Sanderson Farms Case Study

Cargill is one of the largest family businesses in the world. Earlier this year, we analyzed the Family Capital list of the world’s 750 largest family businesses; Cargill checked in at number 15 on that list, with annual revenue reported to be in excess of $110 billion. Cargill made headlines earlier last week for its acquisition (together with another family business, Continental Grain) of Sanderson Farms, a publicly traded poultry business (ticker: SAFM).

It is not every day that family businesses acquire publicly traded companies, so the transaction is worth exploring a bit further. For family business directors contemplating M&A activity of their own, or thinking about whether now is the right time for the family to sell, the Sanderson Farms acquisition rather perfectly illustrates why family businesses have more than one value.

The Value of Sanderson Farms on a Standalone Basis

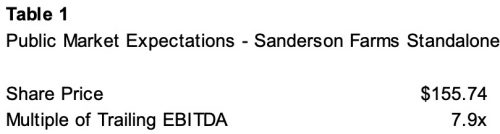

Since its shares are traded in the public markets, we know what Sanderson Farms was worth on a standalone basis. Prior to rumors of a potential transaction influencing trading, SAFM shares closed at $155.74 per share on June 18, 2021 (corresponding to 7.9x trailing EBITDA).

Business values always reflects consensus expectations regarding future cash flows, risk profile, and growth prospects. We will spare you the math, but the public market expectations for each of these factors is summarized in Table 1.

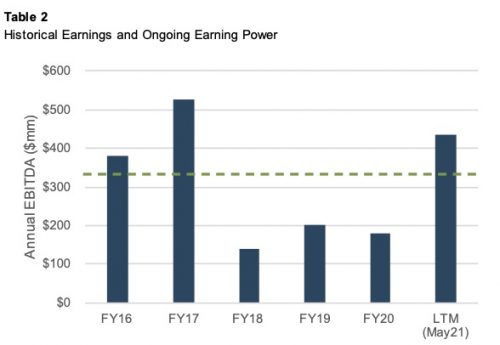

As is the case with many agribusiness companies, earnings for Sanderson Farms are cyclical, depending in large measure on various commodity markets. Table 2 relates the estimate of “ongoing” EBITDA noted above, to recent earnings (the green dotted line).

So, what does the public market price of $155.74 “mean”? If investors paid that price, and the company continued to operate on a standalone basis while growing at 2.9%, those investors would earn an annualized return of 6.5% on their investment, which is consistent – on a risk-adjusted basis – with alternative investments available to them.

The Value of Sanderson Farms to Cargill/Continental

In contrast to public market investors, the Cargill/Continental consortium agreed to pay $203 per share for Sanderson Farms, or 10.4x trailing EBITDA. This represents a 30% premium to the public market price. Why where these buyers willing to pay more to for the company? As described in last week’s post, Cargill and Continental are strategic buyers. In other words, they anticipate integrating Sanderson Farms into their existing poultry operations. By doing so, their expectations for the three factors determining value are different, in some respect, than the expectations of public market investors for the company on a standalone basis.

Table 3 summarizes several different scenarios that correspond to the $203 per share transaction price.

Why might Cargill and Continental have different expectations than public market investors?

- Cash Flow. As strategic acquirers, the Cargill/Continental consortium might reasonably expect to be able to extract higher earnings from Sanderson Farms by combining with existing operations. Common cost savings in mergers come from consolidating facilities and eliminating redundant overhead costs. As shown in Table 3, the purchase price implies approximately $50 million of annual cost savings. In recent years, total selling, general and administrative expenses for Sanderson Farms have been on the order of $200 million annually. Could the buyers anticipate eliminating 25% of the existing corporate overhead? Perhaps, but one shouldn’t rule out other expense saving opportunities within cost of goods sold as the combined entity will likely enjoy greater negotiating leverage with suppliers than Sanderson Farms did on a standalone basis.

- Growth Prospects. Moving one column to the right in Table 3, we see that the higher acquisition price could also be explained by more aggressive growth expectations. It is likely that the newly combined entity will also enjoy enhanced negotiating leverage with customers as well as suppliers. Perhaps the greater market share of the combined entity will unlock opportunities for faster growth than would be available to Sanderson Farms on a standalone basis.

- Risk. Return follows risk. If the acquiring consortium enjoys a lower cost of capital than SAFM does, it may be willing to accept a lower prospective return on the acquisition. By way of perspective, published data on the returns for shares of companies stratified by size suggests that the returns for mid-cap firms like Sanderson Farms is on the order of 125bps higher than the return for large cap companies the size of Cargill.

The acquiring consortium is more likely to anticipate incremental value from each of the three potential sources, as illustrated in the rightmost column of Table 3.

It is important to note that transaction prices do not necessarily represent the maximum price that a strategic buyer could pay for the acquired company. In other words, it is possible that Sanderson Farms is really worth $220 per share to Cargill/Continental, but the seller was only able to extract $203 per share due to the relative negotiating leverage of the two parties. The value of the seller on a standalone basis (in this case, $156 per share) sets the floor for the transaction, while the (unobservable) value of SAFM to the acquiring consortium represents the ceiling. The ultimate transaction price of $203 is the point within that range at which the negotiating leverage of the two parties was balanced.

Takeaways for Family Business Directors

Most of our family business clients are not likely to acquire a public company. Even so, family business directors should bring the same discipline to bear when evaluating a potential transaction.

- When considering an acquisition opportunity, it is important to carefully analyze not just what the target company could be worth to you, but also what it is worth to the existing owners. Developing a bid for the target within that range should consider both the actions of other potential bidders for the target and how unique the target is.

- When contemplating a sale, the same considerations are appropriate. What is the family business worth to your family? What can you reasonably expect the family business to be worth to potential buyers? What strategies can you put in place today to help tip the negotiating leverage in your favor so you can extract more of the incremental value to the buyer?

These are tough deliberations and the consequences of your final decision may affect your family for decades to come. Don’t make these decisions without a seasoned financial advisor in your corner. Give one of our professionals a call today to discuss your situation in confidence.

Family Business Director

Family Business Director