Family Business Purpose and Transactions

In this post, we offer a unique perspective from Atticus Frank, CFA who worked in his family’s business for nearly three years prior to returning to Mercer Capital and joining the team’s Family Business Advisory Group. We hope the stories illuminate special issues family business directors need to consider from someone who lived them day-in and day-out.

NYU Professor Aswath Damodaran has highlighted the mixed bag on value creation through acquisitions. However, McKinsey & Company suggests that family businesses are more prudent in their M&A activity, and don’t necessarily seek the home run deals, but instead seek value creation.

My family’s business did its best to be prudent when engaging in M&A transactions. We developed objectives for selling and buying within the framework of our business’s meaning and family goals.

During my stint in the family-business, the company was going through radical changes. We divested significant operating assets and acquired new businesses in a span of four months. Over the same period, the shareholder base was reduced from 30+ individuals to a select handful.

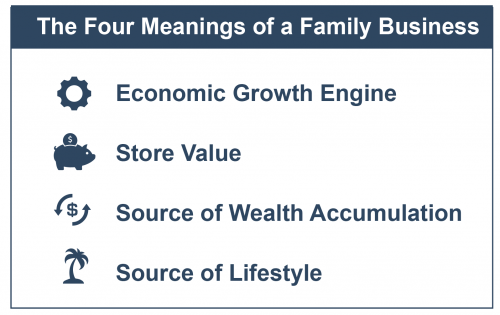

But why? Framing the question in terms of the following four meanings of family business can help answer it.

Give Me One Reason

As we have previously written, the meaning of a family business is a function of both family and business characteristics. Most family businesses hold one of four “meanings” for their family shareholders, which we have summarized below:

- Economic Growth Engine – Create economic growth for future generations. Less emphasis on distributable income for the current shareholders; focus on growth opportunities for business to grow along with the family.

- Store of Value – Preserve the family’s capital. Serve as a stabilizing component of the family’s overall balance sheet.

- Source of Wealth Accumulation – Focus on significant current distributions that family shareholders are expected to allocate to unrelated investments.

- Source of Lifestyle – Priority on stability of dividend payments and the business is managed to protect the company’s dividend capacity to help facilitate travel, philanthropy, education, or other family objectives.

With the above framework in mind, where did my family’s business fit in?

The Times – They Are A-Changin’

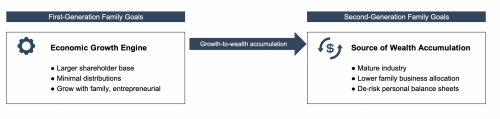

The family business was going through big changes when I arrived. A major part of the business was being sold to another family and the shareholder base was in the process of consolidation. From the mid-70s through mid-2010s, the business had been the economic growth engine for the family: minimal distributions and earnings plowed back in to achieve growth. But with the passing of the patriarch (first generation), the new shareholders (majority control in second-generation) experienced a shift in their objectives for the business.

After nearly 40 years of growth, many of the new controlling shareholders were ready to “de-risk” their personal balance sheets. The family business could help provide that, but the most immediate way to do that was to sell part of the operating assets.

Thinking in terms of the “Four Meanings” framework, this transaction represented a radical wealth accumulation transition. If the family were to develop more diversified personal balance sheets, either distributions from the legacy family business would have to increase in a hurry, or a sale of at least a portion of the business would be required (at the right price). It just so happened the right price came along.

Turn The Page

As we were spinning off a large part of the business, I was preparing to move to Florida to jump into the family business with my wife. We knew we were joining a company that was different than the one my wife had known her whole life.

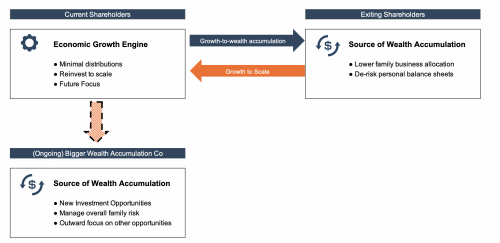

But what company would we be joining? For one, it would have a consolidated shareholder base, with our CEO, my father-in-law, the primary shareholder. Second, it would be considerably smaller. The assets we were selling to generate cash flow for the other major shareholders represented the lion’s share of the company’s revenues. Our objectives for the future, while not “to-the-moon,” were more ambitious than maintaining a “lifestyle” family business. We wanted the remaining company to scale to a level that could support the remaining shareholders’ goals and objectives.

Following the divesture, we completed a smaller acquisition relative to the business units sold to achieve an expected cash flow level suitable for the new, smaller shareholder base. Our impetus was to grow to ensure the longevity and stability of the overall family enterprise for the remaining family shareholders and allow our family to pursue other strategic investments outside the business. Getting there will require a growth mindset for the next several years. I’ll report back on our progress.

Here Comes the Sun: What Will Family Business Directors Do?

We have noticed that our wisest clients demonstrate patience and know where they are and what they are trying to accomplish through transactions. These clients have focused on what the family business means to them: growth engine, store of value, wealth accumulation, or lifestyle. This framework helps them make the right deals at the right times for the right reasons. Otherwise, a “deal” can become a four-letter word for your family.

Conclusion

Mercer Capital has a long history of working with companies on both the buy and sell-side of transactions. Let us know if we can help you and your fellow directors evaluate the transaction opportunities and challenges facing your family business.

Family Business Director

Family Business Director