In our Energy Valuation Insights from recent weeks, Mercer Capital’s Sebastian Elzein addressed the challenges facing U.S. O&G drillers, and Bryce Erickson covered the uncertainty in the overall O&G sector due to shifting world trade patterns. This week, we address some of the same themes but focus on the Oilfield Services (OFS) industry. In particular, we cover changes related to the recent recovery in activity level, the influences of technological advances, the push for energy independence, and expectations going forward.

Potential Stall in Revenue Growth

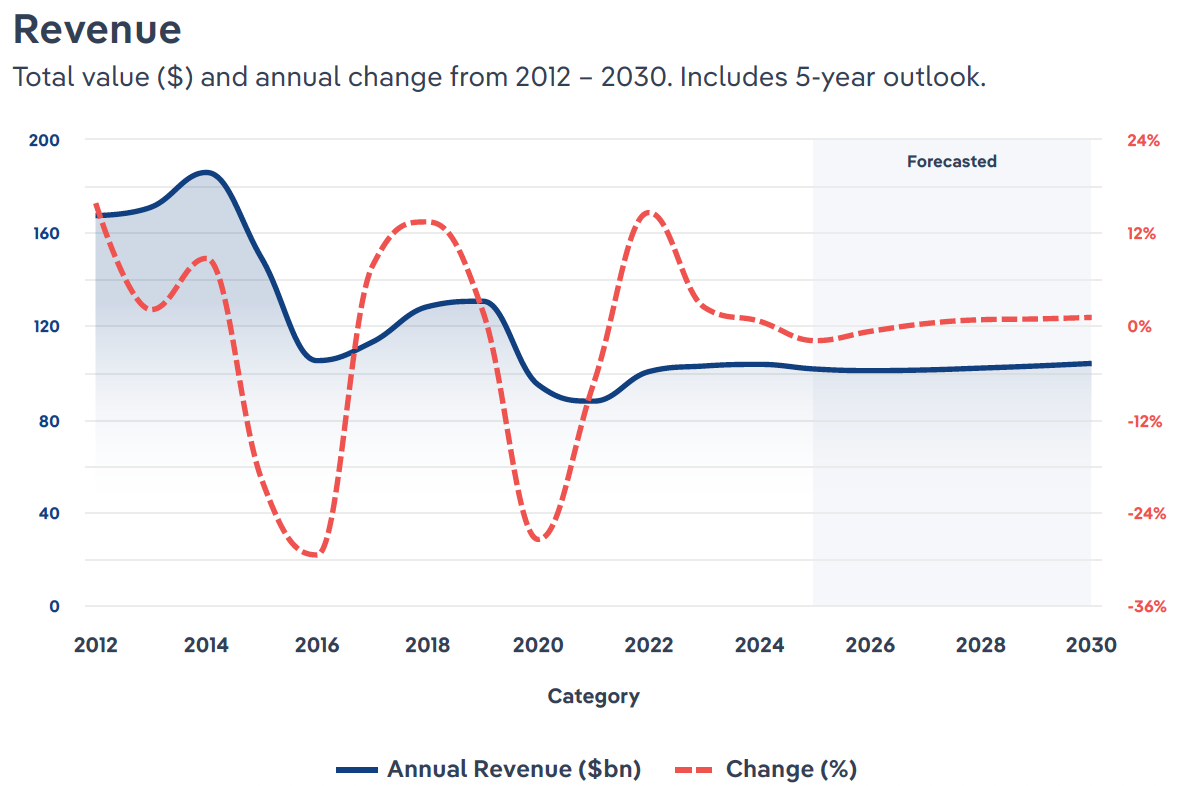

After 10 years of lagging behind the overall O&G industry growth, with revenues tumbling from a 2014 high of $186 billion to the 2021 low-point at $88 billion, the OFS industry posted three consecutive years of revenue expansion through 2024.

Source: IBIS World

Source: IBIS World

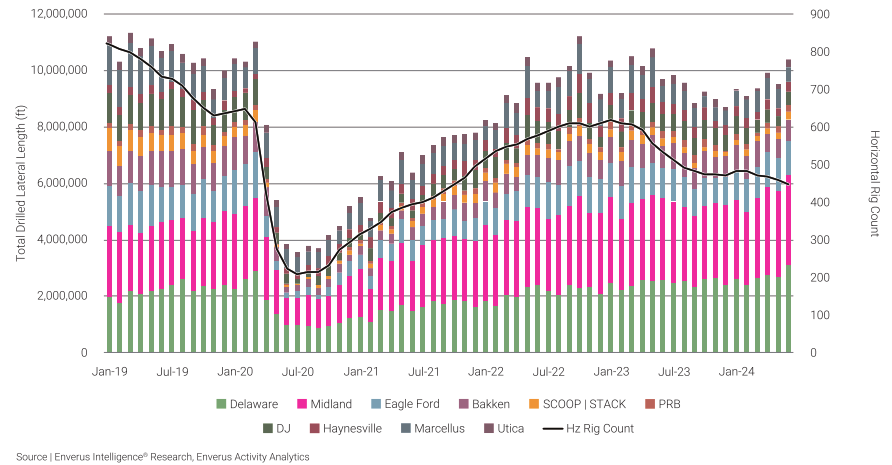

During the revenue decline period, the industry became a victim of its own technological advancements to some degree. In recent years, this has manifested in more efficient drilling and production, such that operators hit their production targets with 30% fewer rigs. Also contributing to the operational efficiencies was the consolidation of E&Ps. That effectively made a larger portion of OFS activity driven by larger operators capable of harnessing greater efficiency, such as longer laterals, batch drilling, and rig automation.

Drilling Efficiency: Increasing Total Lateral Footage Despite Rig Decline in 2024

Click here to expand the image above

While the last three years showed consistent OFS revenue increases, the growth rate consistently declined. After a COVID-related recovery with 14.6% revenue growth in 2022, the growth rate came in at a more sustainable level of 2.4% in 2023 and a modest 0.6% in 2024. Looking ahead to 2025, the outlook for the OFS industry is decidedly mixed, with residual inflation, capacity, and geopolitical factors all weighing in to create marked uncertainty. In light of those headwinds, OFS revenues are expected to dip by 0.6% in 2025 on an expected 2% decline in overall O&G capital budgets. The expected decline is far from consistent across OFS segments. For example, while shale/tight oil service segment revenues are expected to slide by 3.8%, offshore supply segment revenues are expected to increase by 1.8%.

Regarding the 2025 OFS outlook, TD Cowen analyst Marc Bianchi noted, “We’re again lowering our global OFS activity assumptions for 2025 and beyond as market data and industry commentary continues to erode,” Bianchi further stated that “with OPEC forced to hold oil off the market and a continued sluggish oil demand outlook, it’s difficult to build a case around any positive inflection.”

Similarly, Evercore ISI’s Stephen Richardson expressed similar sentiments, referring to OFS as a “low-expectations energy sub-sector” adjusting to weak capital expenditures. Richardson added that “oilfield services have been hit with the dual negatives of a low-growth North America with a rapidly consolidating customer base and capital restraint internationally...that has ended any semblance of a coordinated global upcycle for the industry.”

But, “Drill Baby Drill”?

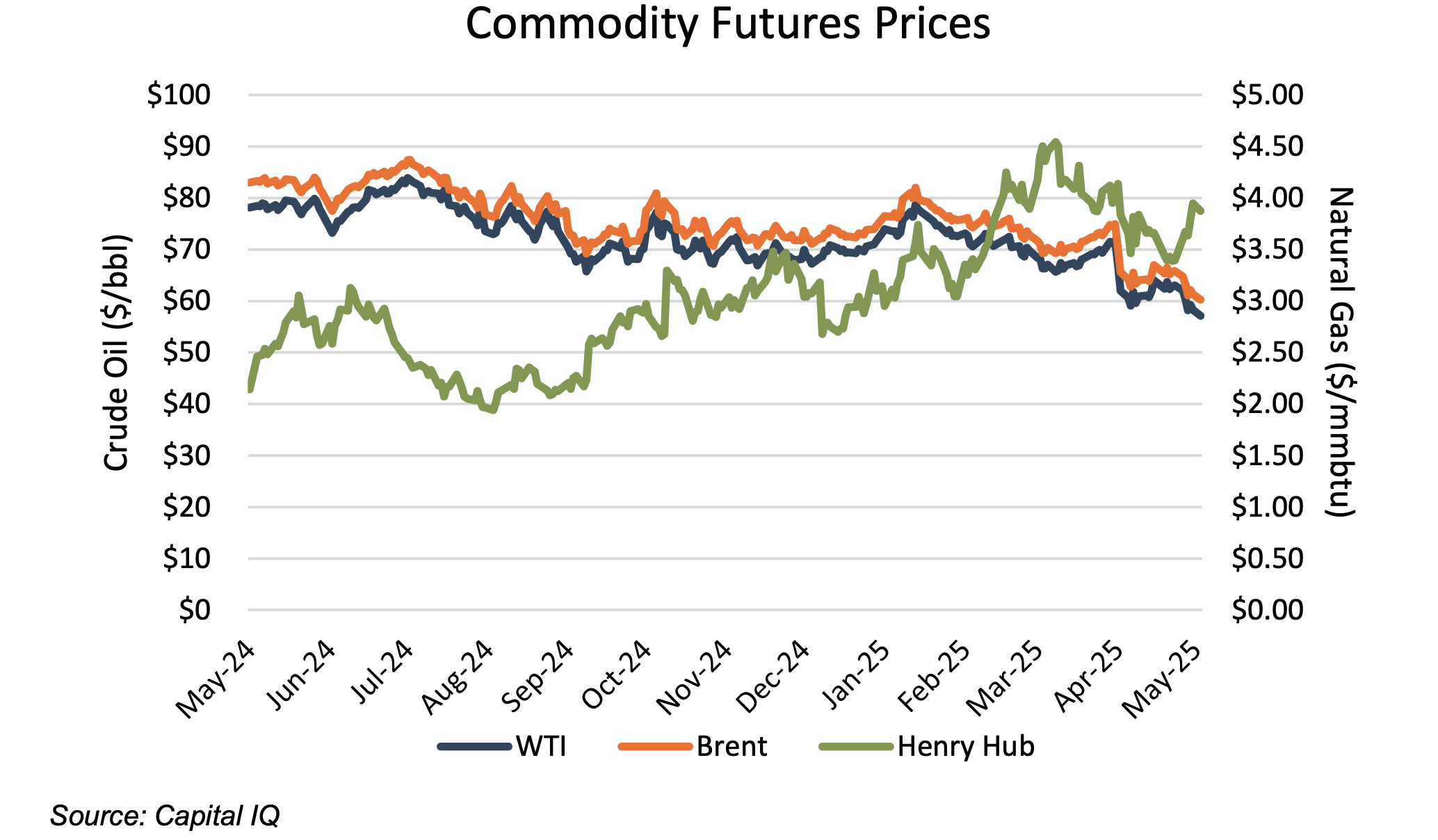

In the face of the expectations for OFS industry revenue shrinkage, industry observers might be prone to ask, what about President Trump’s campaign messaging of “drill baby drill”? President Trump promised energy priorities on the campaign trail, including pushing hard toward achieving U.S. energy independence and driving down energy costs. Since taking office, the President has moved rapidly to streamline permitting, expedite environmental approvals, and remove the Biden administration’s “pause” on new liquified natural gas export permits. All certainly logical moves in pursuit of the President’s stated goals. However, those actions involve the removal of production impediments. In the case of O&G production, incentive is directly tied to profits, and profits are directly tied to O&G commodity prices. While natural gas prices have moved in a favorable direction for greater production, that hasn’t been the case with oil prices, which have generally declined over the last year.

