Z. Christopher Mercer, ASA, CFA, ABAR, Founder and CEO of Mercer Capital, maintains a blog focusing on “Business Valuation & Ownership in Transition.” This guest post first appeared on ChrisMercer.net on October 13, 2015.

Leveraged dividend recapitalizations and leveraged share repurchases are two corporate finance tools that are available to owners of private companies. These tools can be used to create liquidity outside the ownership of private businesses. We begin by defining the two terms:

- Leveraged share repurchase. A company employs leverage (i.e., borrows money) to repurchase a portion of its shares from selected owners. The transaction provides liquidity for some owners and enhanced returns and relative ownership for the remaining owners as result of reducing the number of shares outstanding.

- Leveraged dividend recapitalization. A company employs leverage (i.e., borrows money) to use to pay a one-time dividend pro rata to all owners. The transaction provides liquidity for all owners and does not change the ownership structure.

Interestingly, as we will see, leveraged dividends and leveraged repurchases have very similar impacts on companies (assuming similar companies and same-sized transactions), and quite different impacts on the owners of the companies. Leveraged transactions are often talked about, but are seldom written about.

Chapter 10 of my book, Unlocking Private Company Wealth, provides an illustration of a leveraged share repurchase. While in concept, the transaction is fairly straightforward, there is come complexity when the individual pieces are examined, and there are a number of moving parts.

In this post, we will illustrate the impact of a leveraged share repurchase and a leveraged dividend on the same company. This analysis will enable us to see the impact leverage has on the company and also, the different impacts the transactions have on owners.

A Leveraged Dividend and a Leveraged Share Repurchase

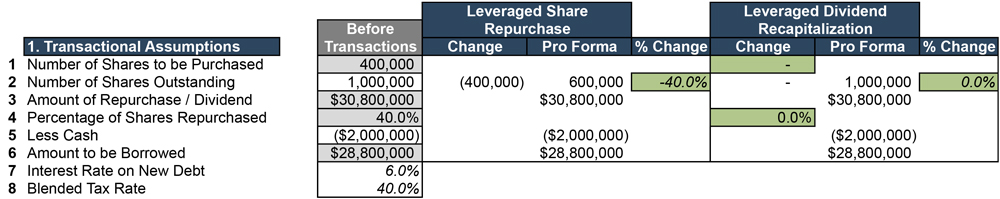

Our example company has sales of $50 million and an EBITDA margin of 26%, providing $13.0 million in pro forma EBITDA. We have valued the company at about 6.0x EBITDA, which provided an enterprise value (less cash) of $75 million, and an equity value of $77 million, assuming debt is zero. The book value of equity for the business is $70 million.

Our company has 1.0 million shares (or units) outstanding. In the example transactions, 40% of the equity will be repurchased or paid out in leveraged transactions. Based on an equity value of $77 million (we will see this momentarily), each transaction is a $30.8 million deal.

There is $2 million of cash on the balance sheet, and it will be committed to the deal(s), so the company will borrow $28.8 million for the hypothetical leveraged dividend and share repurchase transactions.

We have assumed that interest to be paid on the debt is at a 6.0% rate, and that the blended federal and state tax rate for the business is 40%. The assumptions are set out in the first table below.

We see that the use of cash and leverage for both the leveraged dividend and the leveraged share repurchase are identical. One key difference in the two transactions is seen on Line 2 above.

With the leveraged share repurchase, the number of shares is reduced by 400 thousand (40%) from the beginning shares of 1.0 million. With the leveraged dividend recap, there is no change in the number of shares.

The Balance Sheet and the Income Statement

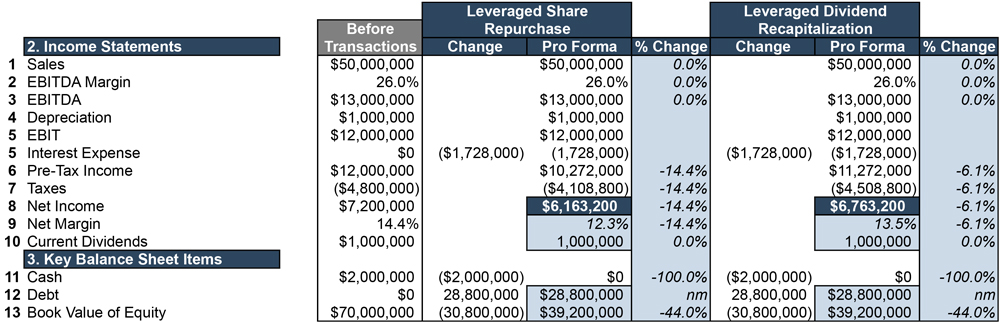

The next table shows a summary of the impact of the two transactions on the balance sheet and the income statement of our example company. The first thing to note in Lines 1-3 below is that the transactions have no impact on sales or EBITDA. This makes sense, because (reasonable) leverage should have no impact on sales or gross earnings, or EBITDA and (EBIT).

At Lines 3 and 5 below, we see that both transactions create pro forma interest expense of $1.728 million, which lowers pre-tax earnings by an equivalent amount. Pre-tax income under both transactions is identical at $10.272 million.

After taxes, pro forma net income falls from $6.6 million to $6.163 million, and the net margin falls from 13.2% to 12.3%. The decline in net income in both transactions is the direct result of the interest expense associated with the new leverage. The company has been paying a dividend of $1.0 million per year and plans to continue to pay that dividend following the transaction(s).

Looking at key balance sheet items above, we see that pro forma cash is reduced to zero under both scenarios, and that debt is increased by the borrowing amount of $28.8 million. The book value of equity is reduced from $70 million to $39.2 million in both instances, or by the transaction amounts of $30.8 million.

The impact of a leveraged dividend and a leveraged share repurchase are equivalent at the company’s level to this point. They are also identical in that someone or someones received $30.8 million, either in the form of a share repurchase or a leveraged dividend payment.

Valuation and Leverage

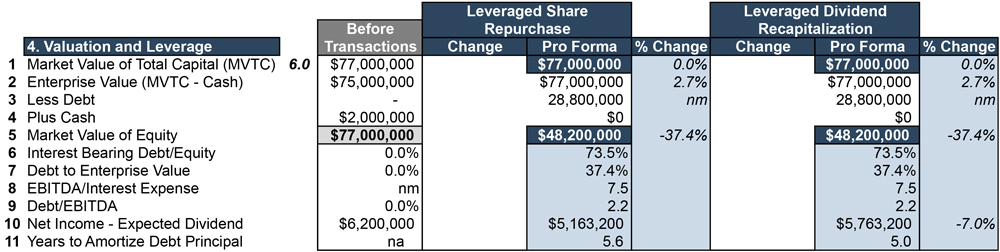

At this point, we can look further at what happens to value and leverage from the viewpoint of the company and its bankers, who will provide the leveraged for the transactions. At Line 1 below, we see that market value of total capital remains unchanged at $77 million (neither EBITDA nor the multiple changed).

Market value of equity has been reduced, however, from $77 million prior to the transaction to $48.2 million on a pro forma basis for both a leveraged dividend and a leveraged share repurchase (Line 5 below).

Lines 6 to 10 provide a number of ratios that are often examined by bankers. The debt/equity ratio is 73.5%, which some might think a bit high. However, the debt/enterprise value ratio is a much lower 37.4% for both transactions.

EBITDA coverage of interest expense is a healthy 6.9x, again for both transactions. And debt/EBITDA is only 2.4x, which should be acceptable to many bankers.

As a shorthand to avoid a lengthy projection analysis, I calculated net income minus the expected dividend of $1.0 million, and then calculated the number of years of that figure it would take to pay down the principal on the loan. That figure, which does not consider growth prospects, is 5.6 years. That’s not a bad result. Should there be any problem in a given year, the company could certainly forego paying its dividend.

The interesting thing about the analysis thus far is that, from the viewpoint of a company, a leveraged dividend and a leveraged share repurchase are pretty much identical.

A Look at the Shareholder Level

Leveraged dividends and leveraged share repurchases do, indeed, look different at the level of shareholders. The differences relate to who gets returns from the company and when.

In a leveraged dividend, all owners get current cash from their investment pro rata to their ownership. In a leveraged share repurchase some owner (or owners) gets cash now, in return for selling their shares, and the other, remaining owners must wait for their returns in the future.

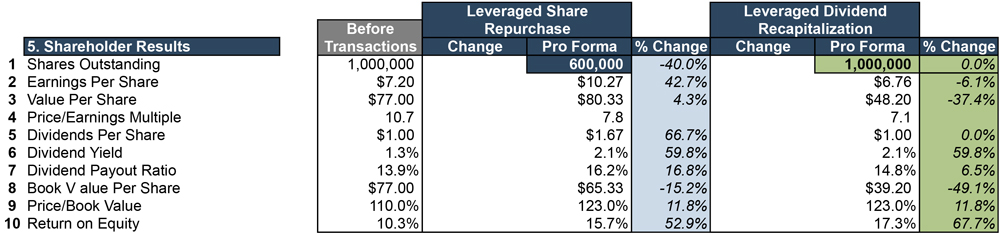

The next figure provides key results at the shareholder level.

