The stakes for a business combination are high. Each party must negotiate a price and deal terms that promote its own interests but accommodate the counterparty’s expectations. Reaching an agreement can be a lengthy process and may require incorporating special provisions to help close the deal. Contingent consideration is a common example of such a provision.

Measuring the fair value of contingent consideration (commonly referred to as an “earnout”) for financial reporting is a complex process – based on a number of variable inputs, unique risk profiles, and potentially complicated payoff structures. Valuation professionals must be well versed in the concepts of fair value, probability, and risk. Here’s what you need to know about what goes into that fair value measurement before it lands on your desk.

How Does an Earnout Differ from Other Purchase Price Adjustments?

While both purchase price adjustments and earnouts can affect the total consideration paid in a transaction, they differ substantially in terms of criteria and realization. Common purchase price adjustments include adjustments for working capital, client consents, and indebtedness. Purchase price adjustments, which are based on financial statement information, are observable and knowable at the closing date of the transaction, while earnouts are not. Earnouts, on the other hand, are payments based on performance that occurs subsequent to the measurement date. Although the eventual earnout payment cannot be known at the closing date, valuation specialists have developed techniques to enhance the reliability of fair value measurements.

What Criteria Must Be Established in a Fair Value Measurement?

The Purchase Agreement establishes the basic criteria, structure, and time frame for the earnout. Based on these characteristics, the valuation professional must determine several inputs for his or her modeling.

Earnout Metric

The Purchase Agreement will define one or more performance metrics for the earnout. A common example is EBITDA for the twelve-month period following the acquisition. The future outcome(s) of the relevant metrics are used to determine the future payout. For purposes of fair value measurement, valuation specialists may reference management projections, analyst expectations, and industry forecasts to model the expected payoff.

Volatility

Since the actual value of the earnout metric cannot be known with certainty at the measurement date, the expected value is paired with an estimate of expected volatility. While there are several ways to estimate expected volatility, the estimate should be reasonable in the context of the volatility observed for similar companies, the subject company’s fundamentals, and the characteristics of the specific metric.

Discount Rate

The appropriate discount rate may be estimated through a bottom-up approach, where beta is built up using earnout-related factors, or through a top-down approach, which starts with the beta implied by the equity discount rate for the company overall. In the top-down approach, the valuation professional adjusts the company level beta up or downward for differences in risk between the metric and the company’s equity. The type of risk associated with the metric will affect the model that should be used to value the earnout. The two broad categories of risk are:

- Diversifiable. Diversifiable or “unsystematic” risk is specific to the subject company and can be reduced through diversification. For example, the risk associated with occurrence of a nonfinancial milestone such as patent approval is considered diversifiable.

- Non-Diversifiable. Non-diversifiable or “systematic” risk is related to the risk inherent in the market. For example, the risk associated with achieving a financial target such as revenue growth is considered non-diversifiable.

Payoff Structure

The structure of the earnout reflects the provisions established in the Purchase Agreement. Questions that a valuation specialist may ask include:

- Is the underlying metric risk diversifiable (unsystematic) or not (systematic)?

- Is the payoff structure linear or non-linear?

- If multiple periods are involved, are the periods dependent on, or independent of, the other periods?

The answers to these questions can help the valuation professional determine the structure of the payoff and whether a scenario based model or option pricing model is best suited to the fair value measurement of the earnout liability.

Term

The term over which the metric is measured is established in the Purchase Agreement. The earnout may be determined after one period or over a multi-period time frame. Payments may be made throughout the earnout period, at the end of the earnout period, or at a later date. Additional time to payment may increase counterparty risk, or the risk that the Buyer will default on the earnout payment due.

Credit Risk of the Buyer

Earnouts typically represent a subordinate, unsecured liability for the Buyer. Thus, risk should be considered for the Buyer’s ability to meet the earnout obligation, commonly called counterparty credit risk or default risk. A valuation professional will look for any mitigating factors that could reduce or eliminate this risk, including:

- Guarantee by a bank or third party

- Escrow account for full or partial funding of the earnout

- Earnout structured as a note to increase its security ranking

What Methods Are Used to Measure Fair Value?

The two primary methods used to measure fair value are the scenario based method and the option pricing method. Selection of the method and model most appropriate for a given situation will depend on to the structure and risk profile of the subject earnout.

Scenario Based Method

Under the scenario based method, valuation specialists apply probability weights to the relevant metrics, and then discount the corresponding payouts at an appropriate rate. This method is most appropriate when the underlying metric for the earnout has a linear payoff structure or the underlying risk is diversifiable. Models within this method can effectively conform to any distribution assumption. This method is intuitive and is likely to mimic how the parties to the transaction thought about the earnout. However, these models can be perceived as unreliable since the inputs are qualitative in nature.

Option Pricing Method

When applying the option pricing method, valuation specialists use models such as Black-Scholes to measure the fair value of a portfolio of financial instruments that replicate the potential payouts of the earnout structure. This method is best suited for earnouts with nonlinear payoff structures and metrics with non-diversifiable risk. A significant benefit to the method is that the use of historical data to estimate volatility, correlation, and the discount rate creates consistency among input assumptions. However, the complexity of the mathematics associated with the models is not well understood by those without financial expertise, rendering them much less intuitive.

Understanding the Differences

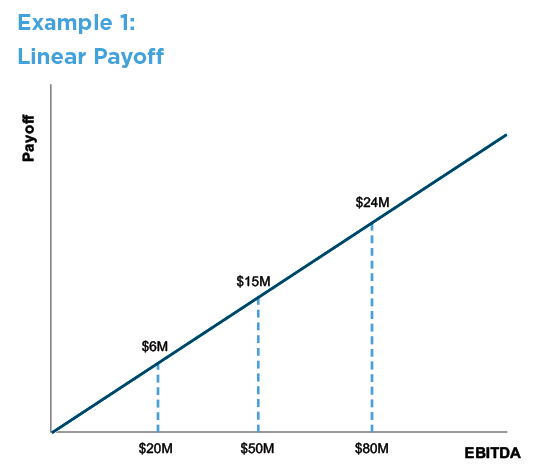

A simple example of an earnout that could be modeled with the scenario based method is as follows: a payment of 30% of the next fiscal year EBITDA. The payoff in this model is linear since it has a constant relationship with the relevant metric, meaning that a payout is due whether EBITDA is $1 million or $100 million (Example 1 below).

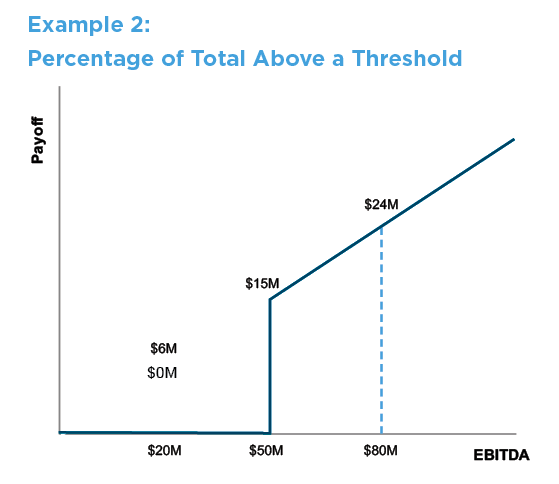

In contrast, an earnout with a threshold or cap is better suited to an option pricing method. For example, a payment of 30% of the next fiscal year EBITDA only if EBITDA meets or exceeds $50 million. The payoff is the same as the linear scenario after EBITDA reaches the threshold; however, the payoff is $0 for any value of EBITDA below that.

The second example can be modeled as a portfolio of options, where the threshold value of the metric ($50 million) acts as an effective strike price.

What Guidance Exists Regarding Fair Value Measurement of Contingent Consideration?

The measurement of contingent consideration has historically been a matter of considerable diversity in practice. While some common practices have generally been followed, new guidance clarifies best practices. A working group formed by The Appraisal Foundation issued a first exposure draft of new guidance regarding the measurement of contingent considerations in February 2017. This guidance details the methods described above and best practices for their application. The exposure draft endorses the risk-neutral valuation framework as the preferred basis for fair value measurements. A risk-neutral framework makes risk adjustments to the earnout metric to account for the unsystematic risk inherent in the metric. The guidance is expected to promote the consistency and reliability of fair value measurements.

What Are the Implications of Fair Value on Financial Statements?

Earnouts can act as a way to “bridge the gap” between what the Buyer wants to pay and what the Seller wants to receive. They can provide downside protection for the Buyer and upside potential for the Seller. These benefits contribute to the common use of earnout provisions in business combinations. However, the financial reporting consequences of an earnout may be counterintuitive once the transaction has closed and the Buyer becomes the owner of the acquired company. Subsequent to this point, if the relevant metric exceeds initial expectations, the Buyer will report a loss on its income statement associated with remeasuring the contingent liability at its new, higher value. In effect, if business goes well, the Buyer will report a loss. In contrast, if business goes poorly, the Buyer will report a gain upon remeasurement of the contingent liability at its new, lower fair value. Sophisticated deal makers understand the short-term implications for the Buyer’s financial statements but remain focused on the long-term goal.

Conclusion

The uncertainty associated with contingent consideration means that the fair value of the earnout will rarely equal the amount that is actually paid out at the future payment date. While valuation professionals do not know what the future holds, they do have tools and techniques to reliably measure the fair value of the earnout liability as of the date of the transaction. While the nuances encountered in fair value measurement of earnouts can extend well beyond the scope of this article, we hope it provided some insight into what goes into the numbers before they reach your company’s accounting department.

The inclusion of an earnout in a transaction negotiation can serve various purposes.

- Bridge the differences in Buyer and Seller expectations

- Serve as a form of alternative financing and defer a portion of the purchase price

- Provide incentive for management to help the company meet post-transaction targets

- Shift and allocate risk between the various parties involved

The motivation behind an earnout can influence management’s choice of earnout structure in order to achieve the intended purposes.

Definition of Fair Value (ASC 820)

“The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

Objective of Fair Value Measurement (ASC 820)

“To estimate the price at which an orderly transaction would take place between market participants under the market conditions that exist at the measurement date.”