Excerpted from Z. Christopher Mercer, ASA, CFA, ABAR,’s newest book, Unlocking Private Company Wealth. It is reprinted here with permission.

The issue of dividends and dividend policy is of great significance to owners of closely held and family businesses and deserves considered attention.

Fortunately, I had an early introduction to dividend policy beginning with a call from a client back in the 1980s.

I had been valuing a family business, Plumley Rubber Company, founded by Mr. Harold Plumley, for a number of years. One day in the latter 1980s, Mr. Plumley called me and asked me to help him establish a formal dividend policy for his company, which was owned by himself and his four sons, all of whom worked in the business.

Normally I do not divulge the names of clients, but my association with the Plumley family and Plumley Companies (its later name) was made public in 1996 when Michael Plumley, oldest son of the founder and then President of the company, spoke at the 1996 International Business Valuation Conference of the American Society of Appraisers held in Memphis, Tennessee. He told the story of Plumley Companies and was kind enough to share a portion of my involvement with them over nearly 20 years at that point.

Let’s put dividends into perspective, beginning with a discussion of (net) earnings and (net) cash flow. These are two very important concepts for any discussion about dividends and dividend policy for closely held and family businesses. To simplify, I’ll often drop the (net) when discussion earnings and cash flow, but you will see that this little word is important.

(Net) Earnings of a Business

The earnings of a business can be expressed by the simple equation:

Earnings = Total Revenue – Total Cost

Costs include all the operating costs of a business, including taxes.

- C Corporations. If your corporation is a C corporation, it will pay taxes on its earnings and earnings will be net of taxes. The line on the income statement is that of net income, or the income remaining after all expenses, including taxes, both state and federal, have been paid. By the way, if your company is a C corporation, feel free to give me a call to start a conversation about this decision.

- S Corporations and LLCs. If your corporation is an S corporation or an LLC (limited liability company), the company will make a distribution so that its owners can pay their pass-through taxes on the income. To get to the equivalent point of net income on a C corporation’s income statement, it is necessary to go to the line called net income (but it is not) and to subtract the total amount of distributions paid to owners for them to pay the state and federal income taxes they owe on the company’s (i.e., their pass through) earnings. This amount would come from the cash flow statement or the statement of changes in retained earnings.

Ignoring any differences in tax rates, the net income, after taxes (corporate or personal) should be about the same for C corporations and pass-through entities.

(Net) Cash Flow

Companies have non-cash charges like depreciation and amortization related to fixed assets and intangible assets. They also have cash charges for things that don’t flow through the income statement. Capital expenditures for plant and equipment, buildings, computers and other fixed assets are netted against depreciation and amortization, and the result is either positive or negative in a given year. Capital expenditures tend to be “lumpy” while the related depreciation expenses are amortized over a period of years, often causing swings in the net of the two.

There are other “expenses” and “income” of businesses that do not flow through the income statement. These investments, either positive or negative, relate to the working capital of a business. Working capital assets include inventories and accounts receivable, and working capital liabilities include accounts payable and other short-term obligations. Changes in working capital can lead to a range of outcomes for a business. Consider these two extremes that could occur regarding cash in a given year:

- Make lots of money but have no cash. Rapidly growing companies may find that while they have positive earnings, they have no cash left at the end of the month or year. They have to finance their rapid growth by leaving all or more than all of earnings in the business in the form of working capital to finance investments in accounts receivable and/or inventories and in the purchase of fixed assets to support that growth.

- Make little money, even have losses, and generate cash. Companies that experience sales declines may earn little, or even lose money on the income statement, and still generate lots of cash because they collect prior receivables or convert previously accumulated inventories into cash during the slowdown.

Working capital on the balance sheet is the difference between current assets and current liabilities. Many companies have short-term lines of credit with which they finance working capital investments. The concept of working capital, then, may include changes in short-term debt.

In addition, companies generate cash by borrowing funds on a longer-term basis, for example, to finance lumpy capital expenditures. In the course of a year, a company may be a net borrower of long-term debt or be in a position of paying down its long-term debt. So we’ll need to consider the net change in long-term debt if we want to understand what happens to cash in a business during a given year.

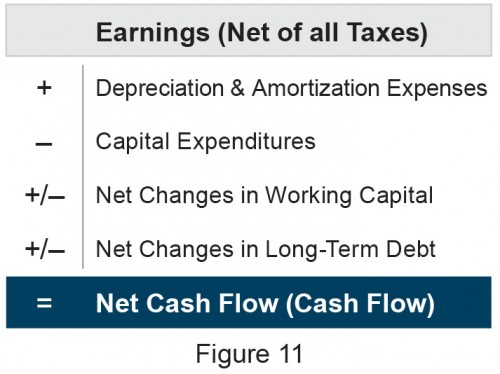

We are developing a concept of (net) cash flow, which can be defined as follows in Figure 11.

Most financial analysts and bankers will agree that this is a pretty good definition of Net Cash Flow.

Net Cash Flow is the Source of Good Things

We focus on cash flow because it is the source of all good things that come from a business. The current year’s cash flow for a business is, for example, the source of:

- Long-term debt repayment. Paying debt is good. Bankers are extremely focused on cash flow, because they only want to lend long-term funds to businesses that have the expectation of sufficient cash flow to repay the debt, including principal and interest on the scheduled basis. Interest expense has already been paid when we look at net cash flow. Companies borrow on a long-term basis to finance a number of things like land, buildings and equipment, software and hardware, and many other productive assets that may be difficult to finance currently. They may also borrow on a long term basis to finance stock repurchases or special dividends.

- Reinvestment for future growth. Investment in a business is good if adequate returns are available. If a company generates positive cash flow in a given year, it is available to reinvest in the business to finance its future growth. Reinvested earnings are a critical source of investment capital for closely held and private companies Reinvesting with the expectation of future growth (in dividends and capital gains) is an important source of shareholder returns, but the return is deferred, at least in the form of cash, until a future date.

- Dividends or distributions. Corporate dividends are also good, particularly if you are a recipient. Cash flow is also the normal source for dividends (for C corporation owners) or what we call “economic distributions,” or distributions net of shareholder pass-through taxes (for S corporation and LLC owners).

What is a Dividend?

At its simplest, a dividend (or economic distribution) reflects the portion of earnings not reinvested in a business in a given year, but paid out to owners in the form of current returns.

For some or many closely held and family businesses, effective dividends can include another component, and that is the amount of any discretionary expenses that likely would be “normalized” if they were to be sold. Discretionary expenses include:

- Above-market compensation for owner-managers. Owners of some private businesses who compensate themselves and/or family members at above-market rates should realize that the above-market portion of such compensation is an effective dividend.

- Mystery employees on the payroll. Some companies place non-working spouses, children or other relatives on the payroll when no work is required of them.

- Expenses associated with non-operating assets used for owners’ personal benefit. Non-operating assets can include company-owned vacation homes, aircraft not necessary for the operation of the business, vehicles operated by non-working family members, and others.

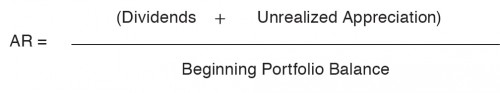

It is essential to analyze above-market compensation and other discretionary expenses from owners’ viewpoints to ascertain the real rate of return that is obtained from investments in private businesses. In an earlier chapter, we touched on the concept of the rate of return on investment for a closely held business. Assuming that there were no realized capital gains from a business during a given year, the annual return (AR) is measured as follows:

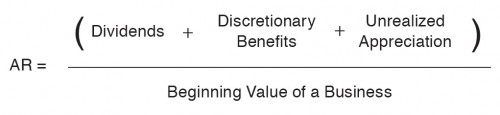

Now, we add to this any discretionary expenses that are above market or not normal operating expenses of the business that are taken out by owners:

We now know what dividends are, and they include discretionary benefits that will likely be ceased and normalized into earnings in the event of a sale.

We won’t focus on discretionary benefits in the continuing discussion of dividends and dividend policy. However, it is important for business owners to understand that, to the extent discretionary benefits exist, they reflect portions of their returns on investments in their businesses.

In summary, dividends are current returns to the owners of a business. Dividends are normally residual payments to owners after all other necessary debt obligations have been paid and all desirable reinvestments in the business have been made.

