May 2025 SAAR

The May 2025 SAAR came in at 15.6 million units, down 9.3% from the previous month and representing a 1.1% decline from May 2024.

Since the implementation of the Trump tariffs in early April, existing consumer demand and inventories have temporarily mitigated the impact on the auto industry. However, the resulting supply chain pressures and threat of higher vehicle prices have reduced sales momentum, contributing to a noticeable decline in the SAAR this month.

Over the next several months, the automotive industry may continue to experience slower sales and tighter margins as it navigates tariff uncertainty and potentially recalibrates its global supply chains.

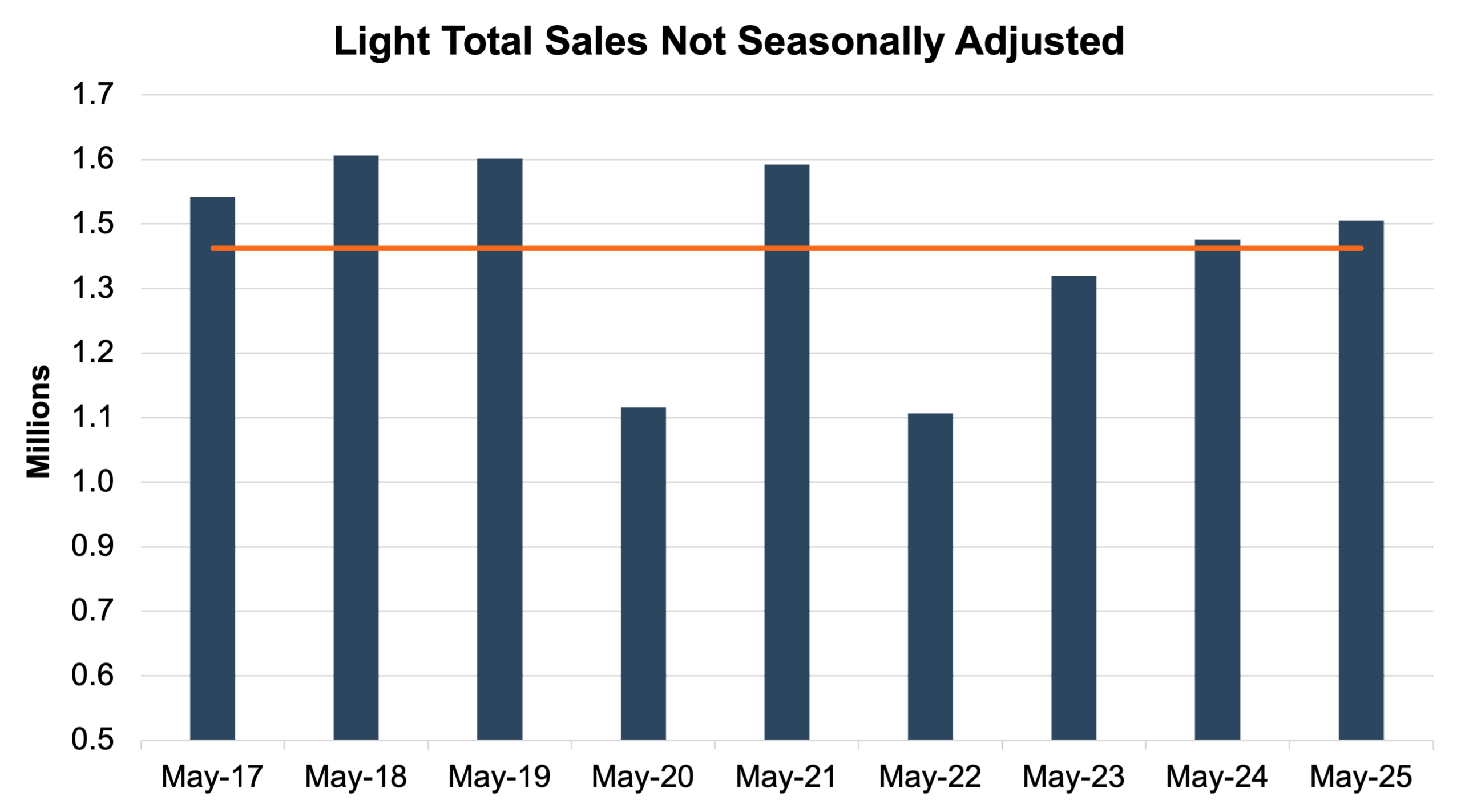

Unadjusted Sales Data

With just one more selling day than May 2024, May 2025 industry sales (on an unadjusted basis) reached 1.46 million units, a 0.3% increase from last month and a 2.5% increase from May 2024.

This month’s unadjusted sales surpassed the nine-year May average of 1.4 million units (2017–2025) by approximately 50,000 units. See the chart below for a look at unadjusted sales over the last nine Mays.

