The Times They Are A-Changin’

This Sunday, it is time to turn the clocks forward after a busy February of Punxsutawney Phil, Super Bowl Sunday, Fat Tuesday, Valentine’s Day, and the infamous February 29. Spring is near, and sunny days with 7:30 PM sunsets await, thankfully. However, these are not the only sunsets approaching that family businesses need to be thinking about.

The Tax Cuts and Jobs Act (“TCJA”), enacted in December 2017, was the largest tax code overhaul in the last three decades. As the name suggests, the purpose of the bill was to cut individual, corporate, and estate tax rates. The bill cut the corporate tax rate from 35% to 21% — a 40% reduction. It also repealed the corporate alternative minimum tax, introduced a new deduction for pass-through organizations, increased the standard deduction, and expanded exemption levels for the estate tax.

Built into the TCJA was the sunset of certain provisions on December 31, 2025. Meaning that on January 1, 2026, certain portions of the tax law revert to pre-TCJA unless Congress acts to prevent it.

With time change on the horizon, we discuss two of the more significant sunsetting provisions that will affect you and your family business.

Qualified Business Income

The main advantage of an S-corporation, or any pass-through entity, versus a C-corporation prior to the TCJA was avoiding the so-called “double tax” on distributions. When Congress lowered the corporate tax rate, the benefits of S-corporations were greatly reduced relative to C-corporations. To mitigate, the TCJA provided a qualified business income (“QBI”) deduction to partially restore the economic benefit of the S-election.

In general terms, qualified business income includes the domestic ordinary trade or business income, net of deductions, of a pass-through entity, and the baseline deduction amount is equal to 20%. By subjecting only 80% of certain pass-through entity income to tax, the benefits of S-corporation status were preserved for many pass-through entity businesses and owners.

The QBI deduction, along with lower marginal tax rates, is sunsetting after 2025. Both will have a substantial effect on taxable income of pass-through entities. On the whole, the tax rate on pass-through business income will increase 10% for those in the top tax bracket, as shown below.

Family business directors need to assess the impact of the QBI deduction and lower marginal rate sunsets on their shareholders.

