Determining the value of financial assets in a divorce case can often be the most complicated aspect of the case.

The value of certain assets, such as a retirement account or a bank account, can be determined by a brokerage or bank statement/balance as close to the date of trial or settlement as possible.

An asset such as a closely held business may be the most valuable asset in the marital estate and can require a business appraiser to determine its fair market value since no market indication of value is generally available (unlike a publicly traded company).

The valuation date is also important. In addition to the value of the business or business interest (%) at the current date, other indications of value, such as the value at the date of marriage, may also be required. This varies depending on the facts and circumstances of ownership as well as state statutes.

Net asset division in divorce proceedings are further complicated because they are governed by laws that differ by state. The majority of states are referred to as Equitable Division (“ED”) states as opposed to Community Property states. In ED states, courts determine the equitable or fair distribution of the marital assets based on the characteristics of each case. Further, a majority of ED states are referred to as Dual Property ED states, meaning that assets are categorized as either marital or separate.

While definitions vary by state, some states define marital assets as those acquired or earned during the marriage. Those states then define separate assets as those consisting of property owned by a spouse prior to marriage or property received by gift or inheritance that has not been commingled or transmuted during the marriage. Generally, marital assets are subject to division in a divorce proceeding whereas separate assets, as the name implies, are held separately and not factored into the equitable division of marital assets.

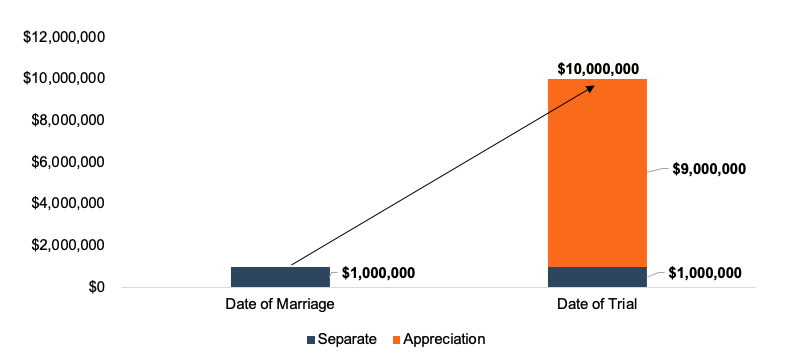

Can a separate asset ever become a marital asset? Yes. In many states, the increase in value of a separate asset during the course of the marriage can potentially be considered a marital asset. Using the example of a closely held business, the increase in value, or appreciation, is often measured by the fair market value of that asset at the date of marriage and some other date as defined by the individual state law or statutes. Other measurement dates are the date of trial, date of separation, or date of filing, among others. In an article published in Family Lawyer magazine, we discussed the importance of the valuation date and its impact on the value of a closely held business.

Active vs. Passive Appreciation

Consider a simple example of a closely held business that one spouse owned at the time of marriage. Let’s assume that the fair market value of the business at the date of marriage is $1 million and the fair market value of the business at the date of trial is $10 million. The simple calculation of the appreciation, or increase in value, is $9 million. Is the entire difference of $9 million considered marital property in this example? The answer may be “it depends,” because it may not be that simple depending on the state or jurisdiction of the case.

In many states, the entire portion of appreciation is not treated as marital property, though, valuation experts must confirm state statute and precedent with the attorneys.

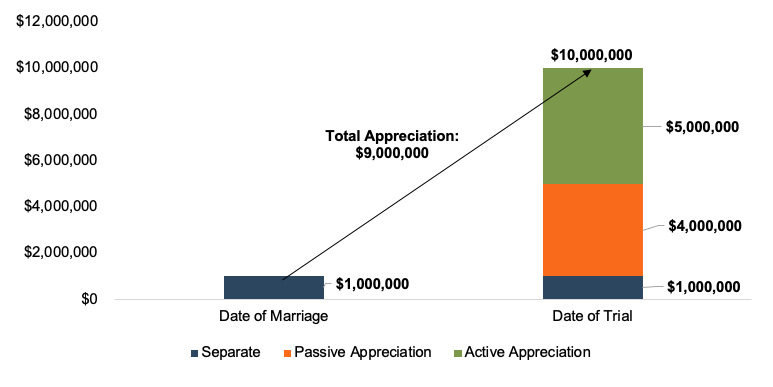

Many states make the distinction between “active” and “passive” appreciation. Active appreciation refers to the increase in value, due to the active, direct and indirect, efforts of one or both spouses. Passive appreciation refers to the increase in value, due to external factors such as market forces, or efforts of other individuals other than the spouses in the divorce.

Depending on the state, courts may then classify active appreciation as marital property, while passive appreciation generally remains separate property.

Active and passive appreciation can also be illustrated by looking at certain assets, such as retirement accounts or real estate. Assuming no contributions during the marriage, the growth in value of a retirement account as a result of the increase in the market values of the underlying investments since the date of marriage would be an example of passive appreciation. The rise in value of a piece of real estate or property due to general market conditions and absent any additional investment, improvement, or management of that real estate during the marriage would also constitute passive appreciation.

Appreciation in retirement accounts and real estate can be simply illustrated and defined through reasonable methodologies. Determining active and passive appreciation in the value of a closely held business can be much more complex. The assumptions used in the overall valuation of the business requires the business appraiser to use qualitative and quantitative analyses. Active appreciation can be supported through direct efforts of one or both spouses such as financial investment in the business, ownership and labor hours contributed to the business, management, marketing strategy, etc. Passive appreciation can consist of economic or market conditions and/or the efforts of non-divorcing individuals.

Examples of Passive Appreciation Factors and Techniques to Quantify

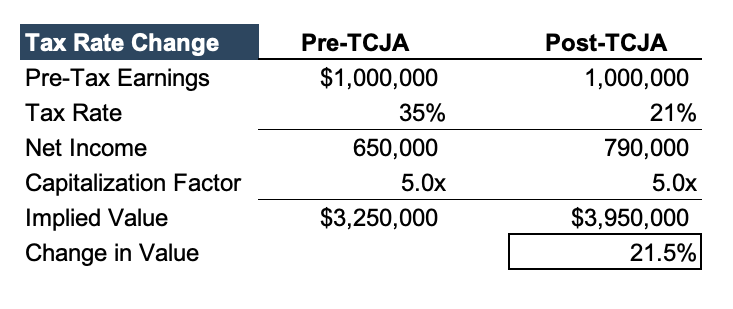

Market forces refer to the economic or market conditions that affect the price, demand, or value of an asset. Market forces happen naturally and are outside of the control or direct efforts of the owners of the company or spouses involved in a divorce. For a closely held business, market forces that can affect value include changes in interest rates, discount/capitalization rates, tax rates, pricing of products or billing rates, legislation that causes an increase in demand for a company’s products or services, etc. Value appreciation attributable to market forces would generally be classified as passive appreciation and as a result, would not be included in the marital estate in those states that recognize active/passive appreciation as marital/separate.

Consider a simple example of a company before and after the tax rate changes brought on by the 2017 Tax Cuts and Jobs Act (“TCJA”). Let’s assume the Company has $1 million in earnings, and the capitalization factor to determine value is 5x. Let’s also assume the tax rate changed from 35% to 21% after TCJA with no state income tax. In this example, all else being equal and not changed, the change in tax rate caused a 21.5% increase in value of the company.

Efforts from individuals other than the spouses could be another area where passive appreciation is present. Business appraisers can perform analyses of these third-party efforts through several techniques. When considering ownership, the following questions are addressed. What is the overall ownership of the company? Is the divorcing spouse the only owner or is he/she one of several owners? The presence of other owners could indicate efforts of other individuals. Management of the Company is also a consideration. Who are the key members of management and how are decisions made? Is the company controlled by a board of directors, and if so, how many individuals serve on the board? In terms of the the role of the spouse, appraisers can analyze these roles and the roles of other key individuals and determine what impact those duties have on the company’s strategy and performance overall. Finally, business appraisers can perform an analysis of the revenue contribution of each owner or key member of management to the overall revenue of the company. Does the company have multiple locations? If so, is the divorcing spouse active and participating at all locations?

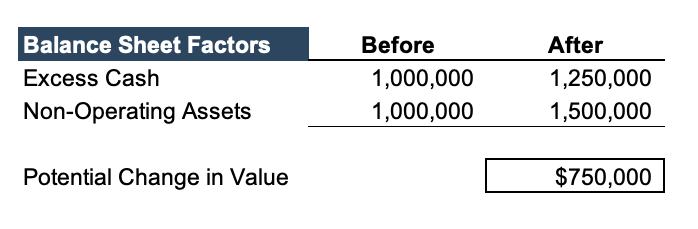

Balance sheet factors can also impact the overall value of a company. The presence of excess cash or non-operating assets can add to the value determined under an income or capitalization method (used in the tax rate example above). The Company may have experienced an increase in these items from the date of marriage to the current date of measurement. From our experience, it is not uncommon to see companies in certain industries with more cash on the balance sheet in the last two years as a result of remaining funds obtained from PPP loans or elevated profits. Non-operating assets can consist of real estate not used in the core operations of the business or an investment account. We discussed both of these assets earlier and illustrated how their values can increase due to passive appreciation factors.

Consider a company with the following changes to its balance sheet: excess cash increased by $250,000 and non-operating assets increased by $500,000. In this example, the change in potential value to the company could be $750,000 and may be characterized as passive appreciation depending on the specific factors. While these are assets and liabilities of the business, they may be categorized as “non-core” assets that have different considerations for separate or marital appreciation from those of the core business operations.

Allocating Active/Passive Appreciation

Once the appraiser identifies and quantifies the areas of passive appreciation, the remaining appreciation, or increase in value, is concluded to be active appreciation. The conclusion of passive appreciation could be in dollars of value or percentage of overall value.

Let’s revisit our original example involving a company worth $1 million at date of marriage and $10 million at the date of trial. If the appraiser had determined passive appreciation to be $4 million, then the resulting active appreciation would be $5 million as seen below:

Conclusion

Determining the value and classification of financial assets can be challenging during a divorce proceeding. As we have discussed, the classification of an asset can also change from the date of marriage to the current date of measurement (trial, separation, filing, etc.) and depending on state statute and precedent. Many states make the distinction between active and passive appreciation, only considering the active appreciation to be a marital asset.

The value of a couple’s closely held business could be the most valuable asset in the marital estate. If the business was owned prior to marriage, the identification and quantification of any appreciation as active or passive could be critical to the overall marital value placed on that asset.

A detailed valuation analysis of the appreciation will be needed in addition to the valuation of the business at each measurement date. A qualified business appraiser can perform both tasks, including examining the specific factors that contribute to the overall value of the business. It’s important for the appraiser to understand the applicable state laws of the jurisdiction in question and to discuss those with the attorney.