M&A has not been a common occurrence among BDCs. Under the external management model, the opportunity for material cost savings is limited, and prices at or near NAV indicate that investors assign little “franchise” value to the lending and origination platforms. The recently announced acquisition of MCG Capital (MCGC) by PennantPark Floating Rate Capital Ltd. (PFLT) is likely the exception that proves the rule. In the conference call describing the transaction, PFLT’s chairman Arthur Penn aptly described the acquisition as a “synthetic equity” raise for PFLT.

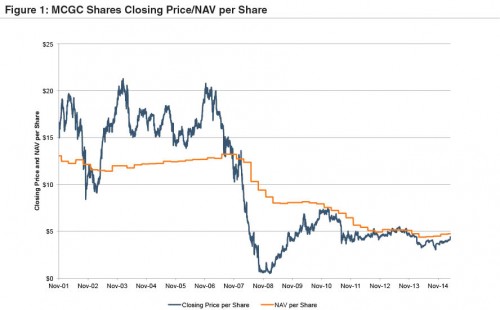

MCGC has experienced steady erosion in NAV per share since the beginning of the financial crisis due to substantial asset writedowns. Since that time, MCGC shares generally have traded at a discount – occasionally substantial – to reported NAV as shown in Figure 1.

The difficulty of operating a BDC that consistently trades below NAV became evident as MCG’s balance sheet contracted steadily from approximately $1.6 billion in mid-2007 to approximately $580 million in mid-2013. MCGC did not originate new assets in 2014, and total assets decreased further to approximately $180 million as the company suspended dividend payments and commenced an aggressive share repurchase program (acquiring approximately 46% of outstanding shares during 2014).

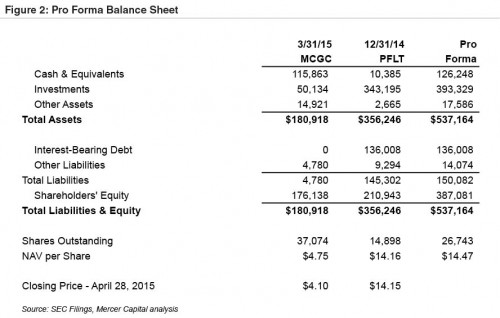

As of March 31, 2015, only four investments remain on MCGC’s balance sheet. Cash & equivalents represent approximately 64% of total assets at that date as shown in Figure 2; hence the description of the transaction as a “synthetic equity” raise for PFLT.

Total consideration to MCGC shareholders of approximately $4.75 per share is equal to reported NAV per share and represents a 15.8% premium to the prior trading price. The consideration consists of PFLT shares ($4.521) and cash ($0.226). Since the cash portion of the purchase consideration is payable from PFLT’s investment advisor, the transaction should be modestly accretive to NAV per PFLT share. PFLT shares did not move on the announcement.

According to PFLT management, the principal strategic motivation for the transaction was the ability to increase the fund’s size materially, allowing PFLT to capture a greater share of the middle market senior secured lending market and be able to provide financing for larger transactions. PFLT completed two secondary offerings in 2013, yielding aggregate proceeds of approximately $113 million. The MCGC acquisition will provide PFLT with an additional $176 million of capital. At estimated transaction costs of $2 million, the relative cost of the MCGC acquisition will be comparable to the offering costs incurred in the 2013 secondary offerings.

Given the increase in the share count from the transaction (approximately 80%), prompt deployment of the new capital will be critical to maintain PFLT’s monthly dividend of $0.095 per share. As with any capital raise – whether direct or “synthetic” – the ultimate success of the acquisition will depend on PFLT’s ability to put the new capital to good use.

Related Link

Business Development Companies First Quarter Newsletter

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.