With 2015 just getting underway, there have been several initial public offering (IPO) announcements, and Box (NYSE: BOX) is one of the biggest so far this year. Box, a cloud-based enterprise content management and file-sharing company, was founded in 2005 and started trading publicly today, January 23, 2015. Box is somewhat unusual among the current crop of IPOs with regards to the time spent in the process, and pricing at the time of going public.

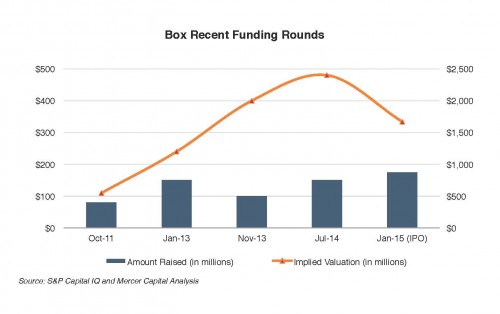

In early 2014 the company announced its intention to go public, yet it chose to delay the process due to the performance of other software IPOs and to give itself time to strengthen its financials. During the delay, Box sought another round of (private) funding which valued the company at approximately $2.4 billion. The Series F round in July 2014 raised $150 million (at $20 per share) for the Company from TPG Growth and Coatue Management. On January 22, 2015, Box was priced at $14 per share, above the $11 – $13 per share range expected until shortly before the IPO. Even at the higher price, the company was valued at nearly $730 million less than that implied by the Series F round just six months prior. The chart below underscores the sharp decline in implied enterprise value over the six months between Series F and IPO.

It appears that the Series F investors were (at least partially) protected in case the IPO effectively turned into a down round. According to a Financial Times (subscription required) report, the investment came with certain provisions (“ratchets”) that insured (a) a minimum return of 11% if an IPO occurred within 12 months of the Series F round, or (b) a 15% return if the IPO was deferred.

Box’s last private fundraising activity, and recent performance leads to a couple of intriguing observations with regards to the company’s IPO.

- First is the issue of the company’s cash needs. In the twelve-month period ended October 31, 2014, Box’s financial performance improved compared to the same period prior year, with revenue and cash growth exceeding the growth in deficit. However, the stipulations of the Series F capital raise along with the fact that Box does not expect to become profitable in the near future begs the question as to how much of the IPO capital Box needs to simply sustain its operations. Will the company need to follow on with a secondary offering to raise even more cash to burn through?

- Another observation is the wide variation in the apparent perception of a company among the investors regarding its value within a relatively short period. Even though specific pricing data was never available for the initial IPO filing in early 2014, the TPG and Coatue investment would have been (at least partially) indicative of pricing (close to $20 per share) from a market participant perspective in July 2014. Stock for the same company priced at $14 per share in its IPO in January 2015. Even though similar amounts of capital were raised for the same company, the IPO price for Box implied an approximately 30% decline in enterprise value compared to the last private investment six months ago. At the time of this writing, Box was trading (publicly) above $23 per share, well north of the IPO price. So, which price is right?

In a prior blog post, we outlined some considerations that are helpful in keeping the IPO price in perspective while estimate fair value. The post concluded, “Blind reliance on an estimated IPO pricing range should be avoided when estimating fair value [of a company prior to an IPO].” Caution is probably warranted in using IPO pricing in estimating fair value after the event as well, as evidenced by Box.

Related Links

- How to Value a Company Planning to IPO

- Box woos investors to secure $150m funds (subscription required)

- Box, Inc. amended Form S-1 filing

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.