Part I of this series presented a broad outline of the PFE-MDVN transaction. Part II will delve more into the transaction to present some high-level observations around allocation of the purchase price.

Allocations for Similar Transactions

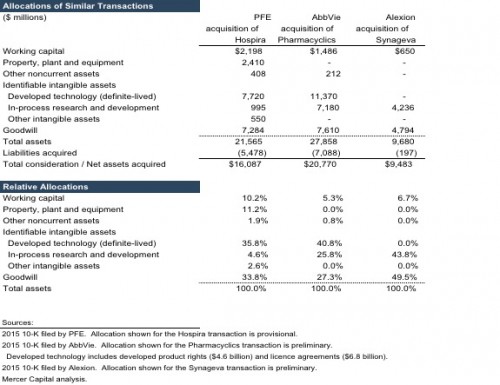

In thinking about the allocation of the purchase price for the PFE-MDVN transaction, a brief review of three recent transactions is useful. In February 2015, PFE announced the acquisition of Hospira Inc. for $16 billion in cash (an estimated 39% premium over pre-announcement Hospira share price). Hospira manufactured and sold generic acute-care and oncology injectables, biosimilars, and integrated infusion therapy and medication management systems. The transaction closed in September 2015. Notably, the erstwhile Hospira operations are part of PFE’s Established Products segment, which includes products that have exhausted (or are imminently expected to lose) patent protection including branded generics, generic sterile injectable products, biosimilars, and some contract manufacturing. Assets acquired as part of the MDVN transaction would, in contrast, be housed under PFE’s Innovative Products business, which includes patent-protected products. Innovative Products also engages in significant research and development efforts to produce an array of new assets including pharmaceutical, vaccine, and oncology products. Accordingly, expected unit pricing, gross margins, and pre-tax profitability for the MDVN products should be different from those of Hospira, suggesting likely variance on the relative allocation of intangible assets between the two transactions.

In March 2015, AbbVie announced the acquisition of Pharmacyclics, Inc. for $20.8 billion in a cash ($12.4 billion) and equity ($8.4 billion) deal. Pharmacyclics sold, and was developing additional extensions of, one product – Imbruvica (ibrutinib). The transaction closed in May 2015. Imbruvica received FDA approval and EC marketing authorization for patients with Waldenstrom’s macroglobulinemia (a rare form of blood cancer) in January 2015 and July 2015, respectively. Subsequent to the transaction, the FDA granted Imbruvica orphan drug designation for the treatment of extranodal marginal zone lymphoma. Pharmacyclics had entered into a collaboration and license agreement with Janssen (a subsidiary of Johnson & Johnson) in December 2011 that provided for the sharing of pre-tax profits and losses between the two companies. Pursuant to the agreement, Janssen has an exclusive license to commercialize Imbruvica outside the U.S. and co-exclusive rights (with AbbVie) for the U.S. market, shares development costs, and is liable for milestone payments of up to $200 million.

In May 2015, Alexion Pharmaceuticals announced the acquisition of Synageva BioPharma for $8.4 billion in a cash and equity deal (an estimated 124% premium over Synageva average share price for the week prior to the announcement). At the time, Synageva did not have a commercial product, but was in late-stage development of Kanuma, an enzyme replacement therapy for patients suffering from lysosomal acid lipase deficiency (LAL-D), a rare, life-threatening, genetic disease. By the close of the transaction in June 2015, total consideration equaled $9.5 billion including $4.9 billion in equity and $4.6 billion in cash. Subsequent to the transaction, Kanuma received European approval for LAL-D in September 2015.

Identifiable Intangible Assets

As discussed in Part 1, the primary assets acquired by PFE in the MDVN deal included:

- Xtandi, a developed product being commercialized. Extensions of the product could expand the total addressable market.

- Talazoparib, a developmental product with Phase 3 clinical trials underway. MDVN recently increased the estimate of expected payments related to the asset.

- Pidilizumab, a developmental product with Phase 2 clinical trials underway.

Based on nature of the assets acquired, the primary identifiable intangible assets for the PFE-MDVN transactions should be definite-lived developed technology, and indefinite-lived in-process research and development assets. The review of three similar transactions provides some additional perspectives regarding the identifiable intangible assets for the PFE-MDVN transaction. PFE was the common acquirer in both the MDVN and Hospira transactions. PFE is currently considering splitting the company along its two primary business lines – Established Products and Innovative Products – and expects to make a decision by year-end. Both the transactions could have appealed to PFE management’s pursuit of growing each of the two businesses to a significant enough size and reach to make stand-alone operations viable and valuable. To this end, while prior to the MDVN transaction management indicated a greater desire to add to the Innovation Products business, the deal appears to have sated (at least for now) the need for an acquisition stance biased towards patented (or patentable) products. Accordingly, PFE could have been especially motivated to acquire both MDVN and Hospira, which would likely be reflected in a similar relative (implied) allocation to goodwill. There are differences between the two transactions, however. Broadly, the Hospira transaction is likely to have included a greater proportion of tangible assets relative to the MDVN transaction. For reference, almost a quarter of the acquired Hospira assets were tangible, while the reported balance of MDVN tangibles assets at June 30, 2016 represent 7% of the proposed deal value.¹

