When a business announces a $16 billion transaction for a mobile messaging company that’s only been around since 2009, what are they actually purchasing? In this case, it’s Facebook acquiring WhatsApp.

The purchase consideration is relatively straightforward: $4 billion in cash and $12 billion in Facebook shares (based the average stock price for the six days preceding the announcement), plus another $3 billion in restricted stock units to WhatsApp founders and employees that will vest over a period of four years subsequent to the closing. Numerous analysts, bloggers, and journalists have spoken out about the deal, with some arguing that Facebook has made a serious mistake and others suggesting that the WhatsApp acquisition was a bargain.

One of the interesting intersections between real-world M&A and accounting occurs when a company documents the purchase price allocation for a deal. In the world of fair value accounting, the purchaser is required to recognize and record the value of assets acquired in a deal.

The press release accompanying the WhatsApp deal announcement touts the size of WhatsApp’s user base (450 million users per month and growing) and degree of user engagement (70% of users active on a given day). What intangible assets might Facebook ultimately record when it books the transaction? Clearly, one of the key components of value is the user base, but the accounting rules for intangible asset recognition require that the asset meet certain contractual-legal or separability criteria. Something like a user-base, in this instance, may not meet those criteria. With WhatsApp, the user is free to come and go (WhatsApp charges $0.99/year after the first year) and the company does not generate revenue from ad sales. This suggests that the value of the user-base is more nebulous than the typical “customer relationship” of most businesses. One of the reasons for this is that the “user” is not really the customer in a business like WhatsApp.

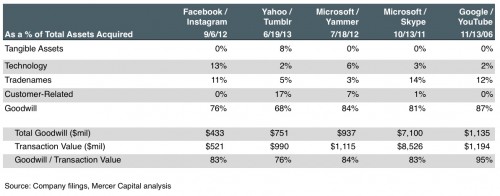

For perspective, we examined the purchase price allocation disclosures from several other large transactions in this space.

As shown above, there was minimal value ascribed to identifiable customer relationships in these deals, and the bulk of the allocations were to goodwill. There is also nothing allocated to “user-base.” Goodwill reflects those assets that are not identifiable from an accounting standpoint as well as any buyer-specific (i.e. strategic) considerations. As Facebook itself noted in its 2012 Form 10-K, “goodwill generated [from the Instagram acquisition] is primarily attributable to expected synergies from future growth and potential monetization opportunities.” Given the pricing and circumstances of the WhatsApp transaction, it is likely to follow a similar allocation.

Mercer Capital has extensive experience performing purchase price allocations for clients across a variety of industries and transaction structures. Please call us today to discuss your valuation issues in confidence.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly.