When Berkshire Hathaway (BRK) announced the planned acquisition of Precision Castparts (PCP), pundits described the $37 billion purchase price as

“hefty“. Has Mr. Buffett forsaken his legendary investment discipline, or does the hefty price tag highlight one consequence of the Fed’s persistent zero-interest rate policy (ZIRP)?

The heft of any particular purchase price can really only be evaluated relative to the (expected) earnings stream acquired. For public market investors, the ratio of stock price to earnings per share is the most commonly cited relative pricing measure. When entire operating companies are transacted, the common measure of relative value is that of enterprise value to earnings before interest, taxes, depreciation and amortization or EBITDA. Enterprise value, the sum of equity and net debt, represents the value of the total company, regardless of how it is financed. Similarly, EBITDA is a broad measure of earnings that is unaffected by a company’s capital structure and common non-cash charges.

Comparing the reported transaction value ($37.2 billion) to the consensus estimate for forward EBITDA ($3.0 billion) yields an EV/EBITDA ratio of 12.3x. By way of comparison, Thomson Reuters reports that the average EBITDA multiple for leveraged buyouts in the broadly syndicated market (i.e., large deals) through the first seven months of 2015 was 10.2x. After peaking at 10.8x in 2008, average EBITDA multiples fell to 9.1x in 2009 and have gradually increased to current levels since then. So, relative to the average multiple, the EBITDA multiple of 12.3x paid for Precision Castparts is high.

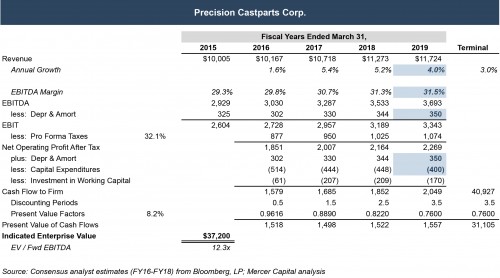

While more informative than absolute price, an EBITDA multiple still fails to communicate the prospective return anticipated by investors. If a forecast of future earnings and cash flows is available, one can derive the prospective return on a transaction. As a hitherto publicly-traded company, consensus analyst estimates are available for PCP.

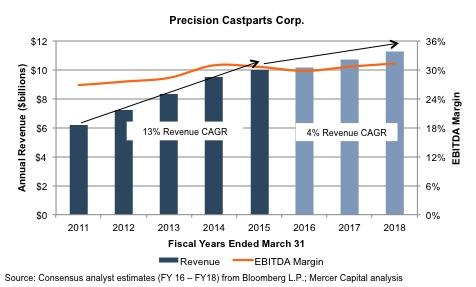

Historical revenue growth as shown in the preceding chart was buttressed by a series of acquisitions representing an aggregate investment of over $8 billion. The forecast results do not contemplate additional acquisitions, so the projected revenue growth of approximately 4% corresponds to an organic growth rate. Augmented by a small amount of margin expansion, the growth rate in projected EBITDA is 5%. Projected cash flows are derived by deducting taxes and net investment in fixed assets and working capital from EBITDA, as shown in the following table.

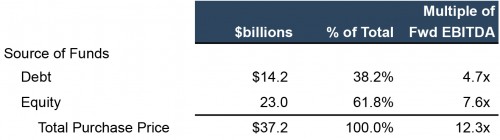

Comparing the projected cash flows to the purchase price yields an internal rate of return of 8.2%. This is the unlevered return on the aggregate purchase price. From the perspective of Berkshire Hathaway shareholders, the use of debt financing increases the prospective equity returns. Berkshire is reportedly financing the purchase using $23 billion of cash reserves and borrowing the balance.

The implied debt in the pro forma capital structure equals approximately 4.7x EBITDA, compared to total leverage of 6.1x for large corporate LBOs in 2015 (per Thomson Reuters). From that perspective, the financing mix is conservative. Although the cost of the acquisition debt has not been disclosed, Thomson Reuters reports that the average first-lien institutional spread on large corporate leveraged loans during 3Q15 has been 388 basis points. Using this average rate as a proxy, the after-tax cost of debt (on a fixed-equivalent basis) is approximately 4.2%, implying a levered equity return of 10.6%.

So the “hefty” price implies a return for equity investors in excess of 10%. As with absolute price, absolute return is less meaningful than relative return. Comparing the prospective equity return of 10.6% to the return on long-term treasuries (approximately 2.5%), the implied equity risk premium is in excess of 8%. By way of comparison, most estimates of the market-wide equity risk premium are in the range of 4% to 7%.

Because of the wide availability of low-cost debt, even a “hefty” purchase multiple does not necessarily obliterate prospective equity returns. Berkshire Hathaway’s purchase of Precision Castparts provides a timely illustration of the practical effect of the Fed’s accommodative monetary policy on corporate costs of capital and valuation multiples.

Related Links

- Valuation for Private Equity Firms & Other Financial Sponsors

- Credit Marks, Asset Yields and Dividend Capacity Are Going to Get More Scrutiny

- Portfolio Valuation Newsletter

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.