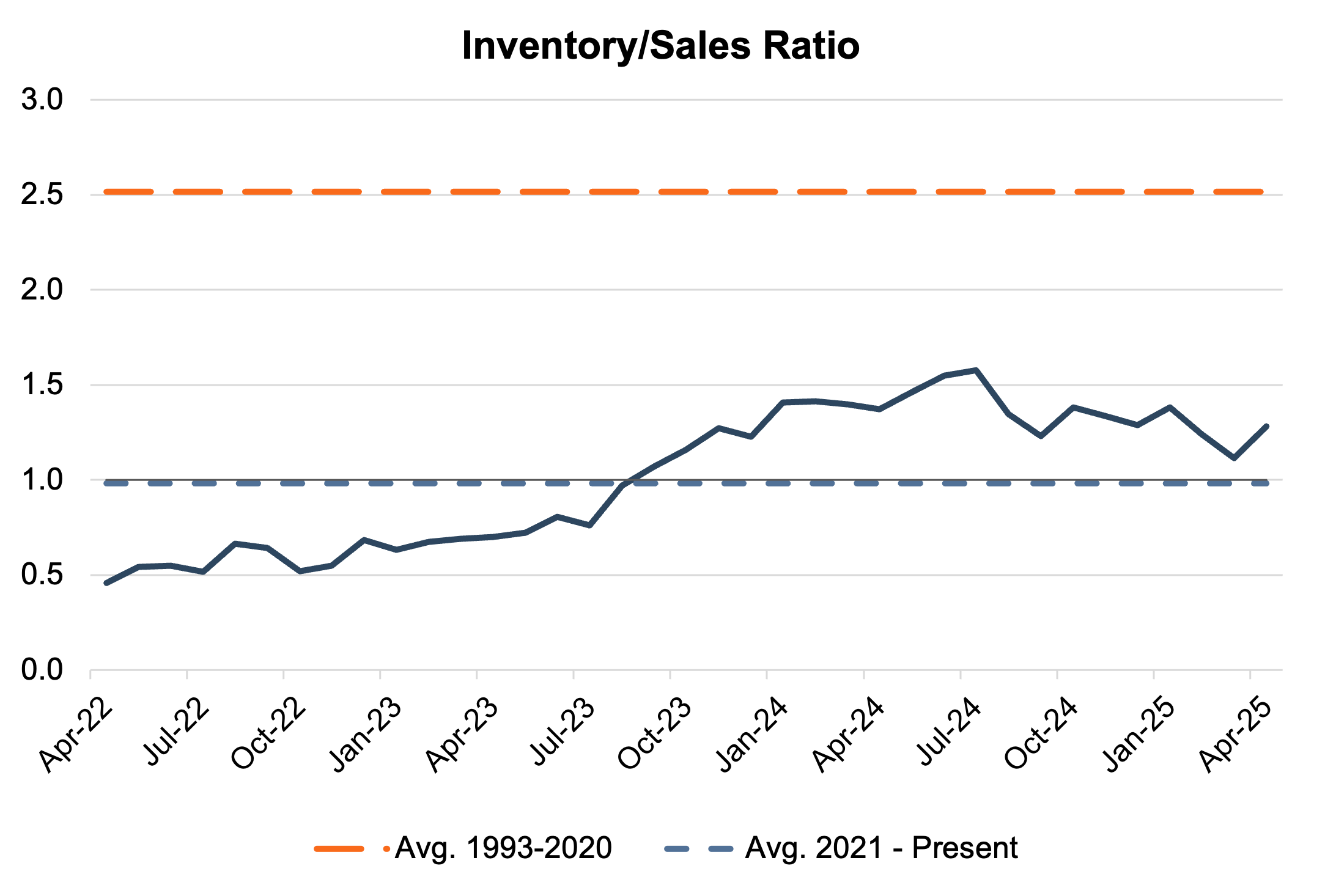

Inventory Metrics

The industry’s inventory-to-sales ratio increased to 1.28x in April 2025 from 1.12x in March 2025. In the coming months, the inventory-to-sales ratio is expected to trend closer to 1.0x as the industry begins to realize the impact of the tariffs on import activity and sales volumes.

The chart below presents the industry’s inventory-to-sales ratio over the last three years.