Dividends and Dividend Policy for Private Companies

With the above introduction to dividends for private companies, we can now talk about dividend policy. The remainder of this chapter focuses on seven critical things for consideration as you think about your company’s dividend policy.

- Every company has a dividend policy.

- Dividend policy influences return on business investment.

- Dividend policy is a starting point for portfolio diversification.

- Special dividends enhance personal liquidity and diversification.

- Dividend policy does matter for private companies.

- Dividend policy focuses management attention on financial performance.

- Boards of directors need to establish thoughtful dividend policies.

We now focus on each of these seven factors you need to know about your company’s dividend policy.

Every Company Has a Dividend Policy

Let’s begin with the obvious observation that your company has a dividend policy. It may not be a formal policy, but you have one. Every year, every company earns money (or not) and generates cash flow (or not). Assume for the moment that a company generates positive earnings as we defined the term above. If you think about it, there are only three things that can be done with the earnings of a business:

- Reinvest the earnings in the business, either in the form of working capital, plant and equipment, software and computers, and the like, or even excess or surplus assets.

- Pay down debt.

- Pay dividends to owners (or economic distributions – after pass-through taxes – for S corporations and LLCs) or repurchase stock (another form of returns to shareholders).

That’s it. Those are all the choices. Every business will do one or more of these things with its earnings each year. If a business generates excess cash and reinvests in CDs, or accumulates other non-operating assets, it is reinvesting in the business, although likely not at an optimal rate of return on the reinvestment. Even if your business does not pay a dividend to you and your fellow owners, you have a dividend policy and your dividend payout ratio is 0% of earnings.

On the other hand, if your business generates substantial cash flow and does not require significant reinvestment to grow, it may be possible to have a dividend policy of paying out 90% or even up to 100% of earnings in most years. This is often the case in non capital intensive service businesses.

Recall that if a business pays discretionary benefits to its owners that are above market rates of compensation, or if it pays significant expenses that are personal to the owners, it is the economic equivalent of paying a dividend to owners. So when talking to business owners where such expenses are significant, we remind them that they are, indeed, paying dividends and should be aware of that fact.

Some may think that discretionary expenses are the provenance of only small businesses; however, they exist in many businesses of substantial size, even into the hundreds of millions in value.

Discretionary expenses are not necessarily bad, but they can create issues. In companies with more than one shareholder, discretionary expenses create the potential for (un)fairness issues. However, discretionary expenses are paid for the benefit of one shareholder or group of shareholders and not for others, they are still a return to some shareholders.

Every company, including yours, has a dividend policy. Is it the right policy for your company and its owners?

Dividend Policy Influences Return on Business Investment

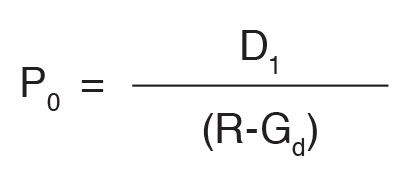

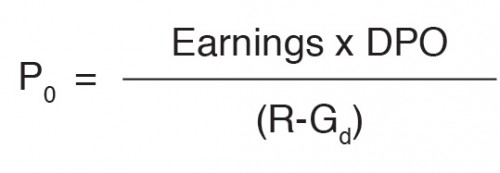

To see the relationship between dividend policy and return on investment we can examine a couple of equations. This brief discussion is based on a lengthier discussion in my book, Business Valuation: An Integrated Theory Second Edition (John Wiley & Sons, 2007). There is a basic valuation equation, referred to as the Gordon Model. This model states that the price (P0) of a security is its expected dividend (D1) capitalized at its discount rate (R) minus its expected long term growth rate in the dividend (Gd). This model is expressed as follows:

D1 is equal to Earnings times the portion of earnings paid out, or the dividend payout ratio (DPO), so we can rewrite the basic equation as follows:

What this equation says is that the more that a company pays out in dividends, the less rapidly it will be able to grow, because Gd, or the growth rate in the dividend, is actually the expected growth rate of earnings based on the relevant dividend policy.

We can look at this simplistically in word equations as follows:

Dividend Income + Capital Gains = Total Return

Dividend Yield + Growth (Appreciation) = Cost of Equity (or the discount rate, R)

These equations reflect basic corporate finance principles that pertain, not only to public companies, but to private businesses as well. There is an important assumption in all of the above equations – cash flow not paid out in dividends is reinvested in the business at its discount rate, R.

There are many examples of successful private companies that do not pay dividends, even in the face of unfavorable reinvestment opportunities. To the extent that dividends are not paid and earnings are reinvested in low-yielding assets, the accumulation of excess assets will tend to dampen the return on equity and investment returns for all shareholders.

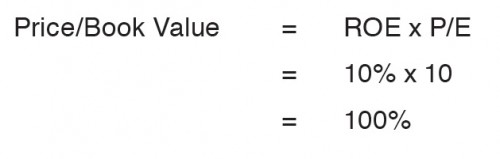

Further, the accumulation of excess assets dampens the relative valuation of companies, because return on equity (ROE) is an important driver of value. For example, consider the following relationship without proof:

ROE x Price/Earnings Multiple = Price/Book Value

At a given multiple of (net) earnings available in the marketplace, a company’s ROE will determine its price/book value multiple. The price/book value multiple tells how valuable a company is in relationship to its book value, or the depreciated cost value of its shareholders’ investments in the business.

Let’s consider a simple example. Assume that a company generates an ROE of 10% and that the relevant market price/earnings multiple (P/E) is 10x. Using the formula above:

In this example, the company would be valued at its book value and the shareholders would not benefit from any “goodwill,” or value in excess of book value. Consider, however, that a similar company earns an ROE of 15%.

- Assuming the same P/E of 10x, it would be valued at 150% of its book value.

- Suppose the second company, because of its superior returns, received a P/E of 11x. In that case the price/book multiple would be 165%.

To the extent that a company’s dividend policy influences its ongoing ROE, it influences its relative value in the marketplace and the ongoing returns its shareholders receive.

In short, your dividend policy influences your return on investment in your business, as well as your current returns from that investment.

Dividend Policy is a Starting Point for Portfolio Diversification

Recall the story of my being asked to help develop a dividend policy for a private company. The company had grown rapidly for a number of years and its growth and diversification opportunities in the auto parts supply business were not as attractive as they had been. The CEO, who was the majority shareholder, realized this and also that his sons (his fellow shareholders) could benefit from a current return on their investments in the company, which, collectively, were significant.

We reviewed the dividend policies of all of the public companies that we believed to be reasonably comparable to the company. I don’t recall the exact numbers now, but I believe that the average dividend yield for the public companies was in the range of 3%. As I analyzed the private company, it was clear that it was still growing somewhat faster than the publics, so the ultimate recommendation for a dividend was about 1.5% of value.

The value that the 1.5% dividend yield was compared to was the independent appraisal that we prepared each year. Based on the value at the time, I recall that the annual dividend began at something on the order of $300,000 per year. But, for the father and the sons, it was a beginning point for diversification of their portfolios away from total concentration in their successful private business.

Your dividend policy can be the starting point for wealth diversification, or it can enhance the diversification process if it is already underway.

Special Dividends Enhance Personal Liquidity and Diversification

A number of years ago, I was an adviser to a publicly traded bank holding company. Because of past anemic dividends, this bank had accumulated several million dollars of excess capital. The stock was very thinly traded and the market price was quite low, reflecting a very low ROE (remember the discussion above).

Because of the very thin market for shares, a stock repurchase program was not considered workable. After some analysis, I recommended that the board of directors approve a large, one-time special dividend. At the same time I suggested they approve a small increase in the ongoing quarterly dividend. Both of these recommendations provided shareholders with liquidity and the opportunity to diversify their holdings.

Since the board of directors collectively held a large portion of the stock, the discussion of liquidity and diversification opportunities while maintaining their relative ownership position in the bank was attractive.

At the final board meeting before the transaction, one of the directors did a little bit of math. He noted that if they paid out a large special dividend, the bank would lose earnings on those millions and earnings would decline. I agreed with his math, but pointed out (calculations already in the board package) that the assets being liquidated were very low in yield and that earnings (and earnings per share) would not decline much. With equity being reduced by a larger percentage, the bank’s ROE should increase. So that increase in ROE, given a steady P/E multiple in the marketplace, should increase the bank’s Price/Book Value multiple.

