Viva Diversification: The Vegas Transformation and Your Family Business

We hope you enjoyed some steaks or chicken wings this past Super Bowl Sunday (Americans consume only 1.25 billion wings alone on the big day). Super Bowl LVIII was the first ever in Las Vegas, perhaps marking the city’s final shift from the “Sin City” of old to an entertainment-focused luxury destination.

Gone are the days portrayed in Martin Scorsese’s Casino. As Robert De Niro’s character laments, “In the old days, dealers knew your name, what you drank, what you played. Today, it’s like checkin’ into an airport. And if you order room service, you’re lucky if you get it by Thursday. Today, it’s all gone.” Live shows, expensive dining, and global sporting events are coming into focus as gaming (somewhat) diminishes as the key driver of Las Vegas. But the change has not been all bad—despite what Mr. De Niro may tell you. Las Vegas has been diversifying its offerings for nearly 30 years and reaping the rewards.

Total casino resort revenue increased from $4.7 billion in 1984 to nearly $30.0 billion in 2022, with fresh records for casino and gaming revenue set in 2023. Over that time, per data from the UNLV Center for Gaming Research, the revenue pattern of the industry has shifted as gaming itself has become less important to the overall revenue picture. Figure 1 below highlights the shift in total gaming department revenues for Nevada from 1984 through 2022, with gaming seeing relative declines to other revenue sources.

Figure 1 :: Nevada Total Casino Department Revenues

So, why should family businesses care? As markets move and tastes evolve, what worked for your family’s business in the first generation may not work for the second or third. Diversification and how you approach where to invest limited family capital should not take a backseat to the tyranny of the now. Perpetuating your family business takes thinking about generations rather than quarters and strategizing for the next phase in your family’s journey today.

What Is Diversification?

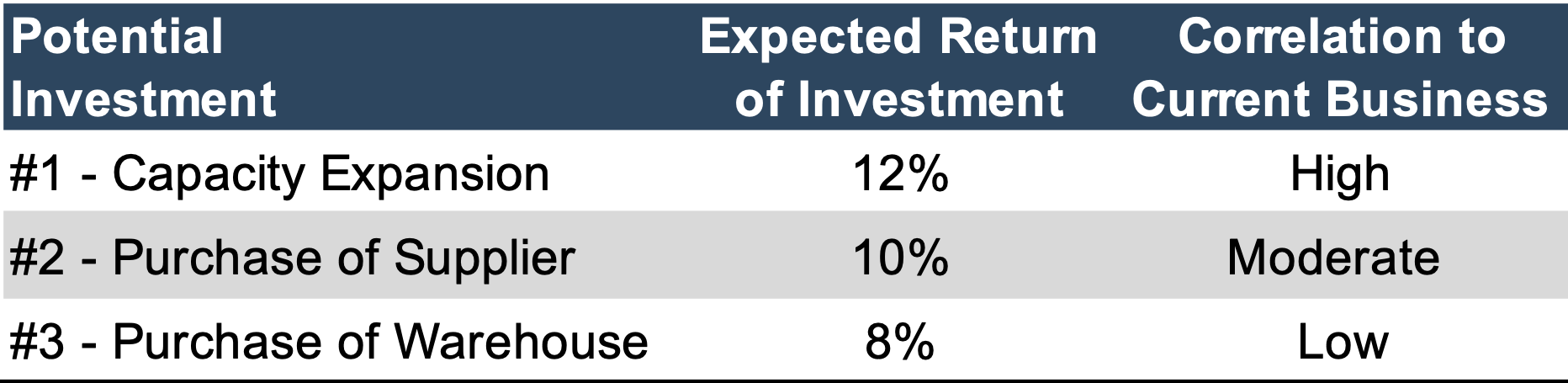

Diversification is simply investing in multiple assets as a means of reducing risk. Suppose one asset in the portfolio takes a big hit. In that case, some other segment of the portfolio will likely perform well at the same time, thereby blunting the negative impact on the overall portfolio. A big question when considering diversification is correlation: if what you are investing in is closely tied to your business, diversification benefits are blunted. Below is a simple diversification decision facing a family business.

Figure 2 :: Simple Diversification Example

There is no unambiguously correct choice for which investment to make. While the capacity expansion project offers the highest expected return, the close correlation of the returns to the existing business indicates that the project will not reduce the company’s risk—or variability of returns. At the other extreme, the warehouse acquisition has the lowest expected return, but because the returns on the warehouse are essentially uncorrelated to the existing business, the warehouse acquisition reduces the overall risk profile of the business. The correct choice in this case should be made with respect to the shareholders’ risk tolerance and how the investments fit the business strategy.

Diversification: Should We Diversify?

As we’ve written previously, assessing the strategic threats to the family business can help directors evaluate the best path forward regarding diversification. Porter’s “The Five Forces” may be helpful in thinking about the strategic position of your family business.

- Threat of New Entrants. What are the barriers to entry for new firms to enter your market? What protects your family business from outside players?

- Supplier Bargaining Power. How could your family business handle supply chain disruptions or price inflation? How much cushion do you have to weather margin compression?

- Rivalry Among Existing Competitors. Why do customers choose your family business over others? How do you maintain and grow market share?

- Threat of Substitutes. Are you selling yesterday’s news? What alternatives pose the biggest risk to your existing products and services?

- Customer Bargaining Power. How would you handle losing your top customer? Do you have significant customer concentrations?

Analyzing these forces can help family business directors evaluate whether to diversify, by how much, and in what direction.

Diversification: Where to Invest?

How does your family business decide where to allocate resources? Before analyzing the expected return of various investments or capital projects, you need to determine the right hurdle rate for your family business.

In addition to minimum hurdle rates, there is also the constraint of limited family capital. You may face multiple options that exceed your company’s hurdle rate or WACC. What then? We see family businesses make good investments by focusing on four areas: market opportunity, strategic fit, financial vetting, and success monitoring. We detail these areas in Figure 3 below.

Figure 3 :: Criteria for Good Investment

Click here to expand the image above

Conclusion

Las Vegas transformed itself and its image over time to become the entertainment destination it is today. While “there’s blackjack and poker and the roulette wheel, a fortune won and lost on every deal,” casinos and operators on the Vegas strip saw an opportunity as gambling proliferated across the country (new entrants and competitors) and consumer tastes changed. Is your family thinking about diversification and new investment opportunities? And if so, how will they affect your company over the next generation? Give one of our professionals a call to walk through these issues together.

Family Business Director

Family Business Director