Gift & Estate Tax

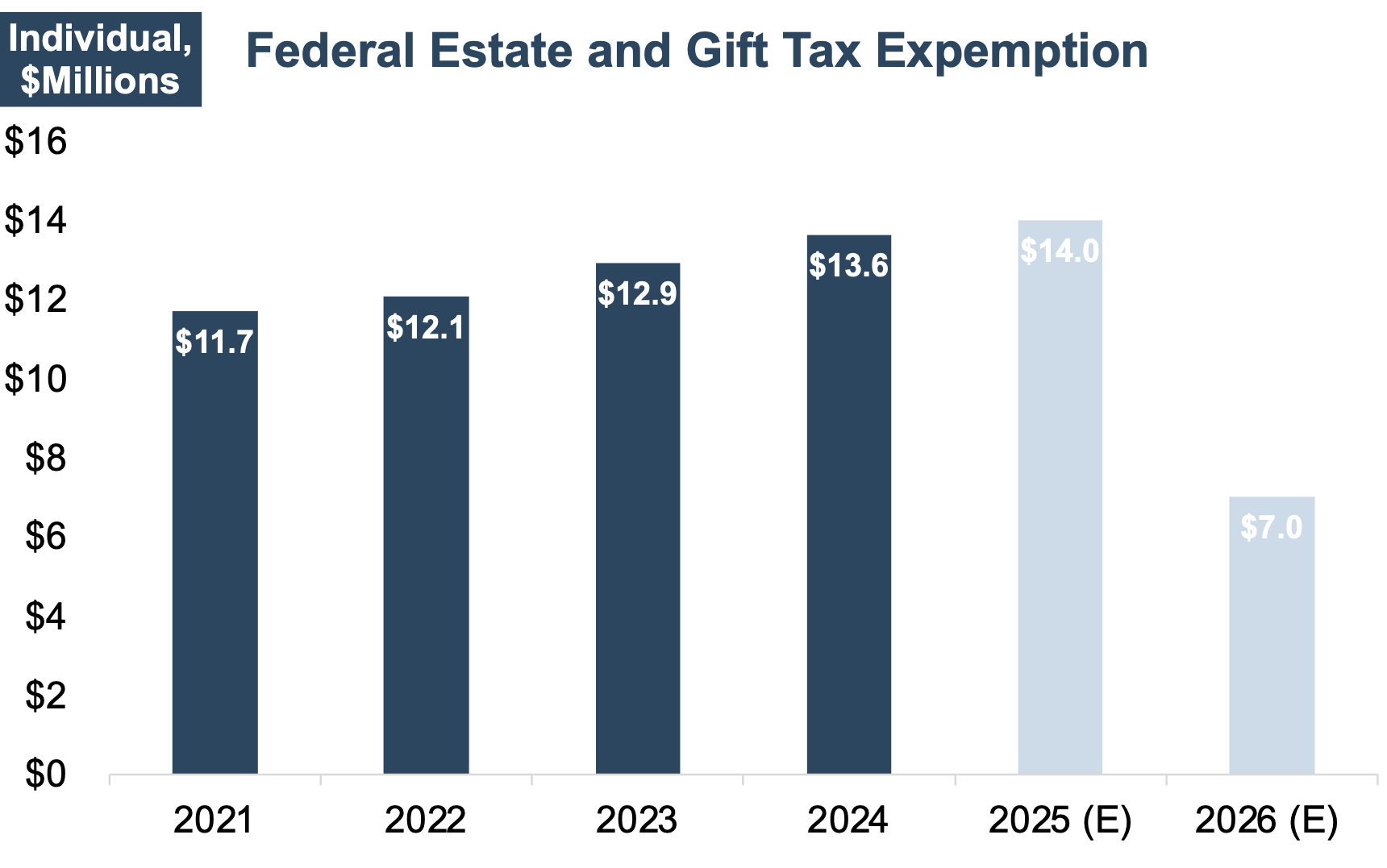

The TCJA doubled the basic exclusion amount individuals could give away without paying estate taxes for tax years 2018 through 2025. For 2024, the combined gift & estate tax exemption is $13.61 million per individual or $27.22 million per married couple. In 2026, the basic exclusion amount is due to sunset to its pre-TCJA level of $5 million plus inflation (estimated at approximately $7 million).

In the context of estate taxes, sunsetting provisions will significantly increase potential estate tax liabilities and motivate taxpayers to re-evaluate their planning strategies. The extension of the federal estate tax threshold amount will most likely come down to which party holds political power in Congress and the White House in 2024.

How To Best Prepare

Estate tax sunsetting provisions add an additional layer of complexity to the already intricate world of estate planning and taxation. While they encourage regular policy review and adaptation, they also introduce uncertainty for taxpayers and can lead to shifts in behavior and financial planning strategies.

All signs point to the QBI deduction not being extended after the 2025 tax year. However, the IRS will most likely have to enact some sort of deduction or credit to maintain the tax benefit of pass-through entities compared to C-corporations. At this time, potential options to prepare for this sunset provision include accelerating income into 2025 and deferring expenses until 2026 to increase the income eligible for the QBI deduction.

It is certainly possible that the higher estate-tax exemption amount could be extended or made permanent, however, wealthy taxpayers need to weigh the risk of inactivity if the sunset takes place.

There was serious doubt about the future of gift & estate tax exemption in 2013. Total gifts reported to the IRS were $135 billion in 2012 compared to $421 billion in 2013. With the sunsetting provisions looming, a spike in estate planning transactions comparable to 2013 is likely to occur through the end of 2025. Don’t wait to call your estate attorney on December 1, 2025.

Conclusion

In the words of Bob Dylan, “You better start swimmin’, or you’ll sink like a stone for the times they are a-changin’.”

Time does not wait for anyone. Family business directors and advisors must stay informed and be prepared for potential changes resulting from sunsetting provisions. Our team of valuation professionals is ready to help you and your clients navigate these challenges.

Family Business Director

Family Business Director