Taking Stock: Thinking About the Pieces of Your Family Business

Returns, Growth & Risk

Family Business Director has a couple of colleagues who play chess at a high level. Sadly, our admiration for the game far outstrips our ability to play it competently. To our largely uncomprehending eyes, one of the things that makes the game fascinating is the unique attributes of the various pieces. Those who can play the game well seem to have an innate sense not just of what each piece is capable of individually, but also of how the pieces interact with each other. This understanding provides the experienced chess player with an expert feel for what the capabilities are of whatever collection of pieces may be at her disposal at any point in the game.

In this week’s post, we conclude our series on taking a year-end strategic inventory in your family business. Family business directors and managers need to think like a chess player when thinking about different business units within the company. What are they capable of individually, and how do they work together?

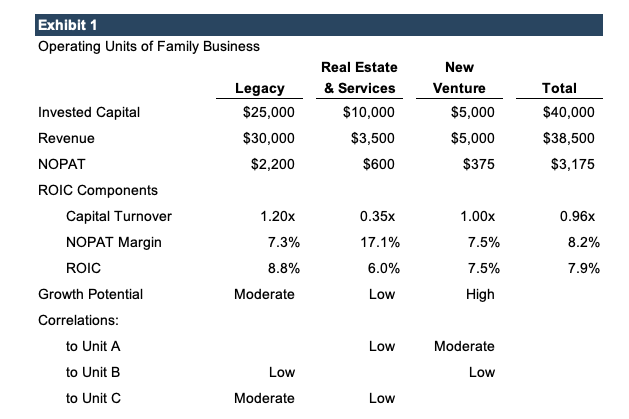

Consider a family business with the three operating units:

- Legacy manufacturing operations in a maturing, but still growing market.

- A real estate division that owns and manages commercial properties and provides related services to a small group of customers.

- A new venture that has developed a niche product gaining rapid acceptance in a developing market.

Exhibit 1 summarizes relevant attributes of each business unit.

In taking their year-end strategic inventory, the directors should evaluate the units along three dimensions: return, growth, and risk. We address each in turn.

Return

The best measure of return for most family businesses is return on invested capital, or ROIC. We’ve discussed the merits of ROIC at length in other posts (here and here). ROIC is a measure of the efficiency with which a company deploys its capital to generate earnings. ROIC is the product of two sub-measures:

- Capital turnover: How much revenue does the business generate from a dollar of invested capital?

- NOPAT margin: How much net operating profit after tax does the business generate from a dollar of revenue?

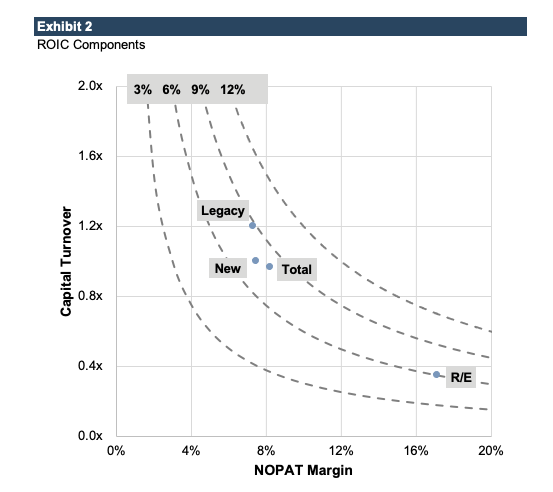

For a multi-unit family business, it can be helpful to plot the ROIC of the various units using these sub-measures as coordinates, as shown in Exhibit 2.

The dotted lines in Exhibit 2 illustrate capital turnover and NOPAT margin combinations that yield the same ROIC. The legacy and new business lines have comparable NOPAT margins, but the legacy business generates more revenue per dollar of invested capital. As a result, the legacy business currently earns a higher ROIC than the new venture.

Mapping the ROIC coordinates for each business unit helps in thinking about what strategies are available and most likely to improve returns. For example, if the goal is for the new business unit to eventually achieve a 12% ROIC, will that result from increasing turnover, profitability, or some combination of both? Which “path” to 12% has the greatest likelihood of success?

The real estate unit clearly has a different set of attributes. Relative to the legacy and new businesses, it is a low turnover/high margin business, and as such likely presents a unique set of challenges for increasing or maintaining ROIC.

Growth

ROIC measures current returns, but just as an experienced chess player thinks multiple moves ahead, family business directors need to incorporate growth potential into their strategic inventory. The goal is to think not just about what the business looks like today, but what it could, should, and might look like in the future. A healthy family business provides capital appreciation opportunities for family shareholders in addition to current returns.

The new business does not yet produce as robust an ROIC as the legacy business. However, the capital allocation decision is dynamic. Throwing more capital at the unit with the highest current ROIC may not promote the long-term sustainability of the family business. Capital allocation needs to be calibrated to growth opportunities. Over-allocating capital to the legacy business is likely to drive down capital turnover and hurt ROIC. Likewise, under-allocating capital to the new business may prevent that unit from maturing into a business with a 12% ROIC, which would then pull up returns for the whole company.

Risk

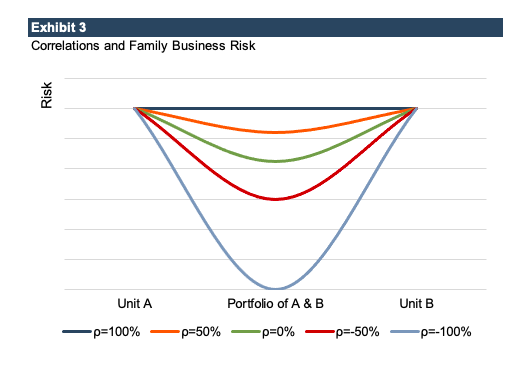

Risk is not linear. When dealing with a portfolio of multiple assets, you must consider not just how risky each unit is in isolation, but how the units correlate with each other. If the legacy business is having a great year, what does that mean for the new business and real estate segment? When correlations between business units are high, there is not much diversification benefit to the shareholders. In contrast, units with low correlations reduce the overall risk borne by the family shareholders. As noted previously in Exhibit 1, the real estate unit has a low correlation with the legacy and new business units. As a result, the real estate division reduces the riskiness of the overall business. The “job” of the real estate unit is not necessarily to increase return, but to reduce risk.

Exhibit 3 illustrates the risk reduction benefits of business units with less-than-perfect correlation (“?”).

If Units A and B move in lockstep (i.e., have a correlation of 100%), combining them does not reduce the risk to the family. However, as the correlation falls, so does the overall risk of the portfolio. Correlation is a matter of degree; no family business units will be perfectly correlated (whether positively or negatively). Family business directors should instead think about correlations on a relative basis. How does the risk of each operating unit interact with the risk of the other operating units? This is important, because focusing on risk and return for operating units on a standalone basis will fail to consider adequately the overall impact of the units on the risks and returns of family shareholders.

Conclusion

Mercifully, 2020 is ending. As family business directors look back on the year, they would do well to consider what pieces are left on the chess board, where they are, and how they fit together. For a fresh set of eyes and a new perspective, call one of our family business professionals today to discuss your business in confidence.

Thank you for reading our Family Business Director this year. We look forward to continuing the conversation with all of you in 2021. Happy holidays!

Family Business Director

Family Business Director