What Is on Your Family Business Box Score?

Back in the day when not all sporting events were shown on TV, reading the box score in the newspaper the next day was sometimes the only way to know the story of the game.

A box score is a structured summary of results from a competition. The box score lists the game score as well as individual and team achievements. Here’s an example of a baseball box score—a savvy baseball fan might remember this game as it was especially memorable.

As you see, the box score can tell the story of the game through key statistics—innings represent the primary measurement period, and runs, hits, and errors summarize the main takeaways from the game. Here’s another example of a box score—personally, one of my favorites as I was born and raised in New Orleans.

A question for you and your board, what is on your family business box score?

When the lights are still on and things are stable, it can be easy to continue with business as usual and not look too closely at key return metrics. Creating a box score, and maybe more importantly, updating it consistently, can help prevent complacency. Establishing fundamental metrics important to your business and benchmarking your performance to peers or “opponents” can help quickly convey to you and your shareholders how the family business is doing.

Consider these three metrics for your family business box score.

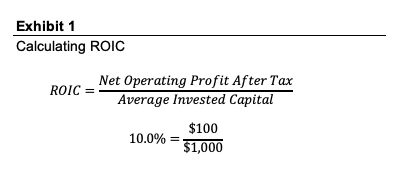

Return on Invested Capital

Return on Invested Capital—ROIC—is one of the best comprehensive measures of financial performance for family businesses. In its simplest form, ROIC is the ratio of NOPAT (net operating profit after tax) to invested capital (the sum of equity and debt capital invested in the business). It describes how much NOPAT the business generates per dollar of invested capital.

ROIC depends on both the income generated by the business and the amount of capital invested. It is a great metric for the family business box score as it facilitates comparison to the performance of alternative investments that may be available to the family. As we have discussed previously, companies with higher ROIC display positive attributes for businesses: faster growth, more cash distributions, reduced risk, increased shareholder returns, and increased worth of the company as a whole.

Paying attention to ROIC today is a reliable way to improve shareholder returns tomorrow. It is a powerful metric for evaluating how your family business has performed in the past and creating a strategy for future improvement.

Shareholder Returns

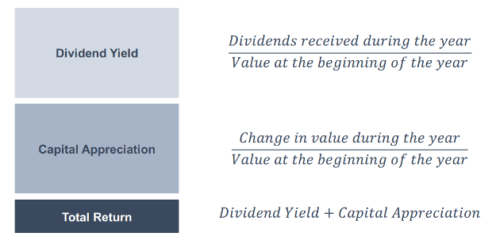

Investment returns have two components: dividend yield and capital appreciation. The yield measures the current income a business generates, while capital appreciation measures the increase in value during the period. As depicted below, total return is the sum of yield and capital appreciation.

These two components have an inherent tradeoff—greater current income limits future upside, and increased growth usually comes at the expense of current income. Investors choose from a menu of different investment alternatives, including short-term treasury notes, small-cap public stocks, private equity, and/or venture capital. Uniformly, investors desire higher returns; however, the greater the expected return correlates with the increased potential risk. Think of it like a football team: are we a run-first, ball-control offense, or do we sling the ball up and down the field? The two represent a tradeoff—but ultimately aim to achieve the same goal: a win. Or, in your family’s case: a return.

Just like a team’s “identity” aims to play to its strengths, your total shareholder return profile likely reflects what your business means to you. Analyzing where the total return comes from (in the form of appreciation or yield) can help you see how you are doing relative to shareholder objectives and desired business meaning.

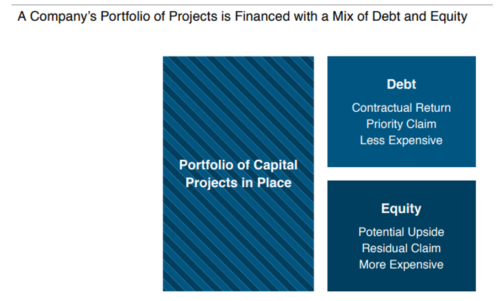

Capital Structure & Financial Leverage

Utilizing capital structure & financial leverage on your family business box score can lead to a plethora of important strategy discussions. Conversations with family shareholders that include: What is the appropriate mix of debt and equity? What is the current capital structure? How does the capital structure compare to our peers? What effect would different financing decisions have on the overall cost of capital? What is the target capital structure?

Capital structure decisions are inevitably linked to family business meaning and shareholder objectives. Are you seeking to leverage current assets to achieve growth into the future (growth engine), heightening risk, or do you avoid debt to reduce volatility and shore up dividends?

Financial leverage can be measured by comparing total debt to invested capital (book values of debt and equity), market values, or relative to cash flow. Ratios like debt-to-equity, debt-to-EBITDA, and debt-to-assets can be useful for your family business box score, especially when used to benchmark to peers in direct competition within your industry.

Conclusion

The sports and business worlds are increasingly data-driven, and access to relevant data is essential to making the right decisions. The best performance metrics address not just “what” performance has been in the past, but reveal the “why” behind it and give direction for “how” to improve operations in the future. We believe that the individual statistics discussed above qualify as the best performance measures to help depict the “why” and guide the “how” in the future.

Creating a process for your family business and understanding which key metrics to utilize for a box score can be challenging. But rather than stress about the exact measures, aim for consistent measurement and understand the drivers and outputs of your selected metrics. Our family business advisory professionals help family management teams develop their box score and align their perspectives on the financial realities, needs, and opportunities of the business.

We’ll be taking next week off from the Family Business Director Blog. Enjoy the holiday, and we will see you in the new year!

Family Business Director

Family Business Director