Why Your Family Business Has More Than One Value

Due to the popularity of this post, we feature it again this week. In this post, we explore why the “value” of a family business can be a matter of perspective. The value of the business to a strategic buyer is different from the value to the family, and different yet from the value of a single share in the business.

It is understandably frustrating for family business directors when the simple question – what is our family business worth? – elicits a complicated answer. While we would certainly prefer to give a simple answer, the reality a valuation is attempting to describe is not simple.

The answer depends on why the question is being asked. We know that sounds suspect, but in this post, we will demonstrate why it’s not. Let’s consider three potential scenarios that require three different answers.

What Is Our Family Business Worth to Our Family?

This is the most basic question about value, and the answer revolves around the expected cash flows, growth prospects, and risk of the family business on a stand-alone basis. This does not mean that the status quo is assumed to prevail indefinitely, only that a combination with a strategic buyer’s business is not anticipated. The family business may have plans for significant changes to operations or strategy, and if it does, the value should reflect such changes.

The value of the family business to the family depends on three principal factors: expected cash flows, growth prospects, and risk.

This perspective on value is especially important to family business directors weighing long-term decisions regarding dividend policy, capital structure, and capital budgeting. The value of the family business to the family depends on three principal factors:

Expected Cash Flows

Identifying the expected cash flows of the business requires careful consideration of historical financial results, anticipated economic and industry conditions, and the capital needs of the business. Revenue and earnings are important, but future cash flows also depend on how much the business will need to spend on capital expenditures and working capital to execute on the business plan.

Growth Prospects

All else equal, the faster a business is expected to grow, the more valuable it is. Cash flows can grow because of increasing market share, a growing market, or improving profitability. The assessment of growth prospects should take into account each of these potential factors and the sustainability of each.

Risk

The value of a business is inversely related to the risk. Investors crave certainty, and risk is just another word for not knowing what the future holds. The wider the range of potential outcomes for your family business, the riskier it is, and the less enthusiastic investors will be about committing capital to the business. When investing in riskier businesses, investors pay less. Risk is evaluated relative to comparable investments or businesses.

Whether using a discounted cash flow method or using methods under the income approach, the value of the family business to the family is a function of these three attributes of the business itself. This measure of value is often likened to the perspective of stock market investors or private equity buyers that look to the operations of the business to drive return apart from a strategic combination with another business.

If this first question deals with the value of the family business assuming it continues being a family business, the second question addresses the value of the business once it stops being a family business. In other words, what is the value of the family business to a strategic buyer?

What Is Our Family Business Worth to a Strategic Buyer?

Families occasionally decide they don’t want to own the family business anymore. Families can reach this decision for different reasons. Sometimes, the family friction associated with managing the family business has reached an unsustainable level. In other cases, the family may be approached by a buyer of capacity with what appears to be a very enticing offer. Or, perhaps, an enterprising family decides that a “fresh start” with proceeds from the sale of the legacy business could unlock new opportunities for the family. In any event, when the decision to sell, or at least consider selling, has been made, directors naturally turn their attention to maximizing the sales price.

A strategic buyer is one that will combine the operations of the target company with their existing operations.

A strategic buyer is one that will combine the operations of the target company with their existing operations in a bid to increase the earnings and cash flow of the target and/or the newly combined entity as a whole. Strategic buyers are most commonly competitors of the target, but they could also be suppliers or customers. The essential attribute is that a strategic buyer has the ability to change how the target operates, resulting in either higher earnings, better growth prospects, or reduced risk (or some combination thereof).

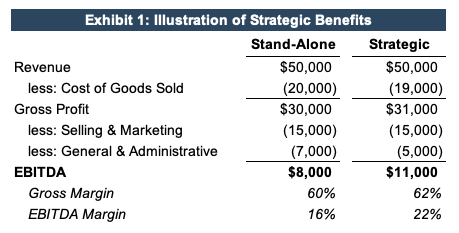

Exhibit 1 illustrates potential earnings enhancements available to a strategic buyer (in this case a competitor).

By combining the target with their existing operations, the larger strategic buyer will be able to achieve purchasing efficiencies, which will contribute to a higher gross margin. In addition, there are redundant general and administrative expenses, which can be eliminated by the buyer. As a result, the strategic buyer anticipates generating an EBITDA margin of 22%, compared to the 16% EBITDA margin available to the target company on a stand-alone basis. Stated alternatively, the strategic buyer anticipates EBITDA that is 38% higher.

