In October 2015, the SEC adopted final rules governing the crowdfunding of startups and Regulation Crowdfunding was issued in May 2016. Subsequently, the SEC has issued investor bulletin(s) to educate potential investors on the new investing opportunities. The new rules allow non-accredited investors to invest directly in startup (and other) companies that can raise up to $1 million every twelve months through crowdfunding. At the time the SEC first proposed the rules in October 2013, we speculated that crowdfunding might turn into a new source of capital for small businesses. Now, a year after Regulation Crowdfunding came into effect, we take a look at the state of crowdfunding.

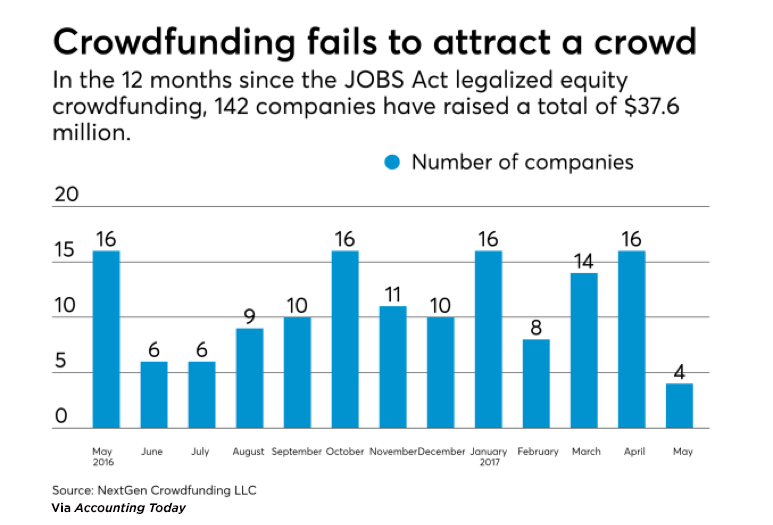

Accounting Today reports that investors have poured $38 million into 142 companies since May 2016. That’s just a drop in the bucket compared to the $69 billion invested by venture-stage investors during 2016 and is well below some experts’ expectations.

What caused the underwhelming response to crowdfunding? There are several potential underlying issues. The SEC requirements that are intended to provide investor safeguards can be onerous for the crowdfunding companies. Data compiled by NextGen Crowdfunding LLC (a crowdfunding consultant) indicate companies seeking crowdfunding spend up to $50,000 on legal, accounting, and marketing expenses, a not-insignificant portion of the SEC fundraising limit.

From the investors’ perspective, several issues may be inhibiting wider participation. The crowdfunding industry is still relatively young and is unfamiliar to many potential investors and company founders. Startups seeking equity via crowdfunding can be risky investments and many ultimately fail. Additionally, crowdfunding investments are generally illiquid. In most circumstances in the US, investors are required to hold their investments for at least a year. Secondary markets for crowdfunded equity are largely non-existent in the US.

Seedrs, a British crowdfunding firm, is attempting to address the illiquidity problem by creating a secondary market where investors can trade shares. There will still be several restrictions on transaction in Seedrs’ market, which is scheduled to open this summer. For example, trades will only be allowed during one week of each month and will use prices set by Seedrs “based on a valuation mechanism in line with industry guidelines.” Only current investors in a company will be able to purchase shares. Additionally, Seedrs will assess a 7.5% fee on any gains generated by the sale.

Once illiquidity is addressed, further financial innovation could address other issues around crowdfunding. The Economist suggests “mutual funds for crowdfunded startups” would provide investors diversification as a way to help manage the risk inherent in investing in individual startups. Perhaps, even index or derivative products could be fashioned.

It appears to us that the key to making such a secondary market for securities in crowdfunded companies work are valuations that can facilitate transactions. In an earlier blog post, we wondered if wider participation in early-stage investing would deliver reliable pricing information for pre-public companies. There may be a circular element to the development and maturing of crowdfunding – perhaps, relevant pricing is necessary in the first place for this corner of the equity market to take off.

Related Links

- Crowdfunding to Provide Alternative Capital Source to Early-Stage Companies

- Crowdfunding: SEC Issues an Investor Bulletin

- Startup Stock Secondaries: Cash In Early, Cash In Often?

- How to Value Venture Capital Portfolio Investments

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.