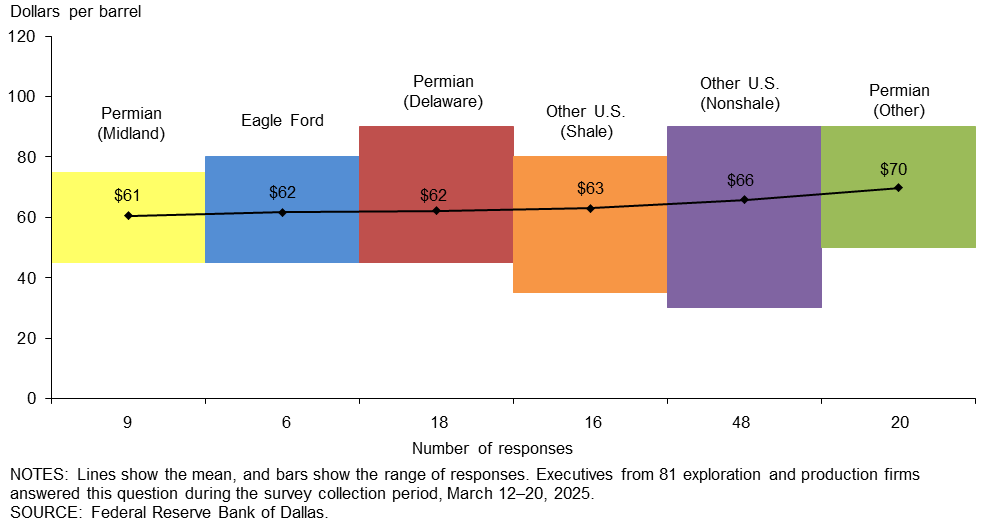

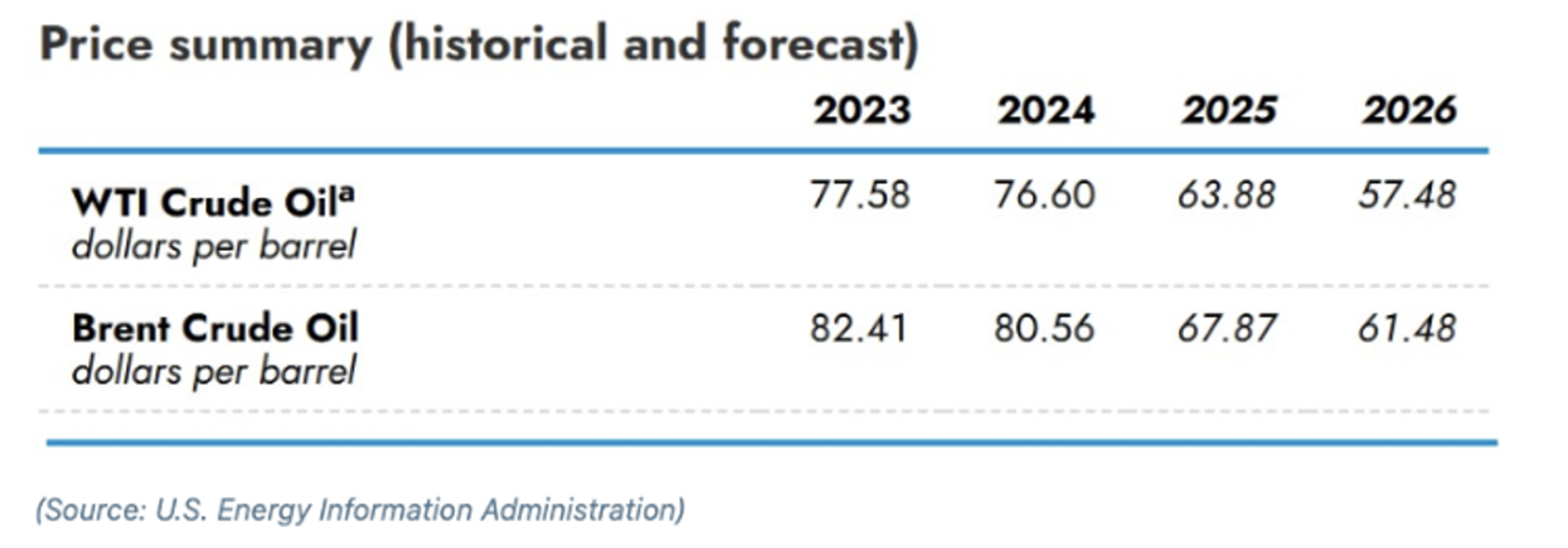

As noted by Bryce Erickson in our April 25, 2025 blog, Uncertainty Rules the Day, “breakeven costs for drilling new wells are climbing and are almost parallel with current crude prices today.” Furthermore, oil price expectations are pointing to WTI prices remaining below $65 this year and falling below $60 for much of 2026. So, while the Trump Administration has removed notable impediments to “drill baby drill,” the lack of economic incentive — profits and pricing — remains a headwind to production growth.

As noted by Bryce Erickson in our April 25, 2025 blog, Uncertainty Rules the Day, “breakeven costs for drilling new wells are climbing and are almost parallel with current crude prices today.” Furthermore, oil price expectations are pointing to WTI prices remaining below $65 this year and falling below $60 for much of 2026. So, while the Trump Administration has removed notable impediments to “drill baby drill,” the lack of economic incentive — profits and pricing — remains a headwind to production growth.

Conclusion

As always, it’s a complicated business for OFS participants. Supply/demand dynamics, geopolitical forces, technology advances, domestic political currents, and sustainable energy considerations create a potentially confusing web of headwinds, tailwinds, crosswinds, and downdrafts that result in significant uncertainties and complicated forecasting. The Trump administration intends to support the industry in pushing energy independence and driving down energy costs to buoy the national economy away from a recession. However, only time will tell if the aforementioned factors align well enough to allow those goals to be met in the near term or the not-quite-so-near term.

Mercer Capital has assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.