Permian Producer Stocks Pummeled

The economics of oil and gas production vary by region. Mercer Capital focuses on trends in the Permian, Eagle Ford, Haynesville, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, the depth of the reserve, and the cost of transporting the raw crude to market. We can observe different costs in different regions depending on these factors. In this post, we take a closer look at the Permian.

Production and Activity Levels

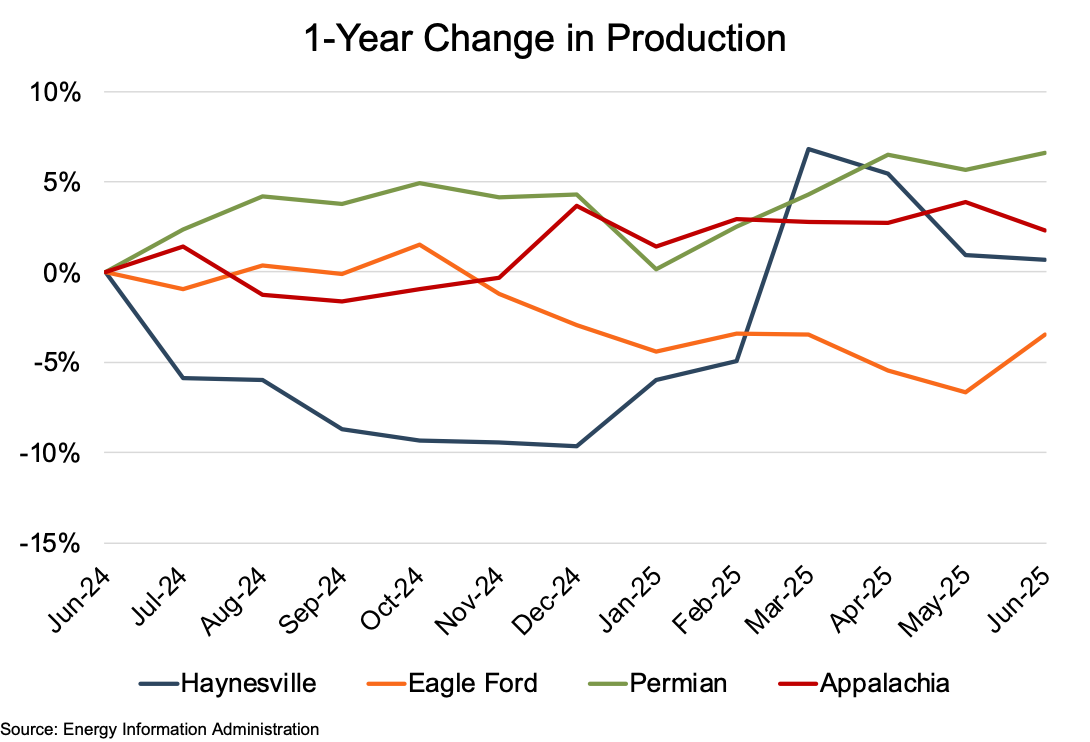

Permian production (on a barrels of oil equivalent, or “boe” basis) climbed 6.6% year-over-year (YoY) through June 2025. Production in the U.S.’s most prolific basin had climbed 4.3% from June 2024 to December 2024, with only two very modest monthly production downticks of 0.4% and 0.8%. However, Permian production dipped 4.1% in January as the West Texas area was hit by uncharacteristically cold temperatures that stifled production for several days mid-month. Production in the basin recovered over the following two months, and by June 2025 was 2.2% higher than the level immediately prior to the winter storm.

The gas-rich Appalachian and Haynesville basins posted the second and third place production increases over the latest year, with increases of 2.3% and 0.7%, respectively. The Eagle Ford posted the only YoY decrease among the four basins at 3.5%, including a long seven-month slide from November 2024 to May 2025 during which production growth was only reported during one month. Only a late review period 3.3% monthly production increase in June 2025 saved the basin from a YoY production decrease in excess of 6%.

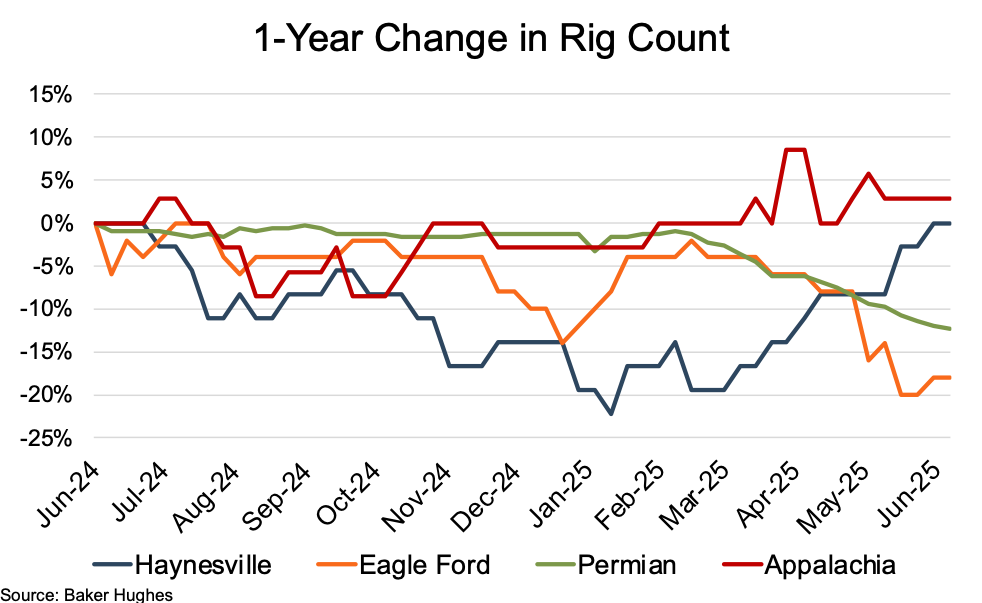

Rig counts for four basins showed YoY changes were demarcated by primary commodity. The oil-heavy Permian and Eagle Ford basins posted rig count declines of 12% and 18%, respectively. The gas-rich Appalachian and Haynesville basins fared better. After reaching a 22% decline through January, Appalachia posted a 3% increase while Haynesville showed a steady recovery beginning in late March to end the one-year period where it started for a YoY “no-change.”

The Permian began the YoY period at 308 rigs and only gradually declined through late January when it reached 298 active rigs. After a short recovery to 305 rigs in February, the Permian rig count shifted to a markedly accelerated decline, losing an average of 9 rigs per month through June to end the YoY period at 270.

Oilgasleads.com noted in early June that new well permit activity in the Permian was showing signs of a significant reduction, and that after several years of strong growth, there were early indications of operators taking a more cautious stance for the second half of 2025. In April, Reuters reported that Permian producers are grappling with increasing gas and water levels that are contributing to rising production costs and reduced production growth.