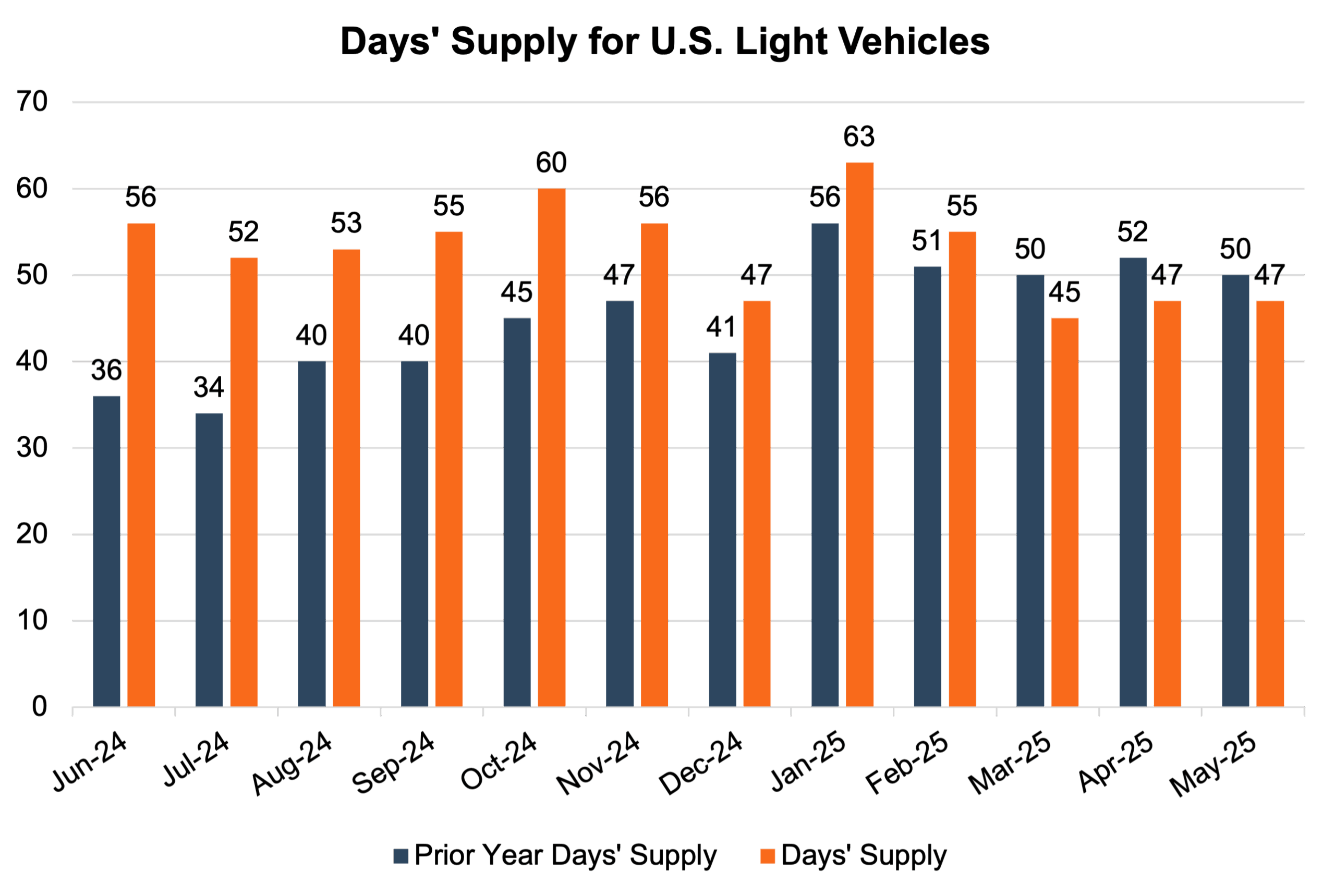

In May 2025, industry-wide days supply came in at 47 days. While the margin between the current and prior month comparisons continues to narrow, May 2025 is the third consecutive year-over-year decline in days supply.

As uncertainty persists due to the tariffs and their potential impacts on the auto industry, we will likely see the days’ supply continue to trend lower over the next several months until stability is reached from the tariff implementations.

The chart below presents the days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in May:

“The threat of higher vehicle prices has yet to materialize in a meaningful way. Most manufacturers have made explicit commitments to maintain stable vehicle prices in the near term. The consumer rush to showrooms in March and April did drive prices slightly higher, but the return to a more typical sales pace in May has led to a stabilization of average prices. The average new-vehicle retail transaction price in May is expected to reach $45,462, up $649 or 1.4% from May 2024, but down $592 or 1.3% from April.”

Incentive Spending and Profitability

J.D. Power notes that the average incentive spending per unit in May 2025 is expected to be $2,563, down 7.2% from the previous month but up 5.3% from May 2024. Incentive spending as a percentage of the average MSRP is expected to come in at 5.1% for May 2025, a decrease of 0.3 percentage points from this time last year.

J.D. Power notes that the May 2025 total retailer profit per unit (which includes vehicle gross plus finance and insurance income) is estimated to rise to $2,502, a $98 increase from May 2024.

June 2025 outlook

Mercer Capital expects the June 2025 SAAR to come in at or below the May 2025 SAAR, as it is expected that the tariffs will continue to impact the supply chain.

Sales volumes, profits, and blue sky multiples are likely to experience pressure over the next several months as the industry adjusts to new import taxes.

Subscribe to our Auto Dealer Valuation Insights blog to stay up to date on tariffs and other industry-relevant news updates.

Mercer Capital offers business valuation and financial advisory services, and our auto team assists dealers, their partners, and family members in understanding the value of their businesses. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights