Oil vs. Gas: Diverging Valuations in the Energy Patch Persist

U.S. Upstream Producers Are Closing 2025 with Sharply Different Stories Depending on the Molecules They Sell

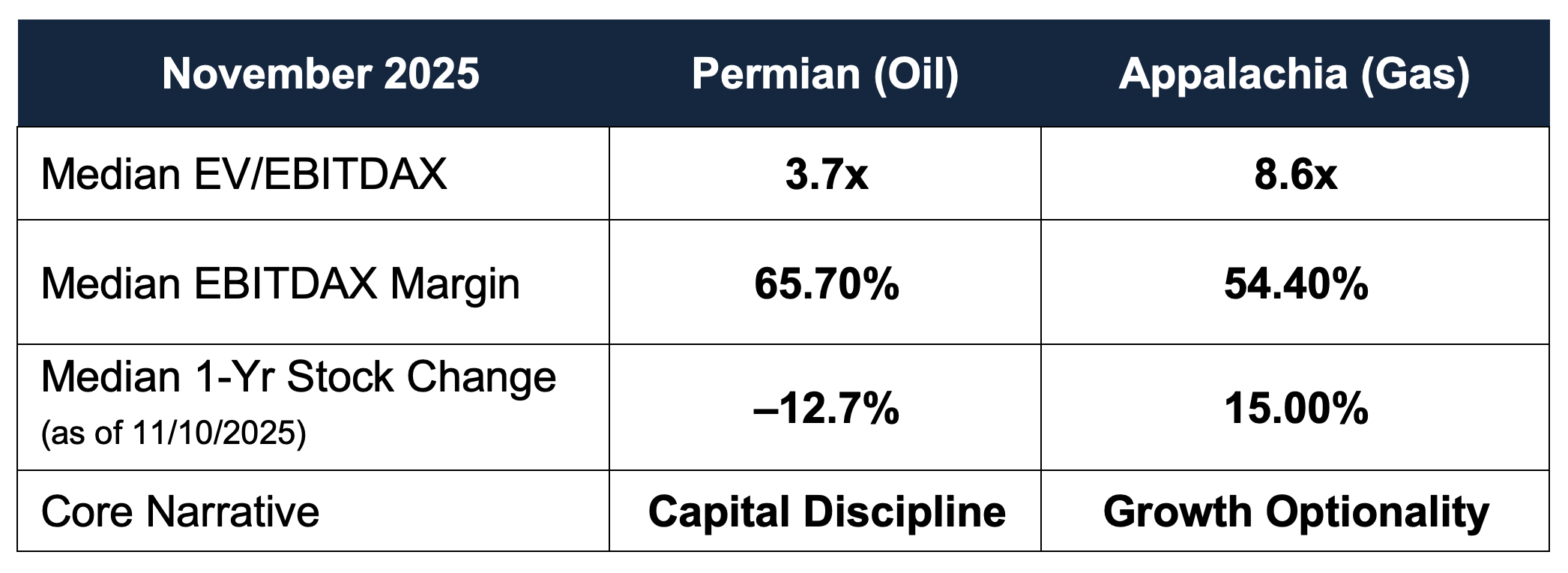

2025 continues some of the same valuation trends that I have written about earlier this year. As U.S. oil producers battle with middling prices, emerging breakeven cost issues, and shrinking Tier 1 acreage, gas investors are foreseeing growth and future profitability. Investors are rewarding future demand visibility over near-term cash generation, a rare reversal in a sector long dominated by oil.

Permian: Scale Without Spark

Five Permian-focused producers: Diamondback Energy (FANG), Permian Resources (PR), Vital Energy (VTLE), Devon Energy (DVN), and APA Corporation (APA) show a median EV/EBITDAX of 3.7x and price per flowing barrel near $34,000, per recent data. Despite robust EBITDAX margins averaging 66%, share prices have declined about 13% year-over-year.

Commentary from the latest earnings calls echoed a disciplined but subdued tone. Diamondback’s leadership underscored that “discipline remains our competitive advantage,” but markets want more than balance-sheet strength, they want growth optionality. Devon cut capex guidance and focused on buybacks. Permian Resources touted record free cash flow and raised guidance without boosting capital, yet its stock remains down 11% year-over-year.