Commodity Prices

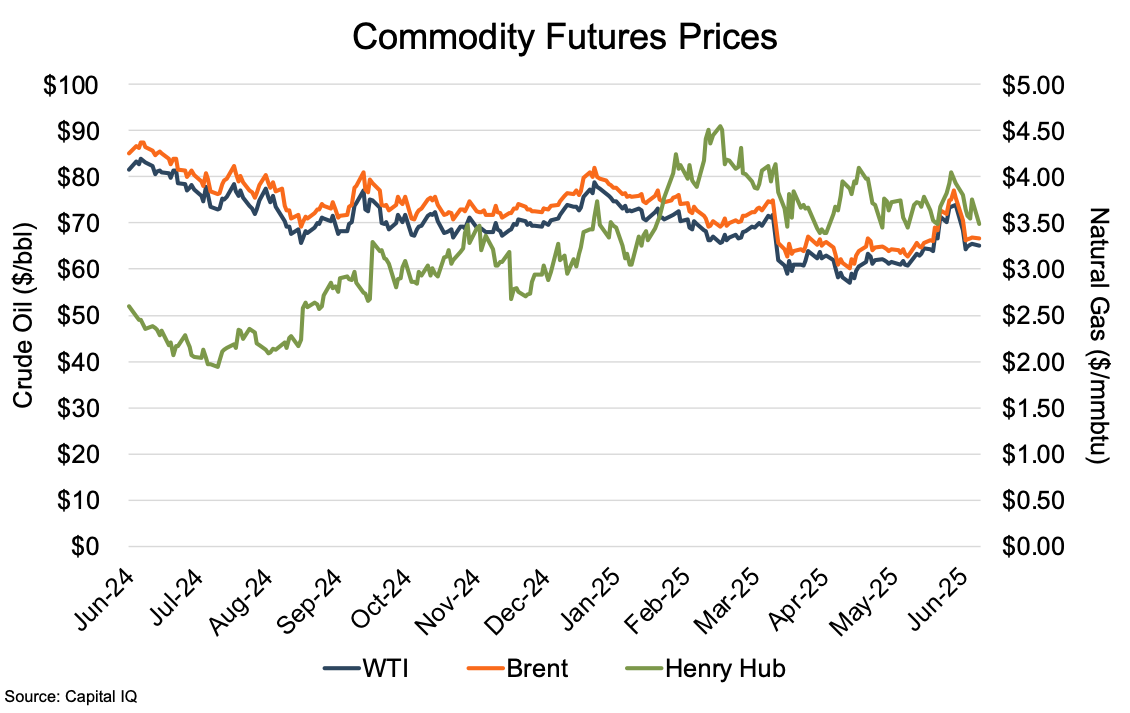

Oil prices, represented by the WTI and Brent benchmarks, generally declined over the first five months of the review period, except for a brief one-month rally from early September to early October. Through early December, WTI slid 20% from a review period high of $83.88 in July to $67.20. Over the same period, the Brent fell 18% from $87.43 to $71.12.

The five-month decline resulted largely from non-OPEC production growth and economic weakness, slowing oil consumption growth. The one-month rally resulted largely from Iran launching a barrage of missiles at Israel, albeit with limited impact, in retaliation for significant Iranian-backed militia losses from Israeli airstrikes in Gaza and Syria in Israel’s ongoing war with Hamas and Hezbollah.

Oil prices rallied back over the next month, reaching $79.10 (WTI) and $79.01 (Brent) on concerns over a potential reduction of Russian crude oil supplies when the United States imposed a new round of sanctions on Russia’s energy sector. The benchmarks took another downward slide over the next four months, reaching period lows of $57.13 and $60.23, respectively.

The price decline included a sharp 20% plunge from early April to early May — the largest monthly drop since 2021 — resulting from the combination of U.S./Chinese trade tensions and OPEC+ accelerating production plans despite weakening demand. The benchmarks generally rose over the last six weeks of the period to end at $65.11 and $66.74 for YoY declines of 20% and 22%.

Following a five-week slide from $2.60 mmbtu to $1.94 through early August, natural gas prices (represented by the Henry Hub benchmark) generally climbed over the next seven months through early March, reaching a review period high of $4.50. The late 2024 through early March run was attributable to multiple factors, including unexpected severe winter weather driving up demand, weather-related “freeze-offs” that stifled production, reduced wind speeds limiting wind-based energy production, and rising global LNG demand. The benchmark slipped downward again through late April as natural gas inventories recovered. Through the remainder of the review period, the benchmark varied between $3.45 and $4.10, with no discernible trend.

