Mild, Medium, or Hot

Will the Fed Cut Interest Rates This Year?

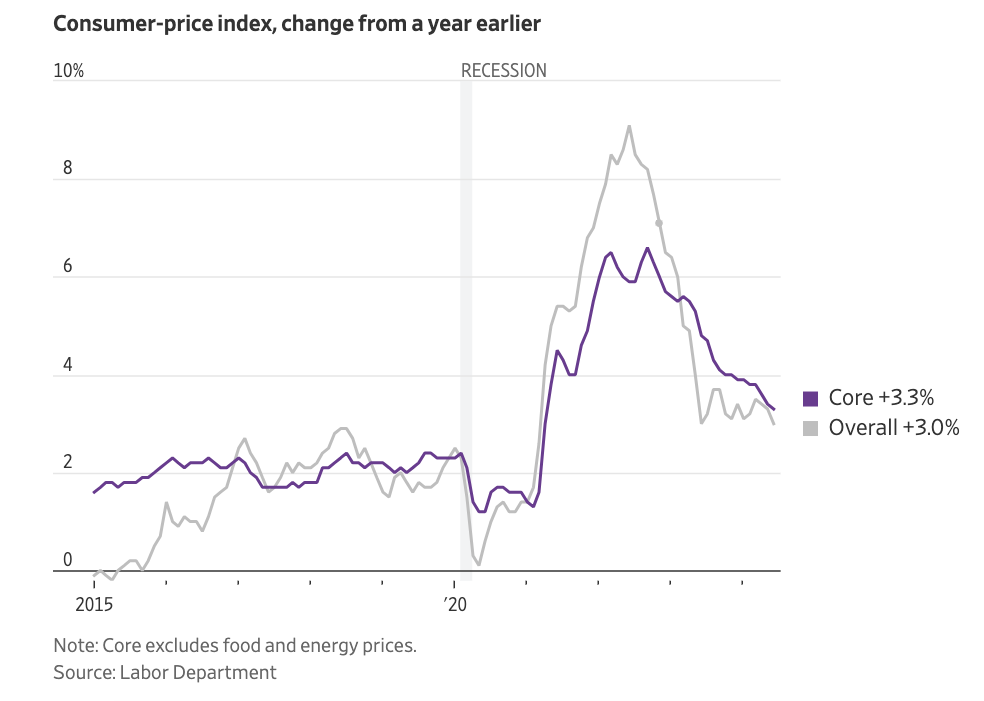

Last week, the consumer-price index decreased slightly from May, resulting in a year-over-year inflation measure of 3%. This is the lowest measure of inflation since June 2023.

Another month of mild inflation strengthens the case for an interest-rate cut by the Federal Reserve in September. Fed Chair Jerome Powell stated last week that the central bank should not wait for inflation to return to its 2% desired target to begin interest rate cuts.

“Because inflation has a certain momentum, you wouldn’t wait that long,” Powell stated last week. “If you waited that long, you’ve probably waited too long.”

The Fed has been cautious to reduce interest rates before year-over-year inflation rates reach the Fed’s stated goal of 2%. While the Fed will meet on July 30-31, investors don’t expect the Fed to begin cutting rates at the July meeting.

A moderating consumer-price index coupled with a gradually slowing job market does give the Fed a window of opportunity, though prevailing investor sentiment views the July meeting as an opportunity for the Fed to lay the groundwork for a September rate cut.

With inflation falling to its lowest level in a year, officials are trying to balance the risk of cutting rates too soon and allowing inflation to persist with the risk of waiting too long and causing unnecessary damage to the job market. This high wire is balancing above a raging sea of political unrest, and with an election looming large in November, the Fed also wants to avoid any moves that could be perceived as compromising its objectivity.

Rate cuts could be particularly impactful to smaller businesses, which tend to have more floating-rate debt. Still, family business stakeholders should pay particularly close attention to a couple key items, regardless of debt composition or capital structure.

Job Growth & Unemployment Rate

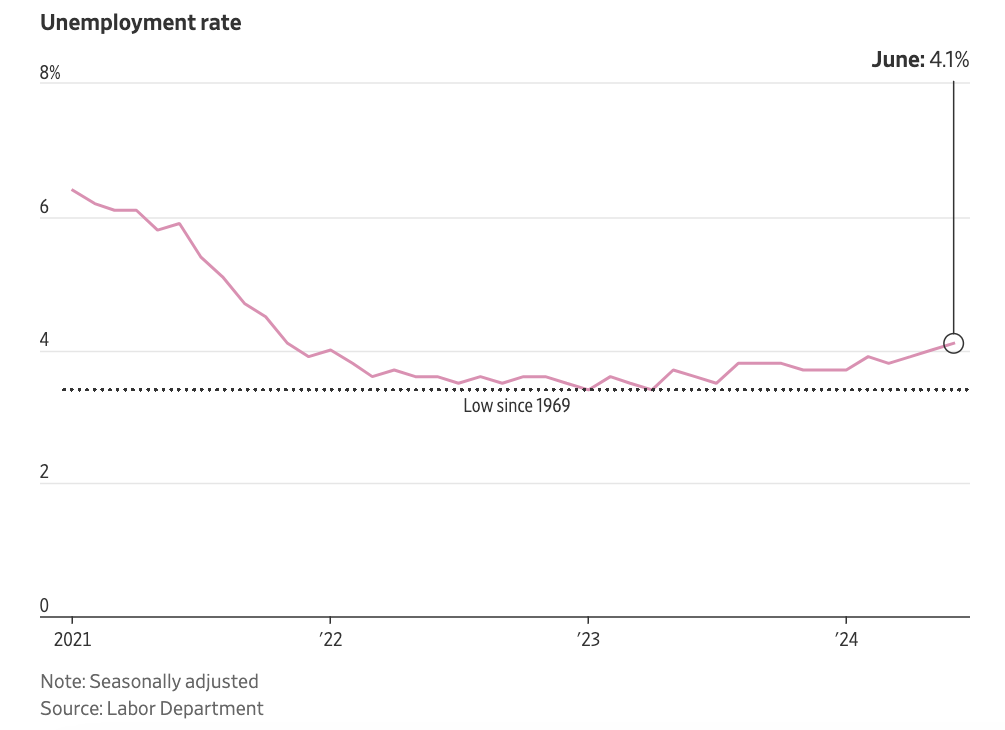

Labor market conditions eased while inflation slowed during the second quarter, giving stronger cause for lowering interest rates in the coming months.

Earlier this month, the Labor Department reported that the U.S. added 206,000 jobs last month, continuing a strong run. However, the unemployment rate ticked up to 4.1%, a sign of some cooling in the broader labor market. Other slowing signs included average hourly earnings increasing 3.9% in June from a year earlier, the smallest gain since 2021.

Even with wages increasing faster than prices, growth in consumer spending has slowed. If this trend continues, employers may respond by cutting staff, causing further deterioration in labor markets.

The Sahm rule, hypothesized by economist Claudia Sahm, states that the economy is in a recession if the average unemployment rate over three months rises a half-percentage point or more above the lowest three-month average the previous year. From April to June, the unemployment rate averaged 4% – 0.4 percent above the three-month average low of 3.6% in 2023.

Earnings Season

As earnings season approaches, the broader stock market is eyeing new records.

Last year, we discussed how family business leaders could use earnings season as an opportunity to discuss strategy and goals with their family board. Today, we focus on earnings season as a broader indication of inflation and investor sentiment.

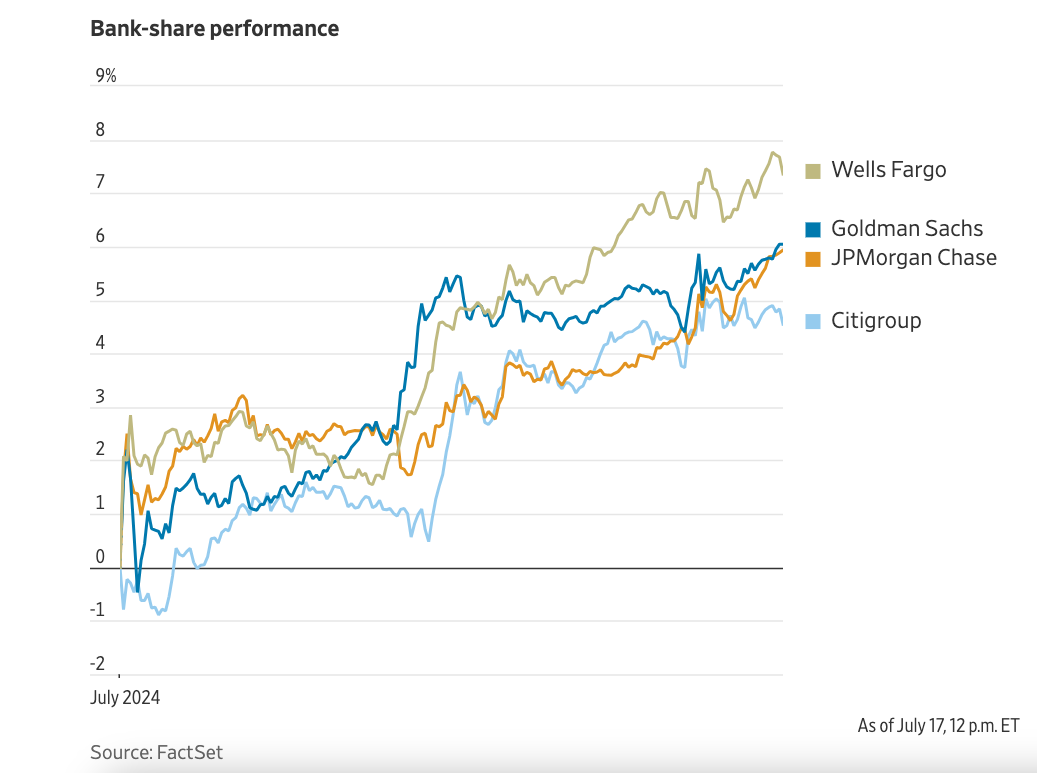

Earlier this week, major players in the financial sector (Bank of America, Charles Schwab, and Morgan Stanley) reported robust earnings, highlighting big gains in investment banking revenue fueled by a healthy return of dealmaking. Favorable economic conditions and thriving markets gave corporate executives confidence in pursuing mergers, refinancing debt, and issuing stock.

A more stable outlook for interest rates is giving bankers renewed hope; however, there is still fear that an economic setback or political disruption could derail deal activity. Due to the dominance of the “Magnificent 7” tech stocks, the financial sector will not remain the main focus of earnings season for much longer.

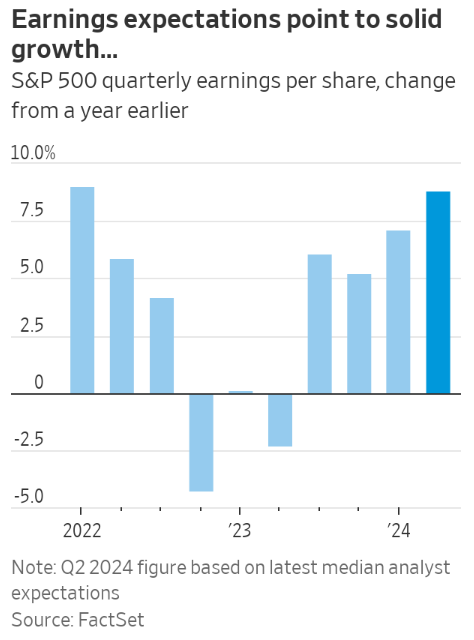

Overall, the S&P 500 is expected to record an 8.8% gain in corporate earnings in the second quarter, driven by the outsized performance of artificial intelligence and big tech companies.

If expectations hold true, this would be the best quarter for earnings since the first quarter of 2022. Investors believe the actual number will most likely be higher, accounting for executives’ tendency to lower investor expectations in order to beat them.

Of the expected ten main contributors to earnings growth, six are massive technology players (Meta, Alphabet, Amazon, Micron, Microsoft, and, of course, Nvidia).

Forecasted income growth on the non-AI and tech side of the index is just 1.5%.

Milder inflation reports are paving the way for a likely September rate cut, but there is more work to be done. Quarterly earnings and labor market conditions are the two biggest factors to pay attention to as we look ahead to the July and September Fed meetings.

Family Business Director

Family Business Director