The director put me on the spot. He asked point blank: “What will happen to the stock price?” I told him that I didn’t know for sure (does one ever?) but that it should increase somewhat and, if the markets believed that they would operate similarly in the future, it could increase a good bit. The stock price increased more than 20% following the special dividend.

Special dividends, to the extent that your company has excess assets, can enhance personal liquidity and diversification. They can also help increase ongoing shareholder returns. I have always been against retaining significant excess assets on company balance sheets because of their negative effect on shareholder returns and their adverse psychological impact. It is too easy for management to get “comfortable” with a bloated balance sheet.

If your business has excess assets, consider paying a special dividend. Your shareholders will appreciate it.

Dividend Policy Does Matter for Private Companies

Someone once said that earnings are a matter of opinion, but dividends are a matter of fact. What we know is that when dividends are paid, the owners of companies enjoy their benefit, pay their taxes, and make individual choices regarding their reinvestment or consumption.

The total return from an investment in a business equals its dividend yield plus appreciation (assuming no capital gains), relative to beginning value. However, unlike unrealized appreciation, returns from dividends are current and bankable. They reduce the uncertainty of achieving returns. Further, if a company’s growth has slowed because of relatively few good reinvestment opportunities, a healthy dividend policy can help assure continuing favorable returns overall.

Based on many years of working with closely held businesses, we have observed that companies that do not pay dividends and, instead, accumulate excess assets, tend to have lower returns over time. There is, however, a more insidious issue. The management of companies that maintain lots of excess assets may tend to get lazy-minded. Worse, however, is the opposite tendency. With lots of cash on hand, it is too easy to feel pressure to make a large and perhaps unwise investment, e.g., an acquisition, that will not only consume the excess cash but detract from returns in the remainder of the business.

Dividend policy is the throttle by which well-run companies gauge their speed of reinvestment. If investment opportunities abound, then a no- or low-dividend payout may be appropriate. However, if reinvestment opportunities are slim, then a heavy dividend payout may be entirely appropriate.

Any way you cut it, dividend policy does matter for private companies.

Dividend Policy Focuses Management Attention on Financial Performance

Boards of directors are generally cautious with dividends and once regular dividends are being paid, are reluctant to cut them. The need, based on declared policy, to pay out, say, 35% of earnings in the form of shareholder dividends (example only) will focus management’s attention on generating sufficient earnings and cash flow each year to pay the dividend and to make necessary reinvestments in the business to keep it growing.

No management (even if it is you) wants to have to tell a board of directors (even if you are on it) or shareholder group that the dividend may need to be reduced or eliminated because of poor financial performance.

Boards of Directors Need to Establish Thoughtful Dividend Policies

If dividend policy is the throttle with which to manage cash flow not needed for reinvestment in a business, it makes sense to handle that throttle carefully and thoughtfully. Returns to shareholders can come in the form of dividends or in the form of share repurchases.

While a share repurchase is not a cash dividend, it does provide cash to selling shareholders and offsetting benefits to remaining shareholders. Chapter 10 of the book (Leveraged Share Repurchase: An Illustrative Example) provides an example of a substantial leveraged share repurchase from a controlling shareholder to provide liquidity and diversification.

From a theoretical and practical standpoint, the primary reason to withhold available dividends today is to reinvest to be able to provide larger future dividends – and larger in present value terms today. It is not a good dividend policy to withhold dividends for reasons like the following:

- A patriarch withholds dividends to prevent the second (or third or more) generations from being able to have access to funds.

- A control group chooses to defer dividends to avoid making distributions to certain minority shareholders.

- Dividends are not paid because management (and the board) want to build a large nest egg against possible future

adversities. - Dividends are not paid to accumulate excess or non-operating assets on the balance sheet for personal or vanity

reasons.

Dividend policy is important and your board of directors needs to establish a thoughtful dividend policy for your business.

Conclusion

Dividends and dividend policies are important for the owners of closely held and family businesses. Dividends can provide a source of liquidity and diversification for owners of private companies. Dividend policy can also have an impact on the way that management focuses on financial performance.

To discuss corporate valuation or transaction advisory issues in confidence, please contact us.

Related Links

- Leveraged Dividend Recapitalizations and Leveraged Share Repurchases

- Presentation: Unlocking Private Company Wealth

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.