Transaction Outlook 2022

Dealmakers logged record levels of merger and acquisition activity in the middle market (deal values between $10 million and $500 million) in 2021. In this post, we highlight a few of the trends that bore themselves out in middle-market M&A activity in 2021 that family business owners and directors should keep in mind when evaluating potential transactions in 2022.

1. Widespread Liquidity

2021: One of the key factors that drove M&A to levels observed in 2021 was companies’ elevated liquidity positions and cash balances relative to pre-pandemic levels. Both public and private companies built up large cash balances in 2020, as large discretionary capital spending projects were often deferred until the uncertainty initially brought on by the pandemic was resolved. Many companies also generated better-than-expected earnings and cash flows throughout 2020 and 2021, adding to the already accumulating war chests on corporate balance sheets. Many companies put these inflated cash balances to work pursuing M&A opportunities in 2021, as the practical difficulties (in-person diligence, etc.) associated with closing deals in 2020 were generally alleviated in 2021.

2022: We expect this trend to continue into 2022, as cash-rich companies will continue to look for favorable M&A opportunities that competitors could otherwise potentially pursue. While some observers believe pricing for deals in the middle market is at an unsustainably high level, growing corporate cash balances may well continue to support elevated deal values and multiples in 2022. These dynamics are likely to extend the favorable environment for sellers in the middle-market that has persisted for the past several years.

2. Ease of Financing

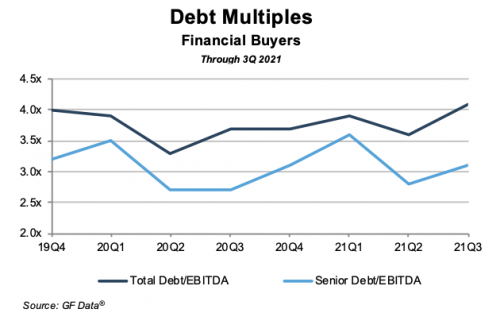

2021: Companies that chose to finance deals rather than pay cash in 2021 benefitted from historically low interest rates thanks to continued quantitative easing pursued by the Fed in response to the pandemic. “Easy money” policies accelerated the use of debt across the middle market, as seen in the chart below. Total debt to EBITDA multiples in the third quarter of 2021 reached 4.1x, the highest level over the past two years.

2022: As the economy continues its recovery and inflationary pressures persist, Fed Chairman Jay Powell has signaled that the Fed plans to raise interest rates by 25 basis points at least three times in 2022. While these increases will still leave rates at relatively low levels, buyers looking to take advantage of the current credit environment may look to accelerate deals – closing sooner rather than later in 2022.

3. Increased Levels of Private Equity Activity

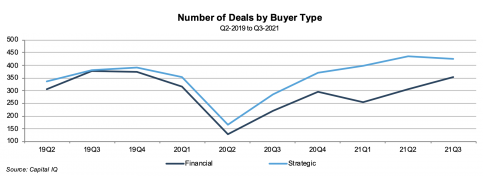

2021: As seen in the chart below, private equity (financial) buyers were increasingly active in 2021, and we expect that the data from the fourth quarter of 2021 will show a continuation of this trend when released. During 2021, the prospect of an increase in capital gain tax rates loomed large over the middle market. This helped bring some corporate assets to market, as sellers looked to take advantage of the current tax environment. Private equity firms deployed capital across the middle market, capitalizing on the buying opportunities brought on uncertainty surrounding future tax policy.

2022: Private equity buyers are expected to remain active in the middle market in 2022. According to S&P Global Market Intelligence, PE firms ended 2021 sitting on record amounts of dry powder (committed, but unallocated capital). We expect PE firms to be anxious to deploy this capital in 2022, which will increase competition for deals and could drive multiples even higher.

The trends outlined above contribute to a continued positive outlook for potential sellers of well-positioned businesses in 2022. Elevated levels of liquidity, relatively cheap debt financing, and increased levels of private equity activity all signal that the seller’s market of the past several years will likely persist in 2022.

While we believe these trends to be instructive as to the potential transactional climate in the middle market in 2022, we also recognize that every family business has a unique “meaning,” which we have outlined on this blog before. When pursuing a transaction on either the buy side or the sell side, it is crucial for family business owners and directors to first develop consensus regarding what the family business means to the family. In short, what may be a favorable transactional opportunity for one family business could turn into a boondoggle for another. Evaluating M&A opportunities on both the buy side and the sell side through the lens of your family business’ “meaning” is crucial to creating value for your family business through M&A.

As seasoned advisors participating on both front-end and post-transaction processes, we understand that every deal is unique. Give us a call if you want us to take a look at an acquisition target or LOI from a potential acquirer of any part of your family business.

Family Business Director

Family Business Director