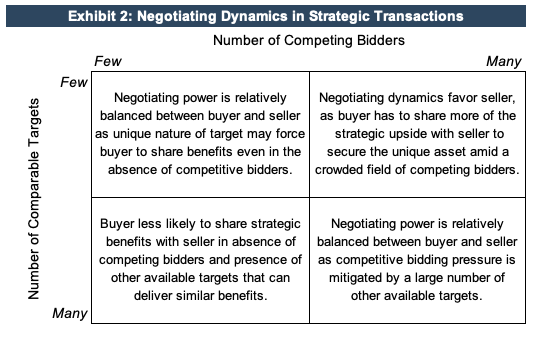

Does that mean that the target company is worth 38% more to the strategic buyer? Not necessarily. The amount that a strategic buyer will, in fact, pay for the target company depends on how many other strategic buyers they are likely bidding against and how unique the target company opportunity is.

The magnitude of strategic benefits available and the likely negotiating dynamics for a family business tend to be very fact-specific. So, assessing the value of your family business to a strategic buyer will require that you and your fellow directors consider the following questions:

- Who are the competitors, suppliers, or customers with whom our family business would provide the most compelling strategic “fit”?

- What opportunities would such buyers have for increasing earnings and cash flow, improving growth prospects, or reducing the risk of the family business?

- How unique is our family business? Are there other similarly situated businesses that can provide comparable strategic benefits to buyers?

A potential strategic sale is not the only context in which family business directors need to think about the value of the family business. We’ll consider the final variation on the question of value in the next section.

What Is a Share of Stock in Our Family Business Worth to an Investor?

The final question relates to the value of an interest in the family business, rather than the family business itself. Minority shares in a family business are often considered unattractive from an investment perspective for a number of reasons. As a minority shareholder, one has no direct influence or control over business strategy or other long-term business and financial decisions: one is simply along for the ride and subject to decisions made by others. Furthermore, since it is a family business, there is likely no ready market for the shares. As a result, one is effectively stuck, and, potentially, for a long time.

So, from this perspective we need to think about all the things that influence what the family business is worth to the family plus some additional considerations that relate to the unique position of being a minority shareholder in a private company. This perspective is critical for gift and estate tax planning.

Are There Any Dividends?

Regular cash flow dulls the pain of illiquidity. If there is a reasonable expectation that investors will receive dividends while owning the shares, that helps to mitigate the burden of being unable to sell the shares. Since many family businesses are set up as S corporations, it is important to clarify that the dividends that matter are those in excess of any tax liabilities that are passed through to shareholders.

What are the Prospects for Liquidity?

Even though there is no ready market in which to sell minority shares in a family business, there are still opportunities to sell the shares from time to time. For example, the family business could be sold, the company may repurchase shares from select shareholders, or other family members may be willing to acquire the shares at a favorable price. While future liquidity opportunities cannot be predicted with precision, it is possible to establish a range of likely holding periods by analyzing relevant factors. The longer the period until a liquidity event can be anticipated, the less attractive the investment.

What are the Growth Prospects for the Investment?

When liquidity does come, what proceeds can be reasonably expected? In other words, at what rate would one anticipate the value of the business to the family to grow from the current level? If the family business has a track record of reinvesting earnings in attractive capital projects, investors will view the growth prospects more favorably than if management has a propensity to accumulate large unproductive stockpiles of cash or other assets in the business.

What are the Relevant Risks?

As with the business itself, the value of a minority share is inversely related to the attendant risks.

As with the business itself, the value of a minority share is inversely related to the attendant risks. The risks of a minority share include all the risks associated with the family business plus those associated with the illiquidity of a minority interest. In other words, the focus is on identifying those risks (including, potentially, lack of access to financial statements, uncertainty as to the ultimate duration of illiquidity, uncertainty regarding future distribution decisions, and the like) that are incremental to the risks of the family business itself.

The combination of expected dividends, holding period, expected growth, and risk factors determine the value of a share in the family business relative to the corresponding pro rata portion of the value of the business as a whole to the family.

Conclusion

There is no simple answer to “What’s our family business worth?” because the question is never quite as simple as that. The answer depends on exactly how and why the question is being asked. From transaction advisory services to gift and estate tax compliance to corporate finance decisions, our valuation professionals have the experience and expertise to help you ask the right questions about the value of your family business and get the right answers. Call us today.

Family Business Director

Family Business Director