The AbbVie acquisition of Pharmacyclics is similar to the PFE acquisition of MDVN’s Xtandi assets. At the time of the transaction, both Imbruvica and Xtandi had a newly approved product (application) with a long patent life, as well as advanced development of additional extensions for more indications. Given its prior experience with selling to urologists, PFE management appears to view favorably the potential to expand the addressable market once (if) Xtandi is approved for earlier-stage prostate cancer indications. In addition, both Imbruvica and Xtandi are subject to collaboration agreements, with the risks associated with developing and commercializing the products and the eventual economic rewards being shared with an outside entity. While the finer details of the two collaboration agreements vary, PFE will likely record developed technology – including both product rights and license agreements components – assets as part of the acquisition accounting exercise. PFE will likely also record an IPR&D intangible asset for the extension cases of Xtandi. Notably, owing to the accounting treatment of R&D, no corresponding asset currently appears in the pre-acquisition MDVN balance sheet.²

There are differences between the Pharmacyclics and MDVN transactions, however. Unlike the Pharmacyclics deal, the MDVN acquisition involves more than one (developed) product. The talazoparib and pidilizumab assets do not currently produce revenue and are in the developmental stage. MDVN has reported progress with the clinical trials and data collection, but regulatory approval is not yet certain for applications of either asset. In this regard, PFE’s acquisition of the two developmental assets is similar to the Alexion acquisition of Synageva. Excluding a small balance of working capital assets (including cash), the purchase price in the Synageva acquisition was allocated entirely to IPR&D and goodwill. The portion of MDVN purchase consideration that is related to the two developmental assets should also represent the same two assets, IPR&D and goodwill.

Brief Comments on Measurement Methods

The developed technology PFE would acquire in the MDVN deal includes two cash flow components, i) shared profits from sales within the U.S., and ii) royalties from sales outside the U.S. In our experience, the values of developed technology assets are measured most commonly using the relief from royalty method. This method should be useful in measuring the value of the first component of MDVN’s developed technology assets. Primary inputs used in the relief from royalty method include the expected stream of future revenues, an appropriate royalty rate, and an appropriate discount rate. Earlier sections of this blog post (and Part 1) discussed various considerations around the potential future revenues for the currently-approved applications of Xtandi including addressable market, implied current market share, and remaining life of the related patent.³ A survey of royalty rates for similar products can inform the appropriate rate to use for the relief from royalty method. In MDVN’s case, the royalties available from sales outside the U.S. would naturally be an observation to be included in the royalty rate survey.

Methods under the income approach are most appropriate in measuring the value of an IPR&D asset. Common methods include multi-period excess earnings method (MPEEM), relief from royalty method, and decision tree analysis. For all three similar transactions discussed in a prior section, the MPEEM was used to measure the value of the IPR&D assets. Applying MPEEM for IPR&D requires development of a number of inputs including the likelihood of regulatory success (approval to market product), expected future revenue stream, likely realizable profit margins, and contributory charges for other assets expected to be used in the business, and the applicable discount rate. For perspective, Alexion filings provide one observation on the discount rate – the company assumed a weighted average cost of capital of 10% in measuring the value of IPR&D assets acquired in the Synageva deal.

Conclusion

In summary, after accounting for a modest balance of tangible assets, the PFE-MDVN purchase price will likely be allocated primarily to two identified intangible assets – developed technology (with two potential components) and IPR&D – and the residual asset, goodwill. The sale process was drawn out, involved a number of potential acquirers, and the winning bidder appeared to be very motivated as demonstrated by both i) the implied revenue multiple using the only currently commercialized product (whatever its flaws), and ii) the sizable premium over (any measure of) the pre-acquisition share price. As in the case of the three similar transactions, these observations suggest a healthy allocation of the PFE-MDVN purchase price to goodwill.

We ended Part 1 by asking whether the transaction premium implied by the PFE bid was (should be?) 130%, 55%, or 20%. We bring Part 2 to a conclusion by asking a related question that requires less judgment but just a bit more patience – given that we are not privy to the assumptions underlying PFE’s bid for MDVN, what will be the relative allocation of the PFE-MDVN purchase price to the various assets (identifiable or otherwise)?4

Related Links

- 5 Things to Know About the Draft AICPA Guide on In-Process Research and Development Assets

- 24-Hour Impairment: Merck’s Drug Deal with Cubist

- Perspectives from Purchase Price Allocations: Value of Intangible Assets

- Facebook, WhatsApp, and Value Allocation

End Notes

¹ Some constituent elements of the tangible asset base are likely to be written up (or down) from their reported values as part of the purchase price allocation process. However, at a reported value of $70 million, the most likely candidate for a write-up (property and equipment) is a small portion of the MDVN balance sheet (and likely to remain so given the business model of the company).

² While IPR&D is an identifiable intangible asset for the purposes of a purchase price allocation, R&D expenditures incurred during the course of operations are expensed and not capitalized pursuant to the current accounting rules. Accordingly, the MDVN balance sheet does not include entries, IPR&D or otherwise, related to the Xtandi extension applications.

³ As technologies age, competitive products or platforms can erode the revenue potential of incumbent solutions (sometimes even when patent protection is available). Accordingly, based on a survey of similar products in the market or in development, it may be appropriate to assume an obsolescence curve to isolate the expected future revenue stream applicable to the currently developed technology.

4 We will present the answer on this blog once the transaction closes and PFE discloses the allocation.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.