business meaning: investing decisions and distribution policy.

Before We Hit the Tables

Before we look at investment and distributions, we have observed that families tend to assign one of four basic meanings to their family business:

Readers of Family Business Director will be familiar with these concepts, but in short, the idea is that your family business’ appetite for growth and risk depends on what meaning your family assigns to the business. As shown below, the meaning of the family business, in turn, influences the company’s dividend policy and investing (as well as financing) decisions.

All on Red?

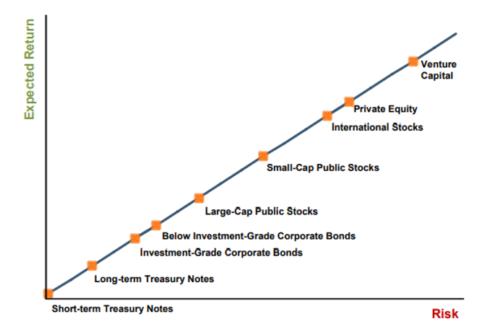

How your family business thinks about investment is tied to how you and the family think about risk and growth. In principle, families make investment decisions from a large menu of potential alternatives (both inside their business and through diversification). The image below illustrates some of the more common risk-return combinations available to investors. To achieve a higher expected return, investors must be willing to accept greater risk.

This concept of accepting higher risk to achieve greater investment returns affects both the family business operator and gambler alike: no risk, no blue chips! For more on risk and return, see our “Corporate Finance in 30 Minutes” whitepaper.

But how do family business directors approach the risk-return question? Going back to the meaning of your family business provides a backdrop for making that decision. For example, if your family business serves as a “Source of Lifestyle,” you are less likely to invest in higher return (higher risk) projects or diversification efforts that could jeopardize current dividends and harm business predictability. Alternatively, suppose your family views the business as the “Economic Growth Engine” meant to grow with your family. In that case, you will likely aim to make investment decisions that maximize the expected return (thus increasing risk) to drive the economic growth of your business for future generations. Ultimately, your goal as a family business operator is to match your family’s risk-return objectives and elucidate your business’s growth and risk profile with family shareholders.

Taking Some Chips Off the Table

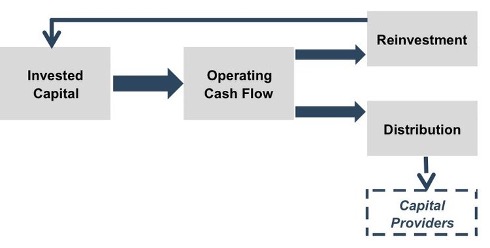

The flip side of reinvestment in your family business is distributions. Net operating cash flows can either be reinvested into your business or paid out to shareholders.

Companies that understand what the business means to them can make distribution decisions that reflect shareholder objectives and needs. Suppose shareholders see the company as a growth engine; they will accept lower distributions to generate higher growth, just as shareholders seeking consistent distribution checks will (or should) accept muted long-term growth.

As we have observed in a previous post, some family businesses appear to avoid paying significant distributions out of earnings on principle: owning shares in the family business should not provide one with disposable income. This “principle” is generally animated by a belief that the family shareholders cannot be trusted with financial resources, “father knows best,” as well as empire building. Ultimately, family business directors need to remember their shareholders are just that: shareholders. While their equity may have been earned through their bloodline, family business owners deserve the same considerations paid to public company shareholders, i.e., a focus on maximizing shareholder value through a mix of good reinvestment opportunities and distributions.

Know When to Hold ’Em and When to Fold ’Em

Both a process of analyzing investment choices (we discuss in detail here) and understanding your family shareholder objectives will help ease the burden of deciding when it’s time to pull some chips off the table and hit the buffet. All family businesses need to evaluate how they invest for future growth and their distribution policies in light of their family’s risk tolerance, growth objectives, and business meaning. If you need help analyzing some of these decisions for your business, give one of our professionals a call.

Family Business Director

Family Business Director