On December 27, 2016 Toshiba Corporation, the Japanese electronics conglomerate, announced the possibility of a goodwill impairment charge related to its U.S. nuclear power plant construction business, specifically, CB&I Stone & Webster Inc. (“Stone & Webster”), which was acquired for $229 million in late 2015 by Toshiba’s Westinghouse Electric Company subsidiary. Both the buyer and target have been plagued by financial difficulties (and goodwill impairment charges) since that time.

A quick summary of events:

- Toshiba purchased Westinghouse in 2006 for approximately $5.4 billion.

- On January 5 2016, Toshiba announced that Westinghouse had completed its acquisition of 100% of the shares of Stone & Webster. The press release noted an initial goodwill estimate of $87 million under U.S. GAAP, with finalization by the end of calendar year 2016.

- On April 26, 2016, Toshiba announced that it expected to record a goodwill impairment charge related to its nuclear power business including Westinghouse and its group companies. The company stated that the forecast for Toshiba’s financial condition had deteriorated significantly, bringing changes to the company’s funding environment. The press release discussed application of ASC 350 Step 1 impairment testing as well as Step 2, in which Toshiba reevaluated the fair value of the nuclear business’s intangible assets. The ultimate amount of the charge was $2.3 billion.

- Problems at Westinghouse and Stone & Webster continued throughout 2016, including litigation with the seller about who should shoulder potential liabilities relating to cost overruns.

- The December 27, 2016 announcement from Toshiba, mentioned at the outset of this post, also noted that goodwill impairment charges could reach a level of “several 100 billion yen or several billion US dollars.” This figure (far in excess of the Stone & Webster purchase price), suggests goodwill impairment at the Westinghouse level. Toshiba indicated that the “cost to complete certain US projects will far surpass original estimates, mainly due to increases in key project parameters.”

- Toshiba issued a press release on January 24, 2017 disclosing that the determination of goodwill impairment was continuing, and would be announced on February 14th, 2017, concurrent with Toshiba’s third quarter FY2016 earnings release.

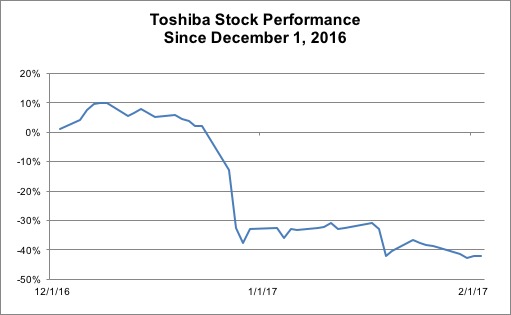

Since the December announcement, investors have reacted negatively, as depicted in the graph of Toshiba’s stock price below. On December 23, 2016 Toshiba closing stock price was at $22.74, falling to $19.41 on December 27, 2016, and even further on the next day as markets responded to the news, closing at $14.99.

Toshiba’s difficulties come at a time in which the accounting for goodwill impairment testing is changing. The accounting continues to be governed by ASC 350, Intangibles—Goodwill and Other, which requires annual testing of goodwill for impairment at the reporting unit level.

Entities have the option to perform Step 0 (a qualitative test) to assess whether it is necessary to perform Step 1 (quantitative test). Alternatively, entities can bypass Step 0 and begin with Step 1 of the goodwill impairment test. Step 1 compares the fair value of the reporting unit to its carrying amount. If fair value is greater than the carrying amount, Step 2 is not required. Step 2 of the goodwill impairment test (as Toshiba referenced in one of its press releases) is required in order to measure the amount of the impairment charge. This charge is calculated by comparing the implied fair value of goodwill to its carrying value. It is that last step that is about to change.

On January 26, 2017, the FASB eliminated Step 2 from the goodwill impairment test, thus simplifying the accounting for goodwill impairment. We previously wrote on the proposed accounting standards update as the simplification process was unfolding. Going forward, goodwill impairment charges will be calculated as the amount by which the carrying amount exceeds the reporting unit’s fair value, with the loss limited to the total amount of goodwill allocated to that reporting unit. FASB also eliminated a previous special requirement for reporting units with a zero or negative carrying amount. The changes are contained in Accounting Standards Update No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. Effective dates vary, beginning in 2020 for calendar-year public business entities that meet the definition of an SEC filer. Early adoption is permitted for annual and interim goodwill impairment testing dates after January 1, 2017.

At Mercer Capital, we will continue to monitor changes in the accounting for goodwill and we will also be watching to see how Toshiba ultimately records and explains any goodwill impairment charges to its nuclear power business units. If you have any questions about the new accounting rules for goodwill, please contact a Mercer Capital professional.

Related Links

- FASB Muses on Goodwill Impairments

- Appraisal Foundation Releases Final Guidance on Fair Value Measurement of Customer-Related Assets

- New Rules for Goodwill Impairment?

- 24-Hour Impairment: Merck’s Drug Deal with Cubist

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.