On Line 1 we highlight the fact that in a leveraged share repurchase, the number of shares is reduced. In this case, that reduction is fairly large at 40%. In the leveraged dividend case, the number of shares remains the same. The resulting differences in pro forma results flows from this basic difference.

To highlight the difference at the outset, suppose an owner holds 100 thousand of the original 1.0 million shares, or 10% of the stock. With a leveraged share repurchase, that owner will now own 100 thousand shares of a total of 600 thousand shares, or 16.7% of the shares outstanding. Someone else got the current return, i.e., the owner(s) who sold their shares. Remaining owners following a leveraged share repurchase must wait for their returns, which will come in the future.

That same owner would hold 10% of the shares following a leveraged dividend transaction, but, he or she would have obtained a substantial current return from the dividend.

The differences flow down beginning at Line 2:

- Line 2, Earnings Per Share. In a leveraged share repurchase, net earnings decline as we saw above, but the number of shares declines disproportionately. In the example above, EPS increase more than 50% in the leveraged share repurchase, with EPS rising from a beginning $6.60 per share to $10.27 per share. In a leveraged dividend transaction, because net earnings decline (interest expense from leverage), EPS also decline, from $6.60 per share before to $6.16 per share pro forma. That is just one expense of obtaining a large current return.

- Line 3, Value Per Share. Assuming that the price paid in a leveraged share repurchase is reasonable, value per share should rise. In this case, value increases from $77.00 per share to $80.33 per share. In a leveraged dividend situation, value per share will likely decline. Why? Equity value is reduced by the extent of the new leverage. However, all owners receive their pro rata share of that value reduction in the one-time leveraged dividend payment.

- Line 5, Dividends Per Share. We have assumed that the company will continue to pay its $1.0 dividend following either transaction. Remaining shareholders benefit significantly as a result. With the 40% reduction in shares, their dividend rises from $1.00 per share to $1.67 per share, a significant increase in current returns. Owners in a leveraged dividend transaction will receive the same $1.00 per share dividend as before, but remember, they got the special dividend.

- Line 6, Dividend Yield. Assuming the historical dividend is maintained, the dividend yield will rise in both cases. The yield is the same on a pro forma basis for both transactions, but the yields are calculated off of different share and value bases.

- Line 7, Dividend Pay Ratio. The dividend payout ratio increases modestly (from 15.2% to 16.2%) for both transactions. Dollar net income is modestly lower in both cases, and the dividend remains the same.

- Line 8, Book Value Per Share. Book value has declined in both transactions. However, in the leveraged share repurchase, book value per share declines relatively less because the number of shares is reduced. In the leveraged dividend transaction, book value per share declines and there is no offset in reduced number of shares.

- Line 9, Price/Book Value. The beginning price/book value was 110%. Both the higher price and the somewhat lower book value are reduced by the new debt, so the numerator is reduced proportionately less than the denominator. As a result, price/book value increases somewhat.

- Line 10, Return on Equity. One of the best things about either transaction is that return on equity, or ROE, is enhanced. Again, it is a function of the relationship between the reduction in net income from added interest expense (modest) and the substantial decrease in equity from the new leverage (substantial). Return on equity increases from 9.4% to a pro forma 15.7% in both transactions.

Concluding Thoughts

Leveraged share repurchases and leveraged dividend recapitalizations are tools available to many successful private companies. Both transactions “recapitalize” a company by adding debt. The proceeds are then used to purchase shares from one or more existing owners (repurchase) or to pay a substantial dividend to all owners (dividend).

The economic impact of either transaction is virtually identical from the viewpoint of the company adding leverage. However, the economic impact to owners is quite different.

Which transaction is right for your company? Or for your client’s company? It depends on each situation, and neither may be appropriate or feasible. However, it is a good idea to discuss the potential use of reasonable leverage to accelerate shareholder returns or to provide ownership transitions when needed.

Related Links

- An Introduction to Dividends and Dividend Policy for Private Companies

- Unlocking Private Company Wealth: Advising Your Clients in Monetizing Their Illiquid Wealth

- Mercer Capital’s Transaction Advisory Services

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.