Chris Mercer, founder and Chief Executive Officer of Mercer Capital, writes and blogs at http://www.chrismercer.net. This guest post first appeared on his blog on August 8, 2014 and is reprinted here with permission.

In August 2012, I wrote a post on my former blog entitled Zynga and the High Cost of Concentrations. At that time, Zynga’s revenue was highly dependent on a handful of games, including CastleVille, Zynga Poker, Farmville, CityVille, FrontierVille and Mafia Wars. Online gaming revenue accounted for 88% of revenues during the first half of 2012.

Zynga announced growth in online gaming during the second quarter, but that growth was offset by substantial decreases in revenue from their popular Farmville and Mafia Wars games. The concentration in online gaming was an open issue in the market at the time.

I reported another concentration involving Zynga. About 90% of its revenue came from operating on the Facebook platform. There seemed to be a general consensus that Zynga would have to reduce its reliance on Facebook. Facebook had just changed its “surfacing” policy with the effect of making it more difficult for Facebook users to find Zynga’s games. And Zynga announced a surprise loss in the second quarter of 2012.

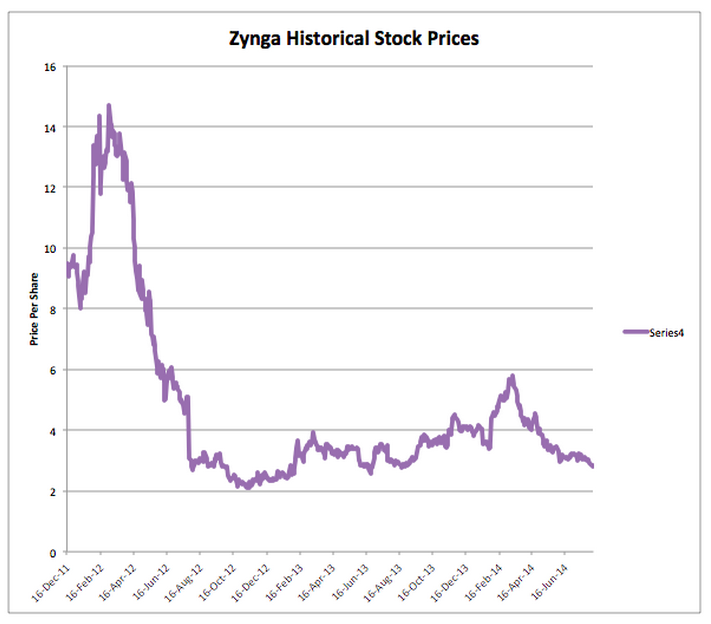

The Zynga IPO came out at $10 per share in December 2011 and the stock peaked at $14.69 in March 2012. The stock plummeted to $3.01 per share by the time I wrote the post on August 9, 2012. I concluded the post with the following:

I thought I’d look to see what has happened with Zynga since that 2012 post. In the first quarter 10Q filed in May 2014, I read:

Facebook is currently the primary distribution, marketing, promotion and payment platform for our games. We generate a significant portion of our revenue through the Facebook platform. For example, for the three months ended March 31, 2014 and 2013, we estimate that 52% and 76% of our bookings, respectively, were generated through the Facebook platform, while 36% and 22% of our bookings, respectively, were generated through mobile platforms. For the three months ended March 31, 2014 and 2013, we estimate that 59% and 76% of our revenue, respectively, was generated through the Facebook platform, while 31% and 22% of our revenue, respectively, was generated through mobile platforms. We have had to estimate this information because certain payment methods we accept and certain advertising networks do not allow us to determine the platform used.

I’ve italicized a portion of the quote because two sentences say different things about Facebook and mobile for the same quarter. Regardless, Zynga is still highly concentrated with Facebook as a primary source of its revenue.

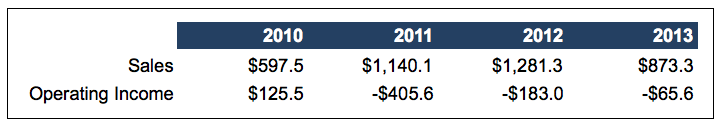

How has performance been? Let’s look at the four most recent years reported on GoogleFinance.

After peaking in 2012 at $1.3 billion, annual revenue for Zynga fell to $873 million in 2013, or 32%. Operating losses have been substantial with Zynga subject to the risks associated with its primary revenue platform, Facebook, as well as its concentration in gaming. The top three games typically account for more than 50% of revenues, but, as we saw above, game revenues are volatile.

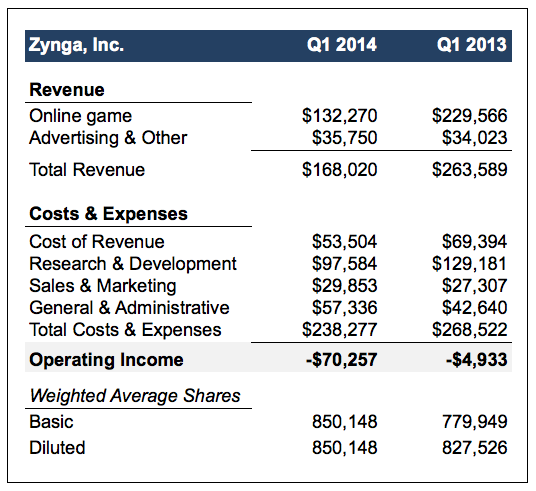

How do things look as we move into 2014? Second quarter results are not available and will likely be out shortly. So let’s look at the first quarter of 2014 results:

Revenues are down from $230 million in first quarter 2013 to $132 million for the first quarter 2014. That’s another 42.5%. The operating loss for first quarter 2014 exceeded the loss for the entire year of 2013.

And what has happened to the stock price?

Since the $10 per share IPO in mid-December 2011, the stock rocketed to $14.69 per share in March 2012 before experiencing the beating noted above, when the stock dropped to $3.05 per share at the time I wrote in 2012 Somehow, the stock rose to more than $5 per share for 23 trading days in late February and early March of this year. Since then, the stock has fallen sharply to $2.79 per share, or about where it was a year ago.

I don’t know the back story on the rising price leading to the peak in March 2014, but I’m guessing the market was surprised and disappointed with the earnings announcement for the first quarter.

Concentrations limit flexibility and increase risk. As I concluded in the discussion about Zynga a year ago:

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.