How Stable Is Your Family Business Stool?

My family and I have been out at the Broadmoor in Colorado Springs for a work conference. Since we were going to a nice resort and conference center, we decided to parlay the weekend into a family business meeting.

Many readers here likely undertake family meetings, whether they involve dozens of family members or just a small handful of key family stakeholders.

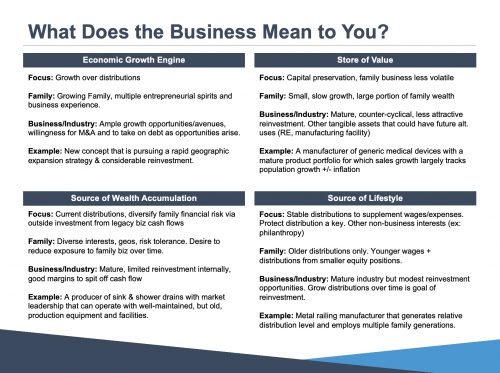

Our agenda included company division updates, a review of the family balance sheet and estate planning, individual and family goals, and new investment opportunities. We framed many of these questions within a broader framework of defining what the family business means to us, a framework we have laid out in full in a previous post.

The meaning of the family business impacts the three key legs of the family business stool: dividend policy, capital investment, and financing decisions. For our family meeting, we summarized the different meanings in the graphic below. We then extended how we define our business to the stool legs; both as it is currently and future targets.

Our Business Stool

My family’s business portfolio consists of three core businesses: media, technology, and movie theatres. The holdings come in part through inheritance, in part as a diversification strategy, but mainly resulted from the passions of the primary owners: newspapers, new technologies, and the movies. How do these businesses impact the legs of our family stool: dividend policy, capital investment, and financing decisions?

- Dividends: Currently our technology business distributes a considerable amount of its earnings to shareholders, requiring minimal working capital and other cash needs. Our media and theatre businesses have higher up-front cash costs and have experienced margin pressure in recent years due in large part to the COVID-19 pandemic, limiting any dividends. The dividends that have been paid by the core businesses have generally been used to diversify shareholder wealth outside the core businesses into other investment areas: equities and alternative investments.

- Investment: While we have limited additional capital spending into the technology business, the media and theatre businesses have required additional capital to both meet operational needs and growth objectives. Similar to dividends, reinvestment capital has generally been used to diversify the family business holdings into other areas outside the core businesses.

- Financing: Family businesses are notorious for taking on little debt, where investor psychology and how well you sleep at night may trump return considerations. In our family, that means we are averse to taking on debt to fund investments.

Do We Need To Fix the Stool?

After first identifying our stool (and how stable the legs were) we asked some questions regarding what we wanted the family business to pursue in our three key decisions areas: dividends, investment, and financing.

- Dividends: Our technology business is successful and pays solid dividends. Should we consider reinvesting into the business (a growth sector) and pursue a more aggressive growth strategy? How would limiting these dividends impact the family business from an income perspective? Are there decisions in our media and theatre operations that we should consider to improve current income returns? What does the family need regarding current income?

- Investment: This discussion focused on the question of diversification, something we have touched on in detail in previous posts. What should the family be investing in? Do we need an investment committee moving forward? Different family members have different personal goals, wealth levels, and beliefs: how do we reconcile these differences?

- Financing: While the family business has historically avoided debt, we discussed what would lead the family to accept some debt financing. Other questions were more philosophical than return focused: why would we take on debt? How does debt play into our overall risk profile? What do different family members think about taking on debt?

Final Takeaways

While we did not answer all the questions we had regarding our family business stool, the framework of defining business meaning and how they impact the legs of the stool did lead us to ask some important questions. These questions helped us to think about the fundamental “why” of being in business together as a family. The conversation helped us to more clearly identify our goals and desires as a family, and to better position our businesses in ways to lead the business to a sustainable long-term future.

Mercer Capital works with family businesses in addressing all three legs of the family business stool. We help directors identify what the business means to the family, benchmarking key metrics to relevant peers, and improving shareholder communications. Give one of our senior professionals a call today to discuss how we can help secure a more sustainable future for your family business.

Bonus

As a final thought, for posterity and the “family business lore” my in-laws were insistent we bring my one and two-year-old to the board meeting. Their only comment: “More dividends!”

Family Business Director

Family Business Director