Financial Performance

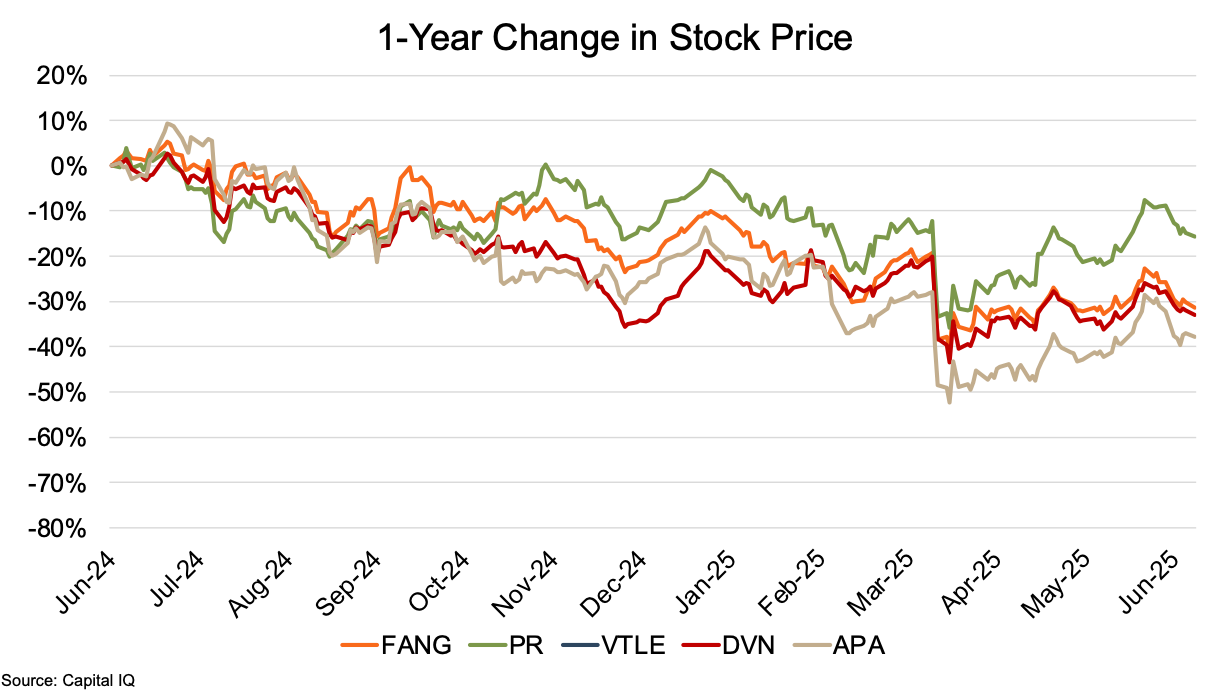

The Permian public company group showed marked stock price declines over the one-year period ending June 2025. Permian Resources (PR) posted the lowest YoY price decline at 16%, while Vitale (VTLE) posted the highest Yoy decline at 64%. The remainder of the group — Diamondback (FANG), Devon Energy (DVN), and APA Corp. (APA) — showed a narrow range of price reductions, from 31% to 38%.

While the first several weeks of the review period showed some upward movement, all but APA had edged into period losses by late July. Prices generally continued their downward path through mid-September, with a particularly sharp slide in early September in response to the aforementioned drop in the WTI benchmark price. Prices showed no distinct direction over the next five months through February, although volatility was high.

During those five months, both FANG and DVN managed to briefly return to their period-starting prices, and DVN came within 1% of reaching its period-starting price a second time. Of the remaining three comps (PR, VTLE, and APA), DVN was the only one to return to 90% of its period start price over the remainder of the review period.

The Permian benchmark group posted two additional dramatic stock price declines from mid-February to mid-March, and again during the first week of April. The more modest drop in February-March (10% to 19% declines, other than VTLE’s 35% plunge) resulted from an unexpected decision by OPEC+ to restart some of its previously halted production.

The more significant April plunge (28% to 38% among the Permian comp group) was tied to ongoing concerns over OPEC+ production, in addition to the Trump administration’s imposition of tariffs on steel. The steel tariffs threatened not only immediate increases in steel costs but also supply bottlenecks, as domestic suppliers were unable to rapidly scale production to meet increased demand, resulting in delayed drilling projects. While comp group prices rose 15% to 30% over the remainder of the review period, only PR ended the period with a stock price loss of less than 30%.

Conclusion

The Permian basin continues to serve as the centerpiece of the U.S. shale revolution. However, Oklahoma Minerals noted in May that with two-thirds of the Midland’s prime acreage and over half of the Delaware’s having been developed, the basin is facing challenges in the near future. Rising water and associated gas content are contributing to increased production costs, leading to more cautious drilling plans for basin operators.

Despite a late-period decline in rig counts, Permian production continued upward over the latest year. However, geopolitical forces and international trade matters pushed oil prices lower, resulting in the Permian producer stock prices being battered since June 2024, particularly in the first quarter and early second quarter of 2025.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights