Accounting Standards Update 2016-01 has generally flown under the radar since it was released almost two years ago. However, this accounting update has the potential to significantly affect financial reporting by public and private companies with minority equity investments – including corporate entities with a portfolio of venture capital investments. Mercer Capital’s forthcoming whitepaper on ASU 2016-01 will provide an overview of the accounting standards changes as they pertain to companies with equity investments and a few best practice considerations for firms with exposure to these changes.

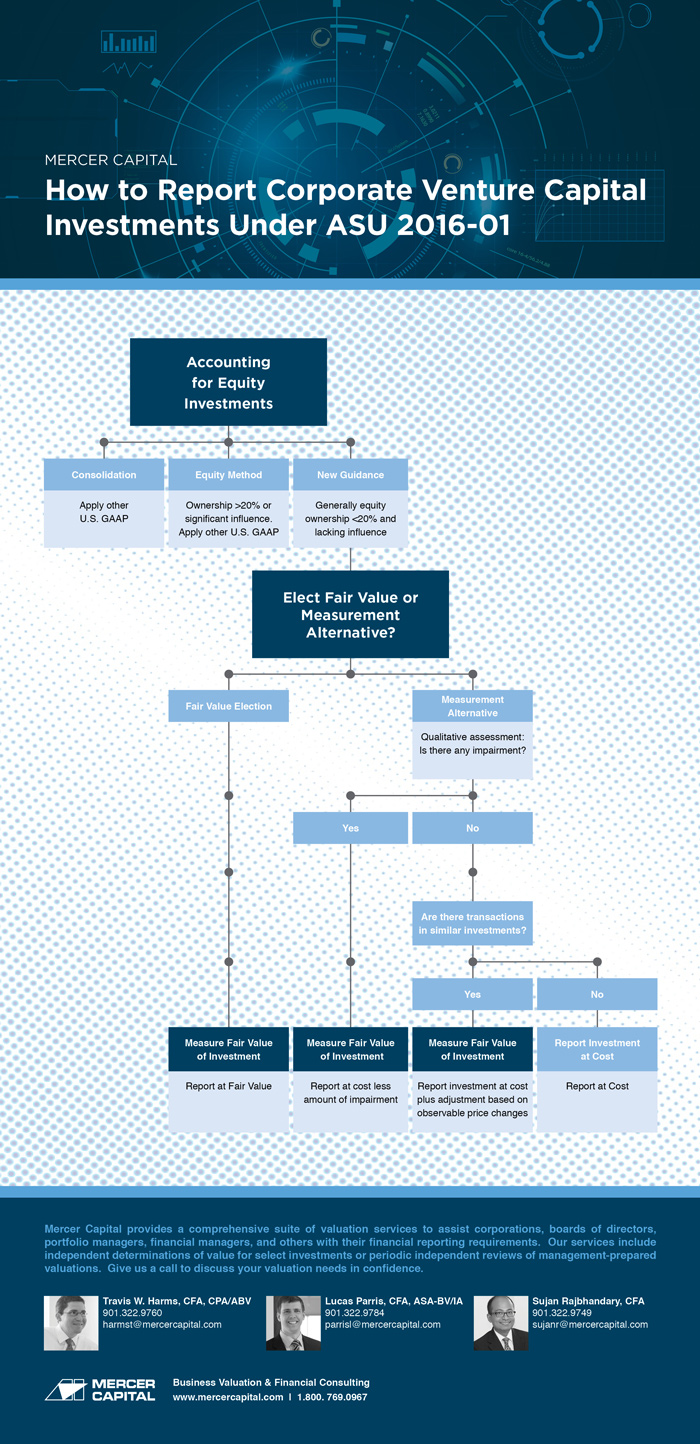

The new rules will require entities to measure equity investments at fair value (other than those accounted for under the equity method or those that result in consolidation), with changes in fair value recognized in net income. In other words, many minority-position equity investments that are currently carried at cost may now have to be carried at fair value at the end of each reporting period. The following chart outlines the decision-making process that entities will need to follow when complying with the new rules.

With the new rules becoming effective for public companies beginning in fiscal 2018 and for private companies beginning in fiscal 2019, entities should address the need for appropriate valuation policies and procedures to evaluate their equity investment reporting, monitor investments for impairment, identify observable price changes, and measure fair value when necessary. Our whitepaper on the new rules will address:

- Recent Trends in Corporate Venture Capital Activity

- Current Methods of Accounting for Equity Investments

- How To Account For Equity Investments Under ASU 2016-01

- Impact of ASU 2016-01 on Corporate Venture Capital Investment Reporting

- How to Value Venture Capital Investments

- ASU 2016-01 Best Practices

To receive your copy of the forthcoming whitepaper, Corporate Venture Capital and ASU 2016-01: Best Practices for Equity Investments sign up for the weekly Financial Reporting Blog here.

Related Links

- 5 Things to Know about Fair Value and Equity Investments

- Corporate Venture Capital Trends

- Presentation: Best Practices for Fair Value Measurement

- How to Value Venture Capital Portfolio Investments

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.