Who Eats First, the Family or the Family Business?

It’s that time of year again. The grocery list has been made, the headcount has been verified, and the dusted box with pilgrim decorations has been taken down from the top shelf of the storage closet. The table might not be set yet, but for the most part, we know who we will be eating turkey with next week on Thanksgiving Day. Aunt Cathy may or may not bring Cousin Lenny, but Cousin Lenny prefers ham and doesn’t even eat any cornbread stuffing or pumpkin pie, so we don’t need to worry about him!

Traditionally, we have offered some suggestions on what not to talk about at the Thanksgiving dinner table. But this year, we decided to focus on something new. Who eats first, the family or the family business?

There is no cookie-cutter recipe or fine-tuned formula one might use to answer this question. On the surface, it does not seem like a tough one. However, every family business operates differently, with different shareholder preferences, family dynamics, and investment decisions.

So, before answering the most important question of who eats first on Thanksgiving Day, ponder these three topics to help guide you.

The Meaning of the Family Business

The meaning of a family business is a function of both family and business characteristics. As shown above, the meaning of the family business, in turn, influences the company’s dividend policy, investing, and financing decisions.

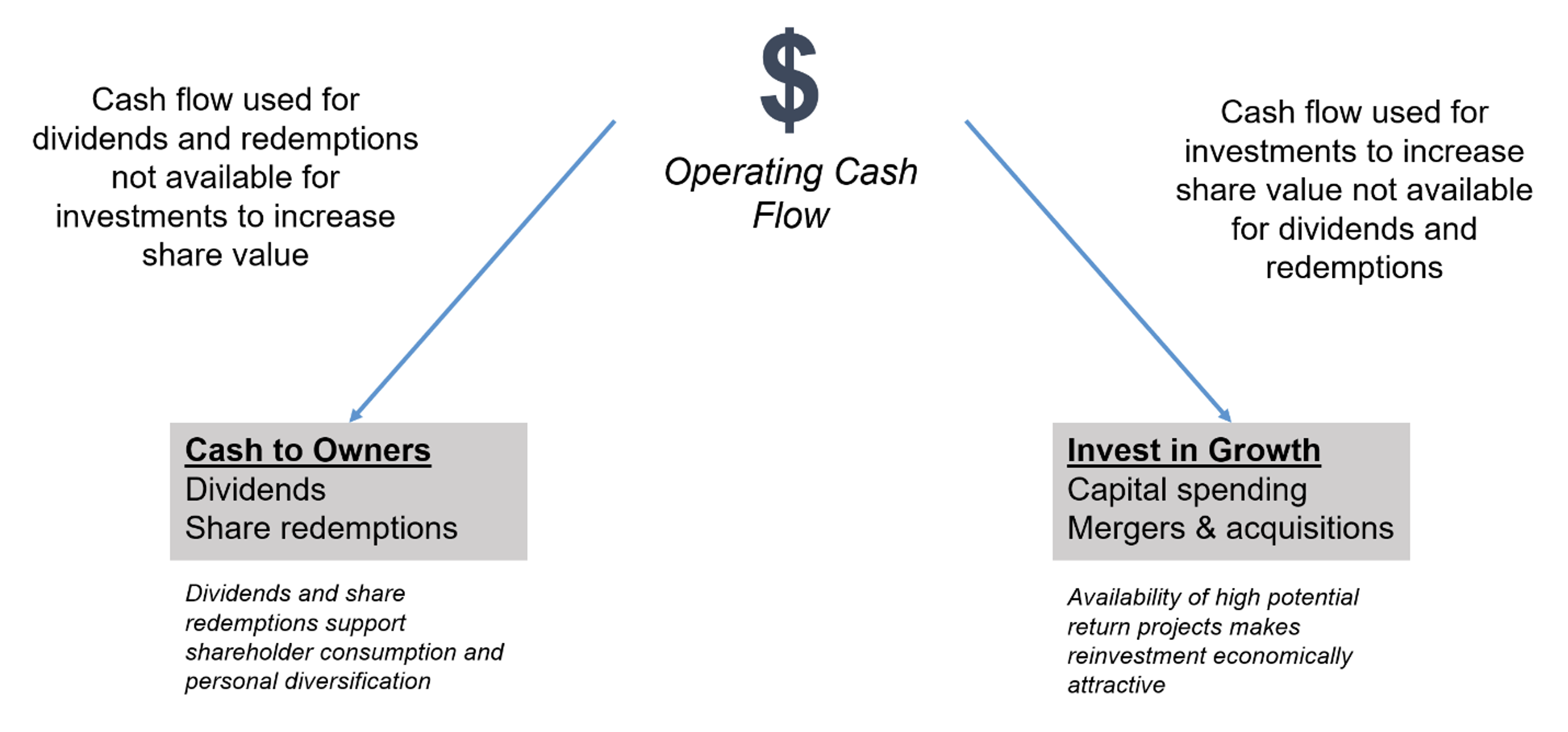

Family business directors must decide how to dispose of every dollar the business generates through its operations. At the most basic level, a dollar of operating cash flow can be returned to owners in the form of dividends and share redemptions or reinvested in the business.

When the family business can access many investments offering high returns, reinvestment will be more attractive. However, if there aren’t many attractive investment options out there, retaining capital in a business that can’t use it well drives down returns and risks the future of the family enterprise.

When discerning what the family needs, there is no substitute for asking.

- What are the liquidity needs of family shareholders?

- How much risk are family shareholders willing to bear in pursuit of capital appreciation?

- How important is the family’s legacy?

Shareholder circumstances and attitudes are constantly evolving, so even if you had a good feel for what the family needed five years ago, you may not know what they need today. In our experience, the most successful family businesses balance the business needs with the family shareholders’ needs.

Dividend Policy

Once the “meaning” has been embraced by the family, the distribution policy will more naturally follow. Answering the dividend policy question for your family business requires looking inward and outward. Looking inward, what does the business “mean” to the family? Looking outward, are attractive investment opportunities abundant or scarce?

Some family businesses have shareholders who are highly dependent on distributions from the company to fund their lifestyle and are focused on the dividend-paying capacity of the family business. Other shareholders may fund their lifestyle needs from other sources and are more focused on the rate at which the value of their investment in the family business grows.

Ultimately, family business directors need to remember their shareholders are just that: shareholders. While their equity may have been earned hereditarily, the family business directors owe a duty to the family shareholders — a focus on maximizing shareholder value through a mix of good reinvestment opportunities and distributions.

Capital Allocation

Dividend policy decisions are not made in a vacuum. When operating cash flows are used to pay dividends, those cash flows cannot be reinvested to grow the business. Conversely, cash allocated for the future growth of the business is not available to provide for the liquidity needs of family shareholders.

Click here to expand the image above

Successful family business directors must balance the company’s needs with those of the family when making capital allocation decisions. Analyzing investment choices and understanding your family shareholder objectives is not easy, but going back to the meaning of your family business will help provide a backdrop for making these decisions.

Conclusion

A clear understanding of what the business means to the family is essential if decisions about dividend policy and capital allocation are to be made in a coordinated manner. Matching your family shareholders’ growth objectives with their relative risk tolerance is a key challenge for family business directors and one that is tied directly to what your family business means to you.

Our professionals are eager to help your family discern what your family business currently means so that everyone has a seat at the Thanksgiving dinner table.

Family Business Director

Family Business Director