“You only find out who is swimming naked when the tide goes out.”

– Warren Buffett

In a prior blog post, we noted a plethora of pricing indications observed around Box, Inc.’s (NYSE: BOX) initial public offering and asked the question, “Which price is right?” The prices (and implied valuations) that a business venture can obtain in future funding rounds, and in the public markets, are important considerations from the perspective of VCs and other investors. Unlike most mature public companies, however, startups have a predilection for complex capital structures, which introduces a degree of opacity that makes simple inference from headline numbers (however correct, however precise) difficult. A future funding round or exit event can result in varying outcomes for the multiple classes of securities with dissimilar rights and protections. This blog post will focus on the impact of (relatively steep) pre-public pricing on equity granted as employee compensation, usually the junior-most security in a startup capital stack.

Lay of the Land

Startup unicorns (pre-public companies with implied valuations exceeding $1 billion) are currently receiving plenty of press. While a broad swath of investors (even mutual funds traditionally focused on public companies) appear to be in a race to grab a piece of the unicorn pie, some founders are equally willing to reciprocate with a penchant for status rounds that “gives [them] credibility and the ability to hire some very important people.” Not all market participants, however, are sanguine about the dizzying escalation in the implied valuations for some of the pre-public companies. In addition to noting that investors rarely, if ever, subject a startup funding round to the same level of scrutiny faced by companies preparing to go public, venture capitalist Bill Gurley was quoted a few weeks ago opining on the potentially pernicious effect of a downturn in the pricing of pre-public companies:

“[At very high valuations] the cap chart begins to calcify a bit, which eventually can be problematic. Hiring new employees, particularly senior management, becomes tough because they worry about getting stuck beneath a huge liquidation preference stack. Some of these deals have so many [anti-dilution terms] that the cap table becomes almost concrete. If the valuation goes down significantly, it will sink them.”

“I think you’re going to see a lot of failure in 2015. If you’re a public company worth $3 billion and your stock trades down to $1 billion, you can survive it because you can still issue options to hire new employees, etc. If it happens when you’re private, though, it becomes immediately harder to hire or to get incremental investment.”

Stick Figure Cap Table

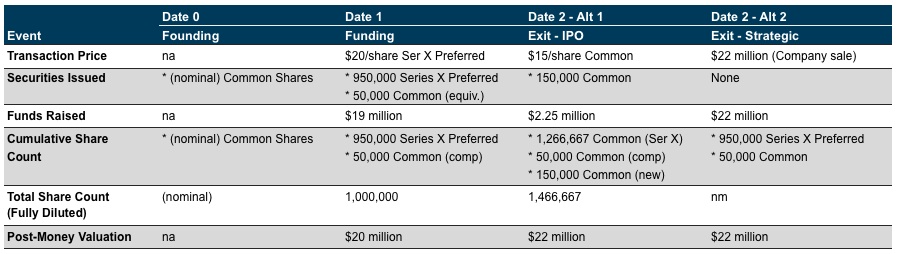

Mr. Gurley’s concern can perhaps be illustrated using a relatively threadbare fictitious capital structure. A couple of (independently wealthy) entrepreneurs found Company A at Date 0, and proceed to introduce a disruptive technology and begin to achieve some market traction. At a subsequent Date 1, Company A raises $19 million in equity by issuing 950,000 Series X Preferred at $20 per share. Venture capital investors and the founders participate in the Series X round. Concurrently, Company A also reserves 50,000 Common shares for the purpose of granting equity compensation to its employees (restricted shares and/or stock options). The Series X Preferred shares have the following rights and downside protections:

- Liquidation preferences equal to 1.15x invested capital ($21.85 million). The liquidation preference would not be available in the case of an IPO exit.

- Conversion rights to exchange the Series X Preferred for Common shares at $20 per share.

- Full ratchet protection to convert Series X Preferred to Common at a lower price per share immediately prior to a future funding event if there is a down round (or, an IPO at a price lower than $20 per share).

Based on the fully diluted count (1,000,000 shares), the implied post money enterprise value of Company A is $20 million at Date 1.

Consider two exit scenarios for Company A at a subsequent Date 2.

- An IPO to sell (new) 150,000 Common shares at $15 per share. Pursuant to the ratchet, Series X Preferred shares would convert to 1,266,667 Common shares immediately preceding the IPO. Based on the fully diluted count (1,466,667 Common shares), the implied enterprise value is $22 million.

- A sale of Company A for $22 million. Pursuant to the liquidation preference, Series X Preferred holders receive $21.85 million, and Common shareholders (employees) receive the balance of the proceeds from the sale ($150,000).

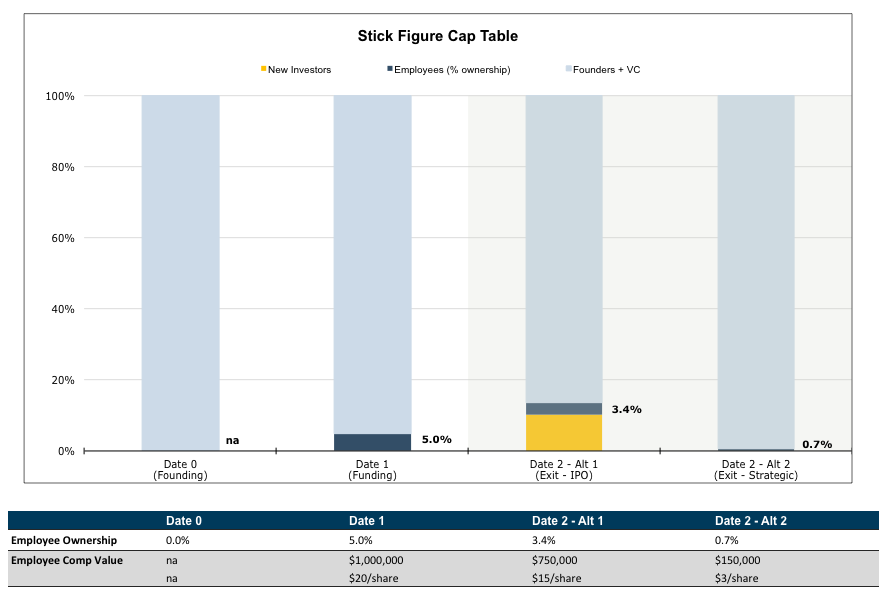

On a fully diluted basis, Common shares granted as equity compensation represent 5.0% of the total capital at Date 1 (nominal value of $20 per share – see discussion in a subsequent section). Under the IPO scenario, the employees’ stake in the Company is reduced to 3.4% (50,000 of 1,466,667 shares) at Date 2. If instead a sale of the Company were to occur, employees could only lay claim to a mere 0.7% of the total proceeds ($150,000 of $22 million).

Note that even as this example assumes a modest increase in the implied (post money) enterprise value between Dates 1 and 2, the value of the securities granted as employee compensation declines significantly. An exit that has to be consummated at a lower implied valuation would further erode any value (theoretically) realizable by the employees.

Real Consequences

In practice, the value of equity securities granted as employee compensation (common shares) should be different from the fully diluted economics presented in the preceding fictitious example. For example, factors that BOX reportedly considered in valuing common shares prior to its IPO included (partial list):

- Contemporaneous valuations performed by unrelated third-party specialists.

- The prices, rights, preferences, and privileges of [BOX] redeemable convertible preferred stock relative to those of [BOX] common stock.

- Lack of marketability of [BOX] common stock.

- Likelihood of achieving a liquidity event, such as an initial public offering or a merger or acquisition of [BOX] given prevailing market conditions.

- Illiquidity of stock-based awards involving securities in a private company.

- Recent private stock sales transactions.

Valuation specialists can employ the probability-weighted expected return method (PWERM) to evaluate potential proceeds from, and the likelihood of, several exit scenarios for a company including dissolution/liquidation, average performance, or spectacular results. Total proceeds available in each scenario would then be allocated to the various classes of equity based on their rights and protections. Alternately, if visibility around the future exit prospects for the company is low, practitioners can use the option pricing method (OPM) to explicitly model the rights of each equity class, and make generalized assumptions about the future trajectory of the company to deduce values for the various securities. Under the OPM rubric, in some situations a backsolve procedure to infer values of certain securities based on recent transaction prices of other equity classes may be feasible. On occasion, valuation specialists also use a Hybrid of PWERM and OPM as relevant/necessary.

Differential rights and protections, and the lack of marketability typically associated with common shares, usually result in valuation conclusions that are lower than the fully diluted indications implied by preferred funding rounds. In theory, the lower value conclusion at the date of grant should dampen the subsequent reduction in value of the common shares if a down round were to occur in the future. Nevertheless, two tax issues around equity compensation can have meaningful, negative impact on employee compensation in the event of a down round. (1)

- Section 409A of the Internal Revenue Code (IRC) mandates that for stock options (or other derivative instruments) granted as equity compensation, the strike price should not be less than the grant date fair market value of the underlying stock. IRS Revenue Ruling 59-60 defines fair market value as “the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.” Specifically as it relates to startups, Section 409A states that a valuation will be presumed reasonable if “made reasonably and in good faith and evidenced by a written report that takes into account the relevant factors prescribed for valuations generally under these regulations.” Pursuant to these guidelines and general practice, prices from recent transactions usually carry significant weight in a valuation specialist’s determination of fair market value of the underlying stock. Accordingly, down rounds effectively raise the hurdle for options granted at prior periods before they can be valuable to the employees.

- An IRC Section 83(b) election allows an employee receiving equity compensation in the form of restricted stock to pay income taxes based on the fair market value of the award at the grant date. Increases in stock prices subsequent to the grant date are taxed at capital gains rates. If such an election is not made, employees are liable for income taxes based on the fair market value of the award as the restricted shares vest. It is easy to see how employees receiving restricted shares and making a Section 83(b) election can benefit if the price of the stock rises between the grant and vesting dates (provided other conditions for vesting are satisfied). In the case of a down round, or if an IPO (and subsequent trading) occurs at prices lower than at prior grant dates, however, the employees will have already paid (certain) taxes based on a higher value for a security that is worth less (and vesting may yet be uncertain).