The Dallas Fed Energy Survey helps explain the malaise. The E&P business activity index slipped into negative territory in Q3, with nearly two-thirds of respondents holding 2025 capital budgets flat. One respondent summarized the sentiment: “We’ve optimized. Growth isn’t the goal; return stability is.”

Even APA, the group’s lone gainer at +12%, attributed its performance largely to debt paydown and balanced exposure to Egypt and the Permian. The market’s message: oil discipline is expected, not rewarded.

Appalachia: Gas Gets Its Repricing

Appalachian producers tell the opposite story. Range Resources (RRC), EQT (EQT), Coterra Energy (CTRA), and Antero Resources (AR) post median EV/EBITDAX multiples of 8.6x and median stock price gains of 15% year-over-year. Investors are buying into the structural gas demand story headlined by LNG export growth and surging U.S. power consumption.

EQT’s third-quarter call captured that optimism. CEO Toby Rice said the company is “on the verge of a multi-decade growth story as the U.S. becomes the global swing supplier of natural gas.” Range Resources, with a more conservative margin (42%), still traded higher on the expectation of long-life reserves and low debt.

The Dallas Fed Survey echoed that tone, projecting Henry Hub prices near $4.00 per mcf in 2026, up modestly from earlier forecasts. About half of gas-weighted firms cited “LNG expansion and electrification” as demand catalysts, versus fewer than 10% mentioning those themes just a year ago.

Coterra, blending oil and gas output, enjoyed one of the strongest operational quarters in its peer set, posting 66% margins and a 7% stock gain. Investors clearly favored its gas leverage.

Valuation Divergence: Capital Discipline vs. Demand Optionality

When one observes these metrics between the two peer groups, oil valuations seem to be constrained by capital-discipline fatigue. Gas valuations in the meantime appear to be elevated by global-growth optionality. In many ways Permian producers are priced more like mature, low-growth cash machines. Gas producers, in contrast, are being rewarded for their future optionality in export and power markets. As one Dallas Fed respondent put it: “We’ve gone from growth to maintenance in oil. Gas may finally be the growth engine again—but we’ll see if it lasts.”

Pipeline Takeaway: Permian vs. Appalachia

Permian Basin: Takeaway Tightness and Associated Gas Drag

While major upstream valuations in the Permian remain focused on oil scale and margin discipline, one under-appreciated headwind is natural gas takeaway capacity. The Permian’s associated gas volumes, driven by rising oil production in recent years, are placing increasing strain on pipeline and processing infrastructure. According to RBN Energy earlier this year, “the Permian is already out of natural-gas takeaway capacity” in places. In short, the Permian’s lack of gas-handling infrastructure remains a latent risk for upstream operations. Until new lines come online, regional basis weakness will continue to pressure realized gas prices and limit near-term flexibility for oil-weighted producers.

Appalachian Basin: Pipeline Approvals and Growing Optionality

Contrast that with the Appalachian Basin (Marcellus/Utica), where takeaway constraints have historically been a hinderance but now show signs of easing. The long-awaited Mountain Valley Pipeline entered service in mid-2024, adding about 2 Bcf/d of transport capacity from West Virginia toward the Mid-Atlantic and Southeast. Proposal activity for new or expanded pipelines has also resumed amid what S&P Global calls a “thawing regulatory environment.” That said, constraints do persist. Pipeline takeaway is basically nearly full until at least late 2027 but the trend is now positive. For gas-weighted producers, expanding takeaway means better realizations and tighter basis differentials, reinforcing higher valuation multiples. The infrastructure tailwind complements the LNG-linked demand growth narrative driving Appalachia’s recent equity outperformance.

Takeaway: Two Commodities, Two Investor Clocks

The U.S. upstream sector has entered a two-speed cycle. Permian producers are treated like bond proxies in that they are valued for stability and yield, not as much for growth. Appalachian gas names, by contrast, are treated like growth stocks and are more prized for strategic positioning and export leverage.

Whether that spread narrows in 2026 depends on which clock investors trust. If LNG projects come online as scheduled and AI-driven electricity demand grows as forecast, gas multiples could expand further. But if global gas trade slows down or interest rates stay elevated, those same valuations could contract quickly.

Until then, markets have drawn a clear line: Oil’s reward is low levered profits while gas’ reward is potential.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights