How Does Your Family Business Think About Philanthropy?

For many, Martin Luther King Jr. Day marks a day of service, with many companies and individuals using it to give back to their communities. Family businesses are no exception; many have more formal charitable arms, whether a specific giving program, philanthropic board, or family foundation. The number of family foundations is too many to name, and their work spans the globe. What many of these foundations have in common, however, is a genesis in the fortunes of the family business (Gates and Microsoft or The Ford Foundation, as examples).

While we’ll be the first to say there are others better suited to help you think about the existential questions (why should we give, to what causes), we think there are some considerations and strategies that you and your family board can keep in mind when determining how your family business thinks about philanthropy.

What Does the Business Mean to Us?

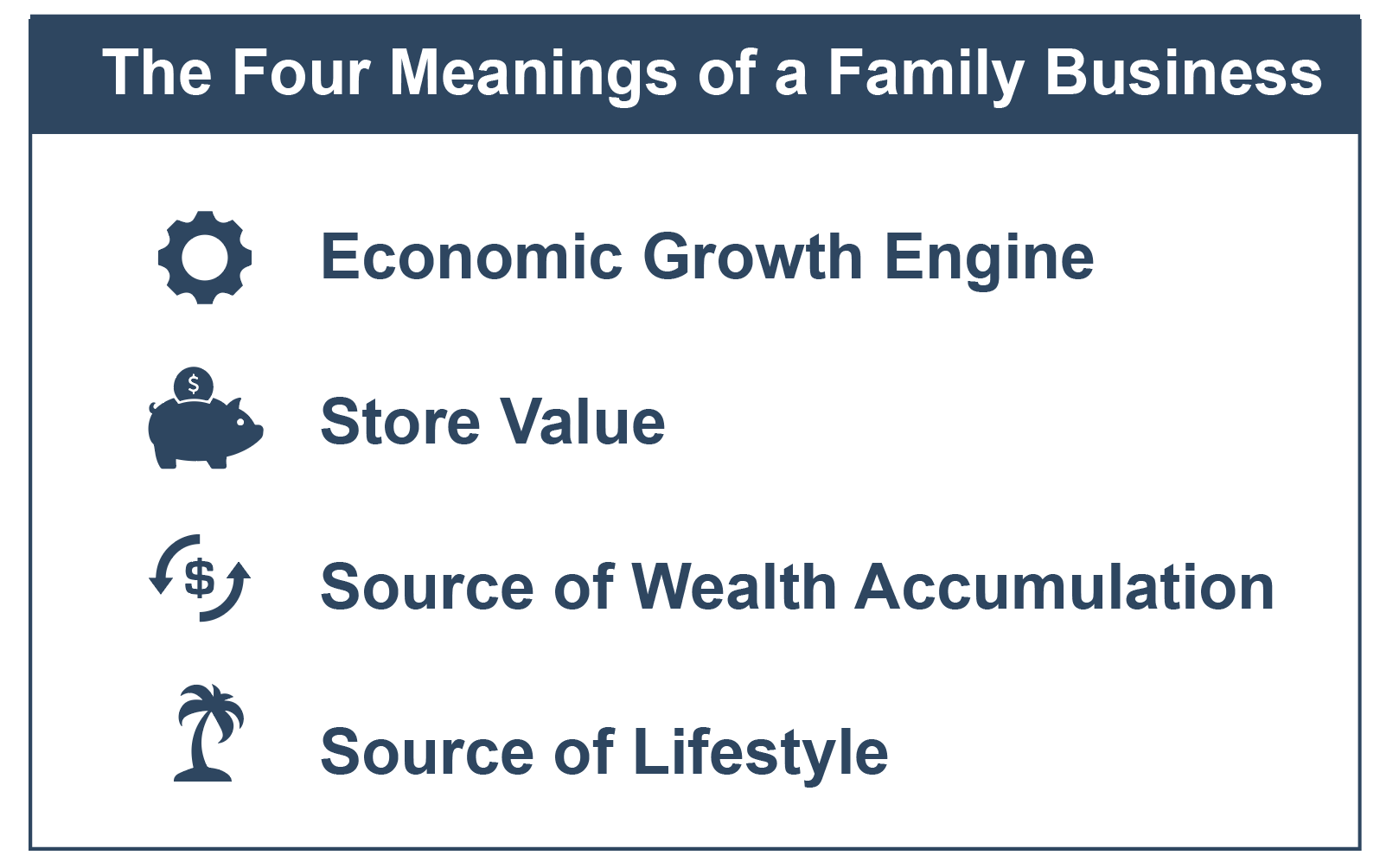

Something to ask (and re-ask) yourself often: what does the business mean to us? Over time, we have observed that families tend to assign one of four basic meanings to their family business:

The idea is that your family business’s appetite for growth and risk, distribution policy, capital structure, and capital allocation all depend on what meaning your family assigns to the business. But how does this impact charitable giving and philanthropy?

If your business is a store of value, accumulated wealth within the business may serve as a suitable base to begin making charitable allocations. This could be achieved directly or through a family foundation or philanthropic board that fits your family profile. If your business is a source of lifestyle, distributions to shareholders to fund their personal causes is a likely strategy that fits how family shareholders view the business. A growth engine for the next generation that is aggressively growing and reinvesting capital may look to give back in non-monetary ways.

Regardless, how you and your board view your family business will determine how you think about your family business’ distribution policy and capital allocation decisions as they relate to philanthropy.

Next Person Up

A big question for family businesses involves determining who’s next at the batter’s box. Finding your next leader is pivotal in perpetuating your family business legacy for the future, and a good transition involves thoughtful planning and shareholder education. A family giving council or philanthropic board could be a ‘testing ground’ for younger generations to display their leadership style and qualities, highlighting how they will make decisions with other family shareholders once they take the reins. Banyan Global, a group that focuses on generational transitions within family companies, also highlights this opportunity in a short case study whereby a family “[H]oped that doing so would help the next generation better understand the real world outside of the bubble of private planes, private schools, and private clubs that the family was increasingly living in.”

Tax Planning

Thinking strategically about giving can also help you and your family business maximize your charitable impact. While there are numerous strategies to maximize the impact of your philanthropic dollars, one strategy we have seen recently is gifting private company stock to a donor-advised fund prior to a sale of the company. We wrote on this previously in greater detail, but, in short, gifting private stock before a deal can, if done correctly, make your charitable dollars go further. A sound strategy can help jump-start funding of a donor pool and can be tax advantageous if structured correctly. (Please consult your independent appraiser and tax advisor regarding your situation and the potential tax consequences of any stock gifts).

You don’t have to have the name “Ford” for your family business to make an impact. Part of your family’s journey in stewarding the family business is responsibly utilizing the capital your business generates. If you have questions on distribution policy or other financial questions more broadly, please give one of our professionals a call.

Family Business Director

Family Business Director