On April 8, 2014, the SEC charged CVS Caremark Corp. with misleading investors by failing to disclose certain financial setbacks and using improper purchase price allocation accounting that artificially boosted its financial performance. The complaint was filed against CVS and Mr. Laird Daniels, retail controller at CVS at the time. Both parties have now settled with the SEC.

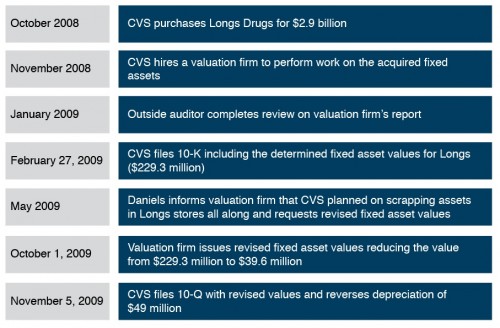

A recent article by Matt Levine on BloombergView describes the SEC’s allegations, in particular, the first charge mentioned above. The second charge, relating to purchase price allocation, has particular relevance in the world of financial reporting. The complaint alleges that Daniels intentionally made some rather creative adjustments to the company’s purchase price accounting relating to its acquisition of Longs Drugs in 2008.

In its third quarter 2009 10-Q, CVS adjusted the value of certain fixed assets associated with the Longs stores from $229.3 million to $39.6 million. The difference was reallocated to goodwill, thus reducing the company’s depreciation expense going forward and allowing CVS to reverse $49 million in depreciation expenses already incurred. The adjustment boosted adjusted EPS for the quarter and allowed CVS to beat analyst expectations.

The original valuation of the acquired fixed assets was performed under the premise that certain store assets would be continued in use. Daniels requested that the assets be revalued under the assumption that CVS was now renovating certain Longs stores and that the assets in question would be entirely scrapped. Daniels argued that this had been CVS’ intention all along, despite the fact that such plans were never contemplated by the parties at the time of the acquisition. The SEC ultimately concluded that the revision was not in compliance with GAAP:

“The Longs PPA adjustments did not comply with generally accepted accounting principles (“GAAP”), specifically SFAS 141, because: (1) they did not reflect the expected future use of the Longs personal property as of the acquisition date in October 2008; (2) they did not reflect information that CVS knew or had arranged to obtain as of the acquisition date; and (3) they did not account for CVS’s use of the assets to generate revenue after the acquisition date. The failure to comply with GAAP had a material impact on the company’s third-quarter 2009 financial results.”

The complaint goes on to state that proper treatment of the assets given the store renovations would have been to write them off entirely as a current period expense in the third quarter and to leave the reported depreciation expense unchanged, rather than revising the PPA.

The SEC’s actions (and the resulting settlements) remind us that fair value matters often come under heavy scrutiny.