Now Could Be a Great Time to Transfer Stock to Heirs

Rising inflation has been top of mind for business owners (and everyone for that matter) over the last few years. As measured by the Federal Reserve’s preferred gauge — the personal consumption expenditures price index — inflation increased from an average of 1.5% in 2019 and 2020 to 5.0% in 2022. Inflation has since decelerated from its peak in 2022 to 2.8% in January 2024 but still remains above the Federal Reserve’s target of 2.0%. In an effort to curb inflation, the Federal Reserve hiked the fed funds target range, leading to a sharp increase in interest rates over 2022 and 2023. The yield on the 20-year US treasury increased from less than 2.0% in 2019 and 2020 to a peak of about 5.2% in October of 2023. Yields currently stand at approximately 4.5%.

FIGURE 1 :: Inflation and Interest Rates

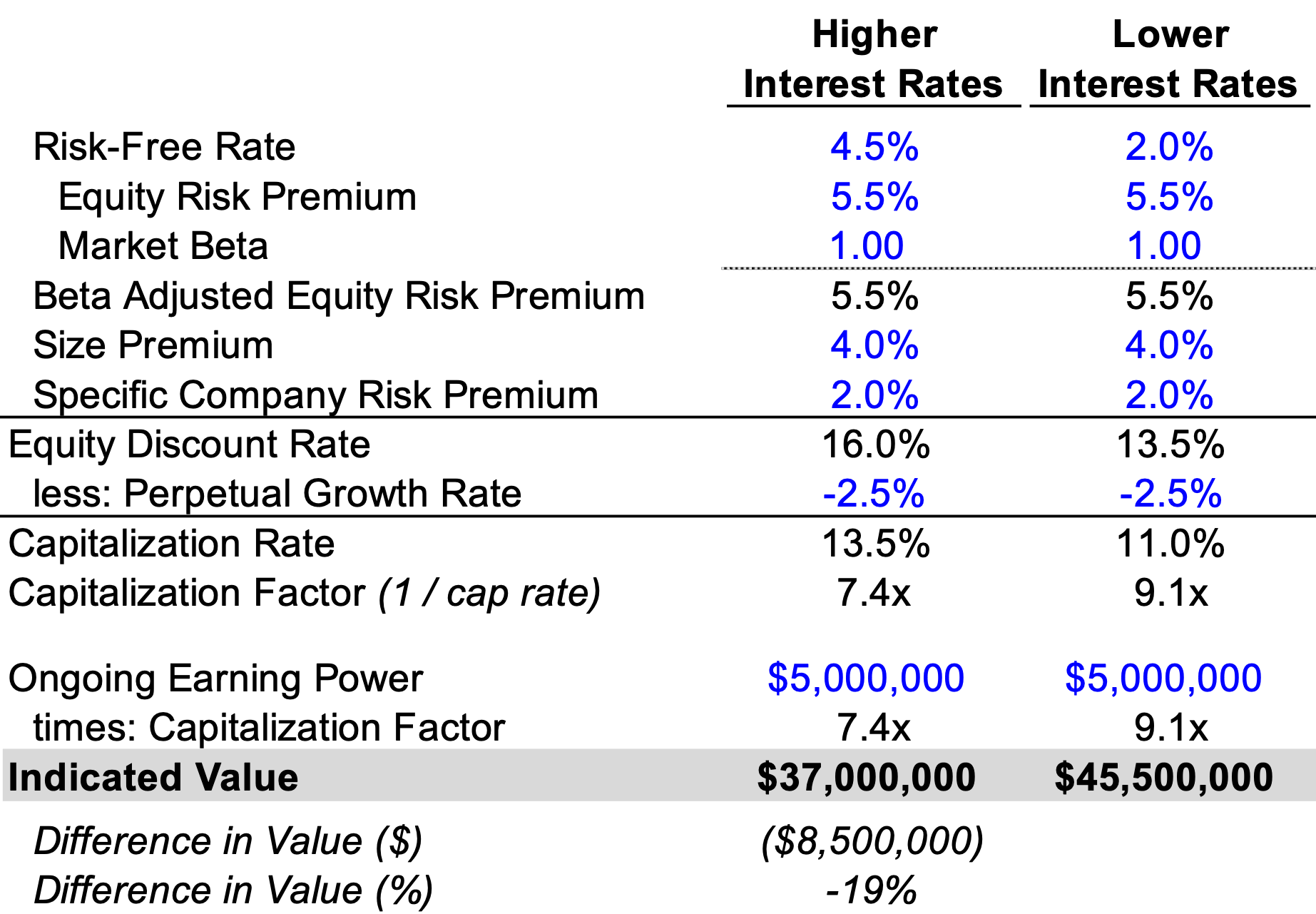

Higher inflation and interest rates have affected every business with few exceptions. All else equal, higher interest rates will negatively affect business value. This is due to higher discount rates used to bring future cash flows to the present. Figure 2 illustrates the impact of higher interest rates on business value, all else equal. In some industries, inflation-driven increases in earnings growth expectations have offset (or even outweighed) the negative impact of higher interest rates. However, not all industries have been immune to pressure from higher interest rates on the value of their shares.

FIGURE 2 :: Effect of Higher Interest Rates on Business Value

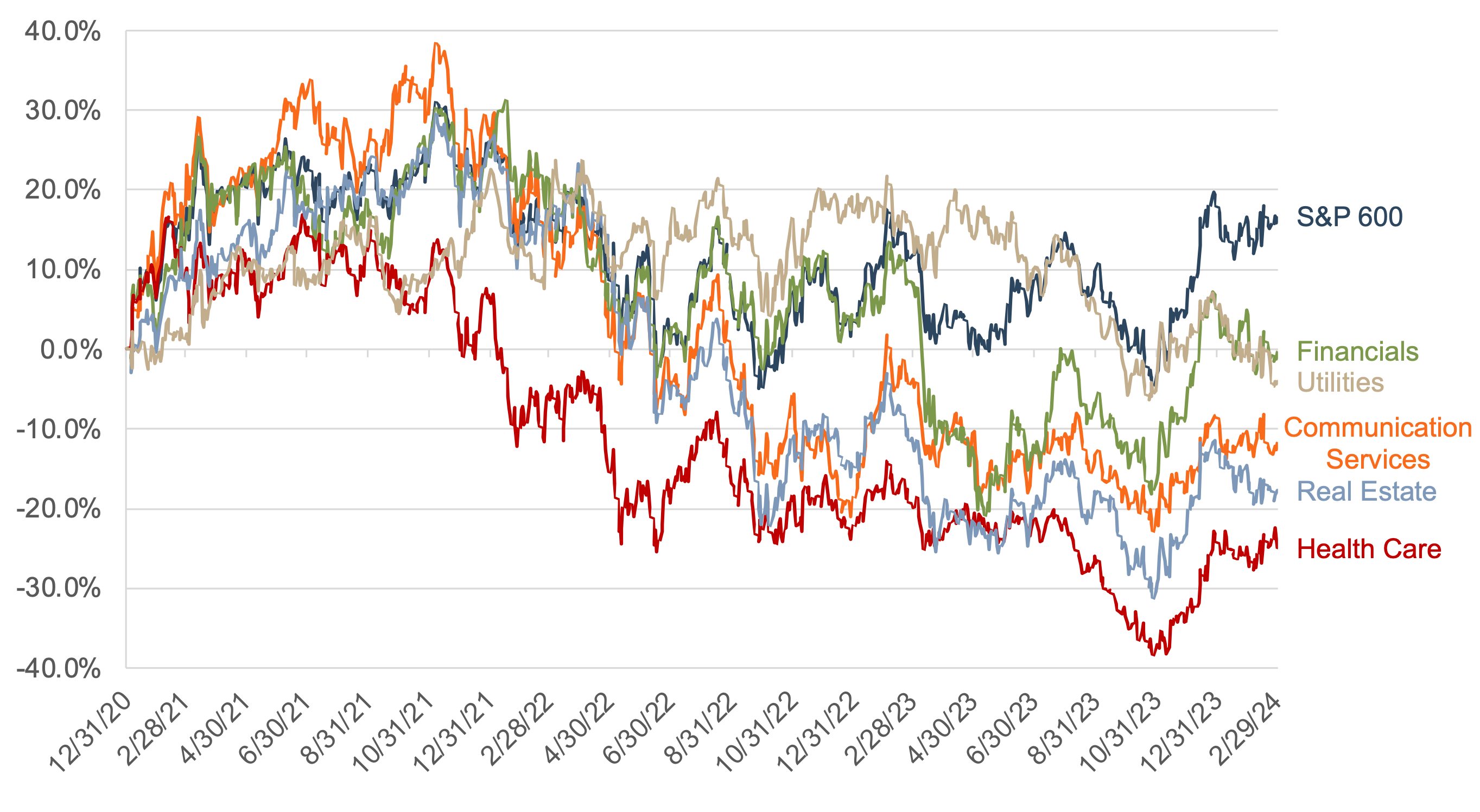

Since the beginning of 2021, when inflation began turning higher, the S&P 600 Small Cap Index has increased about 17%. However, several S&P 600 Sector Indices have underperformed the broader index over this period, including financials (0%), utilities (-4%), communication services (-12%), real estate (-18%), and healthcare (-25%), per Figure 3. It’s clear that certain industries have been able to push through the higher-rate environment, while investors are skeptical of the “new normal” in others.

Figure 3 :: Select Small Cap Performance

The period of rising or high interest rates may be reversing soon. In prepared remarks before the Committee on Financial Services, Federal Reserve Chair Jerome Powell said, “We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.” The Fed has signaled that rate cuts will likely happen later this year, and markets have priced in about a 64% chance that the first rate cut will occur in June. The easing cycle is imminent and will have broad implications for businesses and the overall economy. Like the tightening cycle, the easing cycle will likely have divergent outcomes for different industries. You and your advisors are likely the best to gauge where you stand amidst the sharp increase in interest rates. At this point between cycles, it is important to consider the potential opportunity to favorably transfer business value to future generations.

Issues on the tax and policy front also should be top of mind in current estate planning discussions. The Tax Cuts and Jobs Act enacted in December 2017 doubled the basic exclusion amounts individuals could give away without paying estate taxes. The sunsetting of this provision on December 31, 2025, makes considering transfers all the more important.

Inflation and higher interest rates may still present an opportunity for your family business to favorably transfer stock to heirs. Sunsetting favorable estate tax provisions should also be at the forefront of your mind when sitting down with your advisors. Schedule a quick call with your estate planning advisors to see if there are steps you can take to help reduce the burden of future estate taxes on your family and business. Many strategies will require a current valuation of your business, and our professionals are here to help.

Family Business Director

Family Business Director