Jimmy Kimmel jokes that “Tax day is the day that ordinary Americans send their money to Washington, D.C., and wealthy Americans send their money to the Cayman Islands.” Tax day is now the day when Medtronic, a leading medical device company headquartered in Minneapolis, will be sending its money to Ireland. On June 15th, Medtronic and Irish healthcare company Covidien PLC announced they had signed an agreement in which the former would acquire the latter for approximately $42.9 billion. This price reflects a 29% premium to Covidien’s last closing price before the announcement, 4.3x LTM revenue, and 15.3x LTM EBITDA.

One motivation for Medtronic to acquire Covidien has to do with taxes. As part of the acquisition, Medtronic will have a new corporate tax rate of 12.5%, down from a top marginal rate of 35%, just by changing its address from the US to Ireland, using a strategy known as “inversion” (subscription required). Many healthcare companies have made the news recently by following this tax shopping strategy. (At Mercer Capital, we maintain a focus on medical device companies and provide fair value services including purchase price allocations (PPAs) following mergers and acquisitions.)

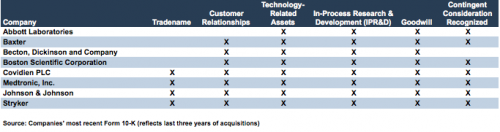

Below is a representative sampling of intangible assets recognized by some of the large, diversified players in this space.

For a transaction like Medtronic/Covidien, how might the presence of the inversion strategy affect the company’s PPA? We don’t profess to be tax experts, but here are a few observations from a financial and fair value accounting point of view.

- Would the inversion tax benefits be reflected in the purchase price? Maybe, maybe not. As a buyer-specific synergy, Medtronic would presumably not want to share these benefits with the seller, though the seller may use the prospect of such benefits to negotiate a higher price.

- To the extent that pricing was pushed upward by the presence of entity-specific tax benefits, that increase would presumably be reflected in the residual asset, goodwill. Total goodwill, measured both in dollars and in proportion to overall deal value, would be higher than typically observed industry benchmarks for “normal” (i.e. non-inversion) transactions.

- The presence of the inversion strategy might also warrant additional consideration on the part of management, the external valuation consultant, and the audit review team to assess whether the purchase consideration and financial projections are truly representative of market participant assumptions. Adjustments to these items may be necessary to develop fair value estimates for any intangible assets that are recognized.

This transaction is interesting for a variety of reasons, and we may revisit it in the future to investigate if the final goodwill allocation falls within “normal” industry ranges. Mercer Capital has extensive experience performing purchase price allocations for clients in the medical device space, as well as many other industries. Please call us today to discuss your valuation issues in confidence.

Related Links

Mercer Capital’s Medical Device Industry Newsletter

Perspectives from Purchase Price Allocations: Value of Intangible Assets

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.