Making It Through December

While its status as a Christmas song is perhaps debatable, Merle Haggard’s “If We Make It Through December” is classic country music at its finest. The song captures the pathos of economic distress, with the recently-downsized protagonist lamenting his inability to provide the Christmas he wants for his daughter.

Although we suspect Mr. Haggard was not writing in this direction, the song has always made Family Business Director think about breakeven analysis. As the year draws to a close, family business directors naturally evaluate the firm’s profitability over the course of the year. For some, profitability was assured months ago. For others, it remains uncertain whether they will make it through December without incurring a loss for the year.

What is Breakeven Analysis?

The purpose of breakeven analysis is to identify the volume of sales at which the company moves from an operating loss to operating income. Breakeven analysis is a great tool for family business managers and directors to forecast profitability and evaluate business strategies.

The fundamental insight behind breakeven analysis is that some costs of a business are variable with respect to revenue, while others are fixed.

- Variable costs are those incurred in rough proportion to revenue, such as raw material inputs, direct labor, revenue-based royalty payments, or incentive-based compensation.

- In contrast, fixed costs do not vary with revenue, but are incurred regardless of how much revenue the business generates in a given year. Typical fixed costs include corporate overhead personnel, insurance, rent, and depreciation.

Of course, classifying expenses as either variable or fixed is a bit arbitrary, and depends on the time horizon considered.

- For example, rent is a fixed expense in the short-term, but when the lease expires, management can decide whether to continue incurring the expense. In the longest of long runs, all expenses are variable.

- Furthermore, some expense categories have attributes of both variable and fixed expenses. Often, rental agreements for retailers include two components: a base rent that is payable regardless of revenue, and an incentive component that is calculated with reference to sales.

These ambiguities should not deter family businesses from using breakeven analysis. Absolute precision is not necessary to yield valuable insights.

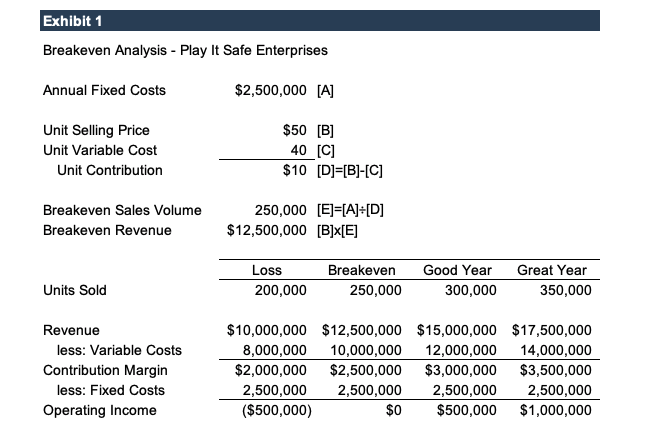

The relationship of variable and fixed costs determines the breakeven level of revenue for a family business. To illustrate, consider Play It Safe Enterprises. Play It Safe incurs fixed costs of $2.5 million annually, and variable costs of $40 per unit, compared to a current selling price of $50 per unit. Exhibit 1 illustrates the resulting breakeven analysis.

Play It Safe’s breakeven sales volume is 250,000 units.

Why Should Family Businesses Care About Breakeven Analysis?

Make no mistake, Haggard – the Poet of the Common Man – is always on heavy rotation at Family Business Director headquarters. Yet, what brought breakeven analysis to our mind was this quote from a Harvard Business Review article about what makes family businesses different from their publicly-traded peers: “Our results show that during good economic times, family-run companies don’t earn as much money as companies with a more dispersed ownership structure. But when the economy slumps, family firms far outshine their peers.” In other words, the family businesses in the study had lower breakeven sales volumes than their non-family peers.

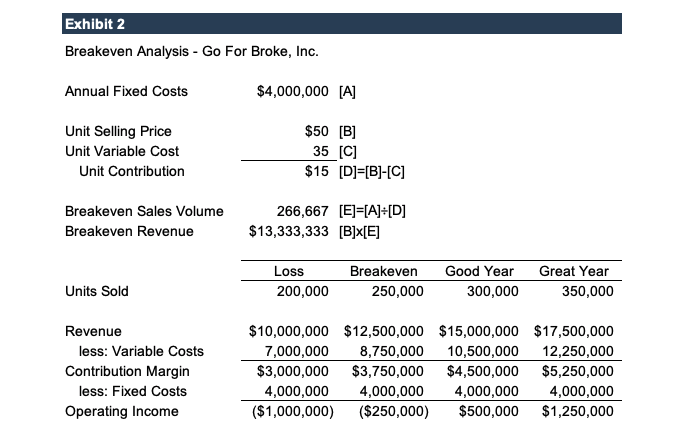

To illustrate, consider Play It Safe’s publicly-traded competitor Go For Broke, Inc. Exhibit 2 summarizes the breakeven analysis of Go For Broke.

Relative to Play It Safe, Go For Broke has invested more heavily in automated production equipment, resulting in higher annual fixed costs ($4.0 million compared to $2.5 million). The payoff from the decision to automate production is a higher contribution margin per unit sold.

- Nevertheless, the breakeven sales volume at Go For Broke is 6.7% higher than at Play It Safe. In other words, if Go For Broke is going to “make it through December,” they will need to sell nearly 7% more units than Play It Safe does.

- In a good year (300,000 units) operating profit is $500,000 for both companies. But in a great year (350,000 units), Go For Broke earns 25% more operating income. During hard times (200,000 units), in contrast, Go For Broke incurs a $1.0 million operating loss while Play It Safe loses only $500,000.

So, operating leverage (the degree to which a business’s operating costs are fixed) is a key part of risk management. Since risk management is ultimately the board’s responsibility, directors should give some thought to breakeven analysis this December.

Managing Risk in the Family Business

We’ve written often about how family businesses can manage shareholder risk through capital structure decisions. Most directors are well aware of how the decision to borrow money increases both the risk and potential return to family shareholders. In our experience, directors are less likely to consider breakeven analysis in their risk management decisions. Yet, the composition of the family business’s operating cost structure can influence the risks and returns to family shareholders just as much as, if not more than, the business’s capital structure.

So which company has the better cost structure, Play It Safe or Go For Broke? Of course, neither structure is inherently better than the other. The right decision ultimately comes down to knowing the risk tolerances and return expectations of your family shareholders and assessing the outlook for industry demand and competitive dynamics. All else equal, strong confidence in the economic and industry outlook suggests that more operating leverage will prove rewarding, while operating in the shadow of recession means shifting to a less leveraged cost structure will be prudent.

Once he made it through December, Hag’s protagonist anticipated making a change, as he had “plans to be in another town come summertime.” For family businesses, changing the company’s cost structure generally takes more time. But even changes at the margin can affect results in a meaningful way. As directors, there’s no time like December to think about whether any changes are needed in your family business.

Merry Christmas from Family Business Director! We will be off next week, but look forward to being back with more content for our subscribers after the holidays.

Family Business Director

Family Business Director