Navigating the Buffet of Investment Options

A Guide for Family Businesses

The Family Business Director team hopes you and your family had a food-filled and uneventful Thanksgiving, all while steering clear of touchy business conversations. There is a time for those tough conversations, but maybe not at grandma’s table as your uncle wields a carving knife.

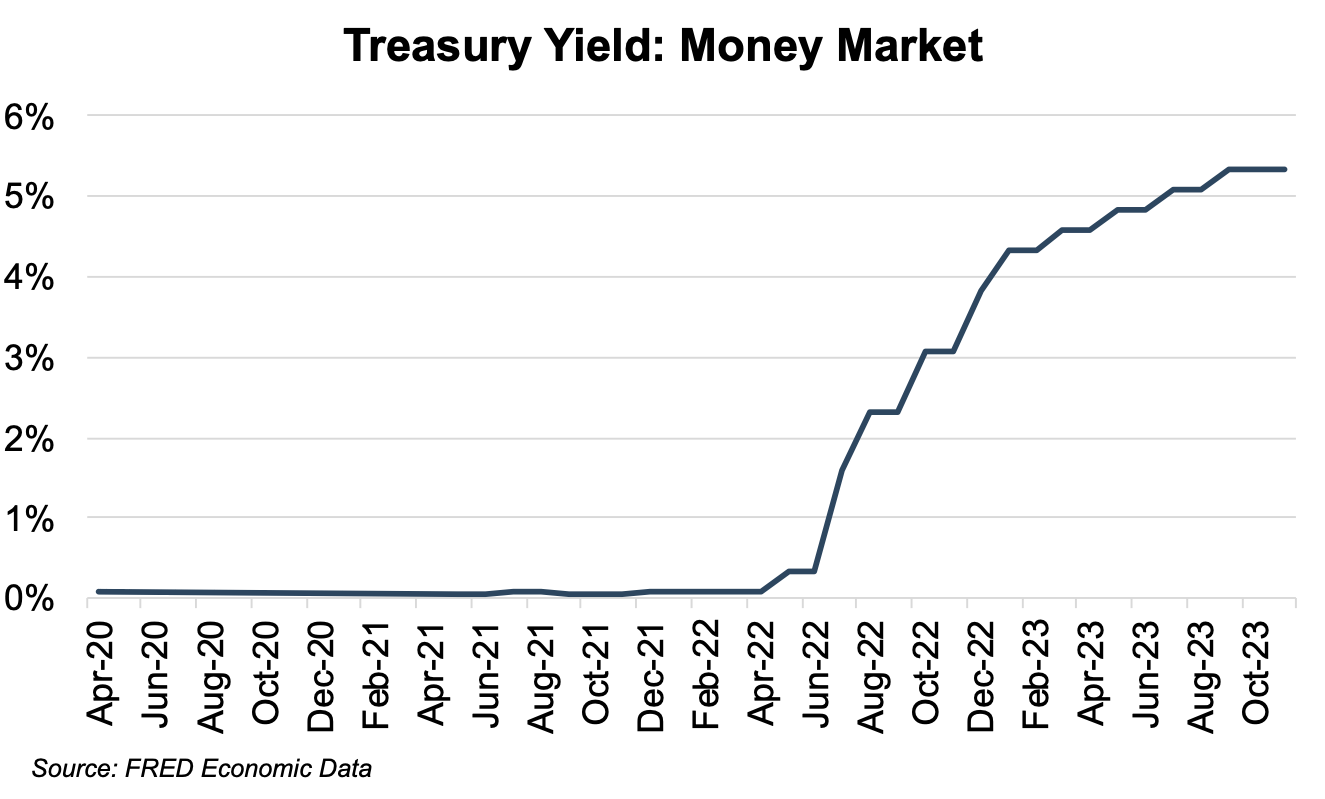

If you are like me, Thanksgiving has you feeling “full” both in terms of family time and your waistline. A recent Wall Street Journal article indicated investors and institutions are also full. Per the piece, institutions and investors have a record $5.7 trillion parked in cash-like money-market funds. The debate on Wall Street is whether investors are ready to gorge on a second helping of stocks, bonds, and other investments or if money market yields north of 5% have everyone ready to put their dishes away and take an afternoon nap. Figure 1 highlights money market yields over the last several years.

Figure 1: Treasury Yield – Money Market Yield

We’ve written previously on the benefits of holding cash on the family business balance sheet as well as the need for family businesses to avoid cash on the balance sheet that is not generating a fair return for family shareholders or lazy capital. But to take a step back, how should your family business think about its investment and asset allocation decisions more generally?

What’s Your Appetite?

Over time, we have observed that families tend to assign one of four basic meanings to their family business:

Readers of Family Business Director will be familiar with these concepts, but in short, the idea is that your family business’s appetite for growth and risk depends on what meaning your family assigns to the business. The meaning of the family business, in turn, influences the company’s investment selection.

