Jeff K. Davis, CFA, Managing Director of Mercer Capital’s Financial Institutions Group, is an SNL content contributor. This guest post first appeared on SNL Financial on December 17, 2014, and is reprinted here with permission. Some links sourced from SNL. Subscription required.

Mercer Capital provides valuation opinions on portfolio assets of business development companies.

Nobel Laureate Paul Krugman went against the consensus this past weekend when he said he doubted the Fed would raise short rates in 2015. I agree with him, but that is just my opinion. Banks, business development companies and other investors who are positioned for rising rates hope he is wrong. While rising rates should support higher net interest margins and EPS for a broad swath of commercial banks that have a sizable amount of non-interest bearing deposits and loans that reprice with 30-day LIBOR, we should focus on credit. If credit spreads are widening (or narrowing), NIM discussions, like much of what the Street chatters about, are just noise.

Kroll Bond Rating Agency touched on this recently. They published a great research piece on the leverage lending market (subscription required) on Dec. 5 that is worth your time to read. Kroll opined that the risk in the leverage lending market is not fully understood by investors and regulators in terms of credit risk and especially structure as it relates to how collateral positions are perfected (or not). For those of you who are under 50, you may not be aware that falling oil prices in the early 1980s after the boom of the 1970s resulted in the failure of Oklahoma-based Penn Square Bank in 1982, which was active in originating and syndicating energy credits. One of its large syndication customers, Continental Illinois National Bank and Trust Co., failed in 1984. Substitute “mortgage” for “oil.” Continental was the largest bank failure in U.S. history until 2008, when Washington Mutual Bank failed.

A few weeks ago I had a post about my thoughts that the energy lending narrative (subscription required) probably will be a slow-moving one as it relates to stepped-up provisioning and ultimately loss recognition if oil and gas prices remain depressed. I mention this and the Kroll piece because credit matters multiples more than NIMs and EPS as a result of hoped-for rate hikes. Most banks lever tangible common equity anywhere from 10:1 to 14:1. If asset quality is weakening, usually nothing much else matters.

Many on the Street are focused on the apparent consensus view that the Fed will begin to raise the fed funds target rate in 2015, seven years after cutting the rate to nearly zero percent. Comerica Inc., City National Corp. and other banks with similar balance sheets that are inherently asset sensitive are favored investments. Consensus estimates for 2015 and 2016 appear to reflect higher rates for both, and for a number of other banks.

History may not quite sync with the plot, however. The SNL U.S. Bank Index rose roughly the same amount as the S&P 500 from late June 2004 — when the Fed raised the funds target to 1.25% from 1.00% — through June 2006, when the rate peaked at 5.25%. Comerica’s NIM was 3.95% in 2003; it hit 4.06% in full-year 2005 and has been declining since in an uneven fashion. City National’s NIM was 4.74% in 2003; it climbed to 4.79% in 2005 and has also declined ever since.

Comerica’s shares closed at $56.06 at year-end 2003, but then changed little over the next couple of years, closing at $56.76 and $58.68 at year-end 2005 and 2006, respectively. Its ratio of price to last-12-months EPS declined from 14.9x at year-end 2003 to 10.7x by year-end 2006. City National’s share price performed somewhat better, increasing from $62.12 per share at year-end 2003 to $72.44 per share at year-end 2005 and closing at $71.20 per share at year-end 2006. Its P/LTM EPS eased to 15.3x at year-end 2006 from 16.7x at year-end 2003. Perhaps I picked the wrong ‘asset-sensitive’ names.

What happened? Credit became an increasing concern, as was the case in the late 1990s. Banks are early cyclicals, meaning they tend to outperform in the early stages of an economic expansion when credit risk has peaked and underperform when the expansion matures and credit risk is increasing. Somewhere between ‘early’ and ‘mature’ is when the Fed usually raises short rates. That is probably a good description of the current economic expansion that will enter its sixth year in the second half of 2015 when the Fed may be increasing short rates.

With this in mind, 2015 may be an interesting year for bank investors if the Fed really does raise rates. NIMs and EPS may increase, but the stocks could underperform the broader market if credit spreads continue to widen as has been the case the past few months. So far the year-to-date performance of the SNL U.S. Large Cap Bank Index just slightly trails the S&P 500 at 6.88% vs. 7.64%, while the SNL U.S. Small Cap Bank Index approximates the Russell 2000 at negative 1.84% vs. negative 2.01% as of Dec. 15.

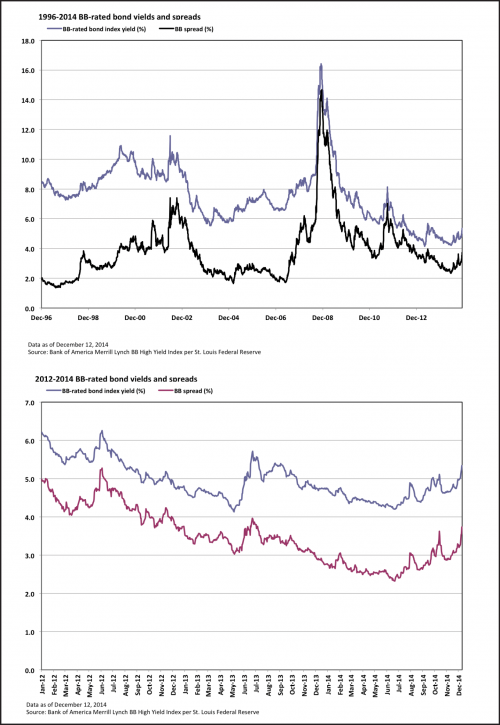

The two charts provide perspective on credit risk as measured by the spread on BB-rated bonds (i.e., higher-rated junk bonds). The recent move higher in spreads barely registers when viewed over nearly a 20-year period that dates to 1996. The second chart shows BB yields and spreads over the past three years. Even then the recent increase does not seem to be much more than a warning shot; however, that does not mean spreads cannot continue to widen during 2015 and lead to material underperformance of bank shares, including those with widening NIMs and rising EPS. The opposite is true too — should credit spreads begin to narrow again, bank shares may outperform for a while.

Kroll is right when it says investors should focus on credit risk. I would add that investors should be less focused on what higher rates may mean for NIMs, and instead question what higher rates may mean for credit spreads and bank valuations.

Related Links

- An Introduction to Business Development Companies

- Q3 2014 Business Development Companies Industry Newsletter

- W(h)ither Yields? Dividend Capacity & BDC Stock Prices: A Mortgage REIT Case Study

- Leverage Lending, Dividend Recaps, and Solvency Opinions

- Portfolio Valuation Services

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.