Is It Time for Banks to Rethink Insurance?

It’s no secret that the number of insurance agency acquisitions by banks and thrifts has declined considerably over the last ten years. According to SNL Financial, an average of 60 agencies were purchased by banks annually between 2004 and 2008. Over the next five years, the average annual tally dropped to 27. The most likely reason for this decline is the effects of the recession and less capital available for investment. Interestingly enough, however, the number of agency divestitures by banks has been fairly constant at about ten per year. In the broader market for insurance agencies/brokerages, transaction volume has only gotten more robust over the last ten years, including a record 361 deals completed in 2012. Private equity and strategic consolidators remain keenly interested in the sector.

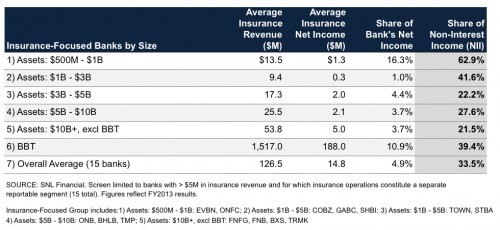

So is there any reason for banks to care about insurance anymore? A look at the numbers from some of the leading banks in insurance suggests that there is. We screened the universe of publicly traded banks for those institutions with at least $5 million in annual insurance revenue and for which insurance operations constituted a separate reportable segment. In other words, these are banks for which insurance operations are material, but the banks themselves are not so big as to dwarf the impact of the insurance revenue. Summary statistics for the 15 banks in our insurance-focused group are detailed below. The group is fairly evenly distributed by asset size, with the exception of BBT which is presented separately.

The most striking observation is the large share of non-interest income that these banks derive from their insurance operations. A consistent theme among banks for the last several years has been pressure on service charges on deposits. In fact, over the last five years, income from this line item has actually declined by 10.5% on average for banks in the $500M-$1B asset-based UBPR aggregate peer group. The results for the next two tiers, the $1B-$3B and $3B-$5B asset groups, were average declines of 4.2% and 3.5%, respectively. Growth in insurance-related revenue averaged 6.6% annually over the last five years for the insurance-focused group. So while the insurance-focused banks face similar pressures with respect to the traditional components of non-interest income, their insurance operations have provided a surprisingly strong source of growth.

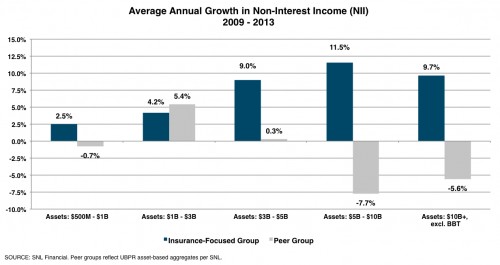

The following chart compares the growth in overall non-interest income for the insurance-focused banks and their corresponding size-based peer groups.

It is clear that for those banks already in the insurance business, the revenue derived from this segment has provided a much-needed source of non-interest income and growth in an otherwise difficult operating environment. And for banks searching for new sources of non-interest income, insurance may offer a compelling opportunity.

What are the key factors to consider when purchasing an agency? First, we would suggest that the investment not be predicated solely on the basis of the cross-selling opportunities. Questions about whether the bank can provide leads to the agency (and vice versa) are important and meaningful, but should you as a buyer pay upfront for these things? A better way to approach the issue is to look for an agency with a stable, recurring revenue stream that can contribute to non-interest income and help diversify the bank’s earnings. An agency that already has an existing client base and recurring commissions can then be leveraged to achieve synergies with the bank.

The insurance business is a personal, sales-oriented business. Revenue is primarily commission-based, and growth is driven by rate (hard vs. soft market) and exposure units (volume). The biggest expenses are people, including commissioned producers to sell business and a quality support staff to service the business and provide customer service and claims support if necessary. Margins in the industry vary by size and product focus, but for the insurance-focused bank group, the average after-tax margin on insurance revenue was approximately 9.0% in 2013. The preferred metric in the agency/brokerage industry is EBITDA margin (earnings before interest, taxes, depreciation, and amortization), which certainly sounds out of place in the banking world, but is nevertheless the base upon which performance is assessed and deals are struck. EBITDA margins for the insurance segments in the bank group highlighted above range from the mid-teens to mid-twenties. Average return on equity for insurance agencies is also higher than for banks because the businesses do not require a large balance sheet. For example, the median return on equity over the period 2009 through 2013 for banks with assets of $1-$10 billion was 6.9% per SNL Financial, compared to 13.6% for the five largest publicly traded insurance brokers.

Other key considerations when evaluating potential agency acquisitions include concentrations (customer/producer/carrier), technology and compliance issues, and cultural fit. Concentrations add risk, especially if a large portion of the business resides with one key producer or owner. For bank acquirers especially, technology and privacy compliance issues could also create unanticipated challenges post-transaction if certain systems and procedures are not thoroughly investigated in due diligence. Cultural fit is hard to define but can either speed along the integration/transition process or threaten to derail it altogether.

How much should a bank pay for an agency or book of business? Rules of thumb can be dangerous, especially those metrics based on revenue, which ignore profitability. Most buyers and sellers tend to focus on adjusted EBITDA for the most recent year or perhaps a pro forma to normalize for non-recurring expenses and income. Transactions are more often than not structured as asset purchases and frequently involve multi-year earn-outs. Purchase prices usually involve a large upfront payment, followed by earn-outs based on future profitability or client retention targets. Because key owners and producers are often asked to stay on for a transition period post-sale, earn-outs serve the dual function of protecting the buyer and motivating the seller by providing for enhanced proceeds if the acquired agency performs above expectations.

Expanding into the insurance business might not be the best option for all banks but it’s clearly an avenue for growth and income diversification for those that can spot the opportunity. Once a platform bank agency is established, the existing regional and community bank branch footprint can be used to expand the model and grow the business. That’s an advantage that potential non-bank acquirers do not have. So while the transaction statistics might suggest that bank-owned agencies are a thing of the past, the performance of banks already in the business indicates that the model works – and that valuable opportunities may reside just down the street.

Mercer Capital provides the insurance industry with corporate valuation, financial reporting, transaction advisory, and related services. To discuss your needs in confidence, please contact us.

Reprinted from BankWatch, May 2014.