Some Observations

Whatever the prospects of the current crop of highly valued late-stage pre-IPO companies as a group, it is not inconceivable that some of the individual companies will experience difficulty in growing into their valuations. Fab.com is an oft-cited reminder of how things can go wrong. The company raised $150 million at an implied enterprise value of $1 billion in June 2013. Cumulative funding obtained by the company totaled approximately $330 million. Within four months of the last funding round, however, the company changed tack and let go of hundreds of its employees. While the founder has reportedly pivoted into a newer venture, the company could be sold for a total consideration (including cash and stock) of $15 million.

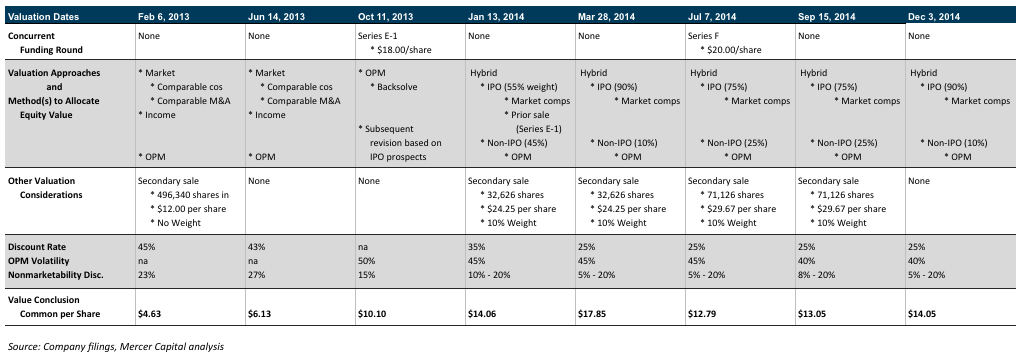

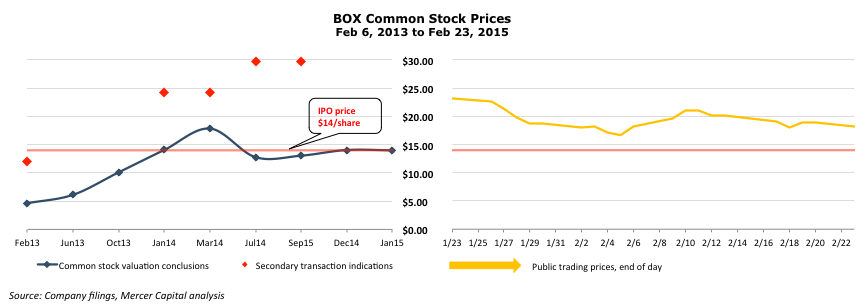

BOX’s story around and since the IPO, admittedly a lot less dramatic than Fab, also provides a couple of interesting data points from a valuation perspective. Prior to the IPO, BOX prepared several valuations of its common stock over a period of approximately two years.

A few observations:

- On two of the valuation dates (October 11, 2013 and July 7, 2014), BOX raised external funding rounds near-concurrently. The conclusion of value for the common shares represents a clear discount from the price commanded by the more senior shares at each of these valuation dates.

- The conclusion of value for common shares at the March 28, 2014 valuation date was $17.85, higher than the eventual IPO price of $14.00 per share on January 22, 2015.

- On four valuation dates, pricing indications from secondary sales of common shares were accorded modest weights. Close to the January 13, 2014 and March 28, 2014 valuations dates, 32,626 common shares transacted at an average price of $24.25 per share. Near the July 7, 2014 and September 15, 2014 valuations dates, 71,126 common shares transacted at an average price of $29.67 per share.

- Trading closed at $23.23 on January 23, 2014, the first day after the IPO, but the price has since generally trended lower and closed at $18.21 on February 23, 2015. Notably, during the first calendar month of public trading, BOX’s daily closing price has remained below the secondary pricing indications of $24.25 and $29.67 reported by the company between January and September 2014.

An Eye to the Future

While a couple of cherry-picked observations do not a trend make, if something that has gone up does indeed come down for some of the individual pre-public companies, investors, founders and other stakeholders will surely feel the pain. As we discuss in this blog post, the impact of a pricing downturn will likely be asymmetrical across the capital structure owing to the differential rights and protections accorded to the various securities. In particular, in the case of equity-based compensation granted to employees, unwarranted optimism regarding the prospects of the employer company coupled with certain tax rules and choices may result in real, negative economic impact. Unfortunately, only hindsight may be a good enough judge of whether decisions being made today, by employees and investors alike, will turn out to be prudent.

(1) We are not tax experts. Those interested in specific guidance for tax or legal matters should seek competent professional advice.

Related Links

- 8 Things You Need to Know About Section 409A

- Equity-Based Compensation: Tax Considerations

- Valuation Best Practices for Venture Capital Funds

- Box (Finally) Goes Public: Which Price is Right?

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.