What’s on the Menu?

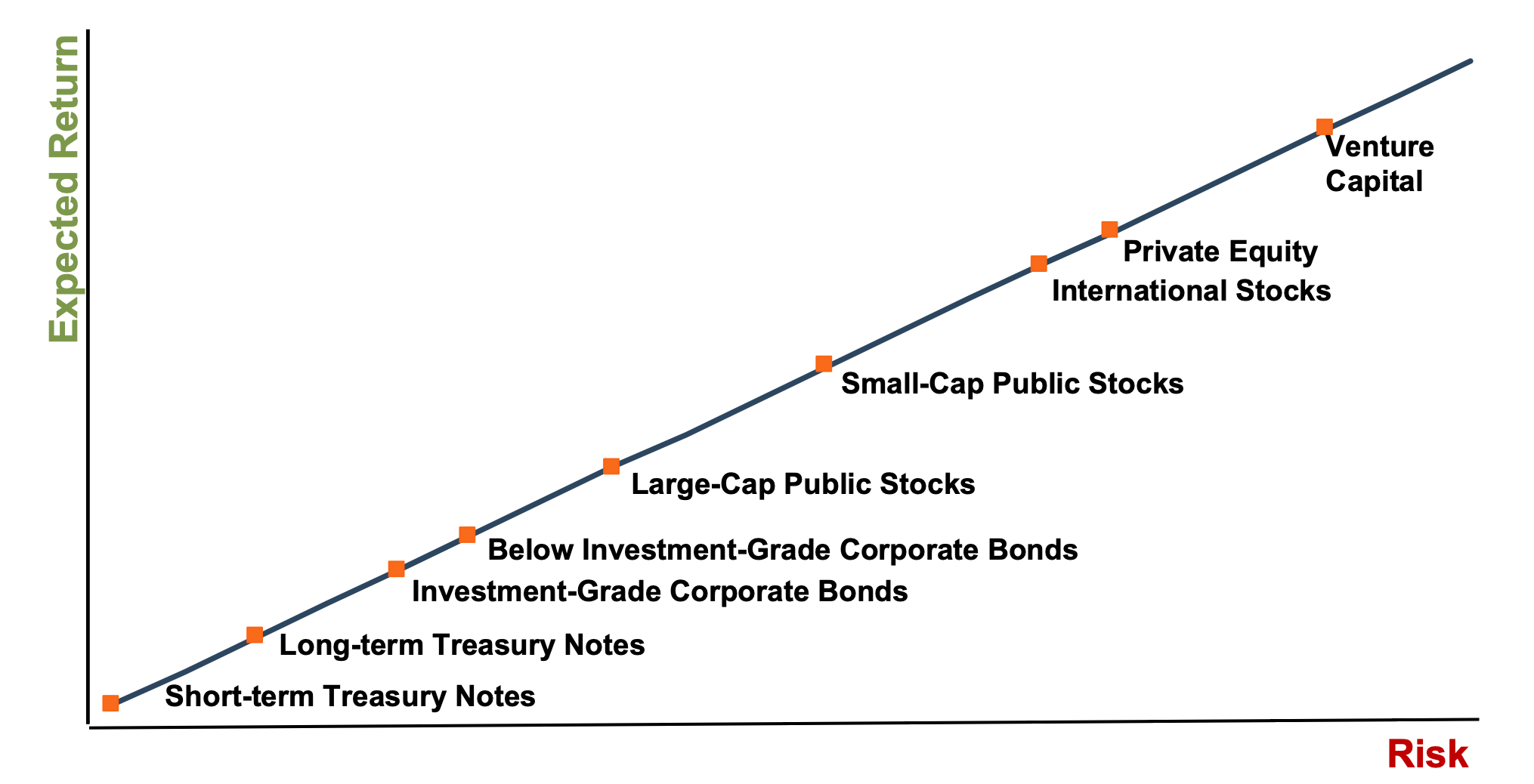

The menu of investment options resembles more of a buffet than a taco truck: families make investment decisions from a seemingly endless menu of potential alternatives (both inside their business and through diversification). As shown in Figure 2, your appetite for risk dictates your achievable expected return. To achieve a higher expected return, investors must be willing to accept greater risk.

Figure 2: Expected Return and Risk

Or, to stay on theme, if you don’t take risks like John Candy in “The Great Outdoors,” don’t expect any free meals or Paul Bunyan hats for the kids.

How to Decide What’s for Dinner

How does your family business decide where to allocate resources? Before analyzing the expected return of various investments or capital projects, you need to determine the right hurdle rate for your family business.

From a finance textbook perspective, the weighted average cost of capital, or WACC, is the theoretically correct rate for evaluating potential capital projects (learn more about capital budgeting and the WACC here). Family business managers are stewards of capital entrusted to them by the family (and, potentially, lenders). The managers’ task is to allocate that capital to a portfolio of assets that earn returns more than the cost of capital. If a proposed project promises a return in excess of the cost of capital, taking on the project will increase shareholder wealth, and everyone goes home happy.

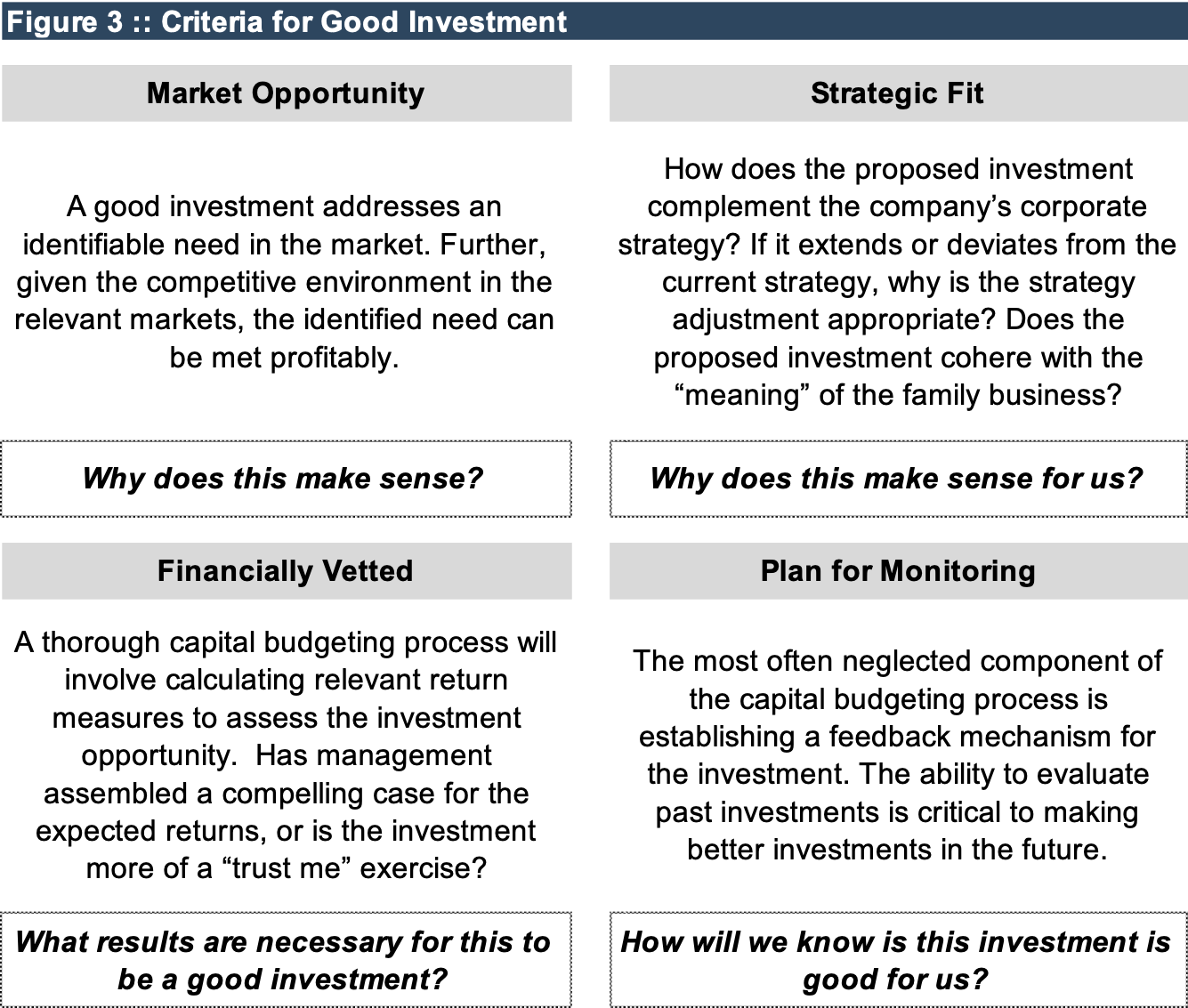

However, family businesses have limited financial resources, and you may face multiple options that exceed your company’s hurdle rate or WACC. What then? We see family businesses make good investments by focusing on four areas: market opportunity, strategic fit, financial vetting, and success monitoring. We detail these areas in Figure 3 below.

There is no “right” answer for where or how your family should invest. Ultimately, your family’s risk tolerance and return objectives will determine the right option for your family business. However, your family needs to have a process for objectively estimating expected returns and analyzing the riskiness of its options. Please give one of our professionals a call for an independent perspective on your family businesses’ investment options.

Family Business Director

Family Business Director