The HBO sitcom Silicon Valley follows the story of six young, tech-savvy, would-be entrepreneurs who found a start-up company. The show depicts the ups and downs of the characters and their company, Pied Piper, against a backdrop of both real-world and semi-fictional companies, tech celebrities, venture capitalists, and other cultural phenomena of Silicon Valley.

Several characters have day jobs at a large, successful technology company called Hooli. Early in the series, a character nicknamed Big Head is offered a raise and promotion by the boss of Hooli. Big Head accepts the offer, but is shocked and confused when he is subsequently told that he won’t be assigned to any new projects. But he’s not being fired, either. As Big Head wanders the halls of Hooli trying to make sense of things, he stumbles upon a group of guys hanging out on the roof of the building who are similarly “unassigned” at Hooli. He’s invited into their group, where the following exchange takes place.

Unassigned Hooli Employee: “We all got acquired by Hooli, and when we didn’t work out, none of us got reassigned….”

Big Head: “Why are you guys still coming in?”

Unassigned Hooli Employee: “Rest and vest.”

Big Head: “Oh… Cause in order to fully vest your options, you’ve got to wait until your contracts are up. I get it.”

Another Unassigned Hooli Employee: “You catch on slow. You’ll fit right in here.”

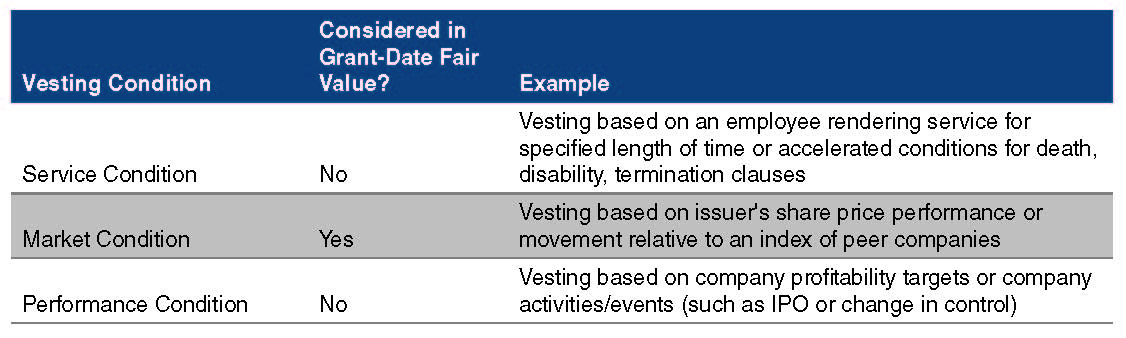

The “rest and vest” scenario is a real thing, though it is debatable how accurately it is presented in the show. There are also obvious differences between the perception of the value of options received by an employee and the financial reporting requirements of the issuing company. In the world of financial reporting, vesting conditions can affect both the grant-date fair value of a stock award as well as the period over which the compensation cost is recognized by the issuing company. “Rest and vest” referenced in Silicon Valley reflects the fulfillment of a service condition in the parlance of ASC 718: Compensation – Stock Compensation. Service conditions are most often time-based. However, many stock-based awards could also include additional conditions that must be met in order for the award to vest. Some of these conditions affect the grant-date fair value of the award and some do not. The following chart summarizes the three types of vesting conditions as described in ASC 718.

The measurement objective of ASC 718 is to determine the grant-date fair value of the compensation, assuming the employee fulfills the award’s vesting conditions and retains the award. That compensation amount is then recognized over the requisite service period. The requisite service period may be explicitly or implicitly stated in the terms of the award, such as a simple award that vests in graded increments over a number of years of continuous service. In other cases, the requisite service period may need to be derived, such as in the case of an award subject to market condition vesting (i.e., award becomes exercisable only if the issuer’s stock rises by 25% at any time during a three year period).

All else equal, an award with a market condition “hurdle” will have a lower grant-date fair value than one that does not. Then, if the award contains service and/or performance conditions, those conditions would be incorporated into the company’s estimate of what percentage of the award will ultimately vest. For instance, management of the company would need to assess the likelihood that performance conditions (such as an IPO or change in control) will be achieved. These estimates then affect the amount of compensation cost recognized in each reporting period.

Estimating the fair value of stock-based compensation and accounting for it properly can be complex. Maybe it’s more appealing to envy the “unassigned” employee just biding his time as he rests and vests. Then again, why doesn’t the company just terminate the “unassigned” employee for cause and cancel his options since the venture didn’t work out? I guess that’s why they call it a television show.

Related Links

- Article: Why Quality Matters in Valuation for Equity Compensation Grants

- Presentation: ASC 718 – Equity Compensation

- Guide to Accounting for Stock-based Compensation: A Multidisciplinary Approach (via PwC)

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.