As Deal Momentum Slows, What’s Next for Wealth Management Consolidation?

As market conditions began to deteriorate early last year, we (along with many others) predicted a coming slowdown in RIA M&A activity. At the time, we’d just seen a record year for deal activity in 2021, but several significant challenges for M&A were emerging:

- The worst year for the 60/40 portfolio in recent history was well underway. By the end of the first quarter, VBIAX (a rough proxy for a 60/40 portfolio) was down 6.3% from year-end. By the end of the second quarter, the index was down 18.1%.

- Inflationary pressures, which first emerged in 2021, continued into 2022. The year-over-year increase in CPI exceeded 7.0% each month from December 2021 through November 2022, putting pressure on the cost structure for RIAs as vendors raced to hike prices in order to keep up with their own higher cost of doing business (Hot Inflation and Cold Markets: RIAs Hit With a New Storm Front – Mercer Capital).

- A historically tight labor market amplified the effect of inflationary pressures on the largest expense for RIAs—compensation.

- Borrowing costs for leveraged consolidators began to rise rapidly (Rising Interest Rates Will Likely Affect More Than Just RIA Stock Prices), driving up the cost of capital at the same time that the performance of the underlying firms was declining.

Despite this environment, we were initially proven wrong: RIA M&A activity seemingly defied gravity as the pace of deal activity continued to keep pace with record 2021 levels throughout the summer. As we watched this occur, we were reminded that M&A activity is often a lagging indicator of economic conditions. Closing a deal can often take many months, and it can take time for buyers and sellers to adjust to new realities.

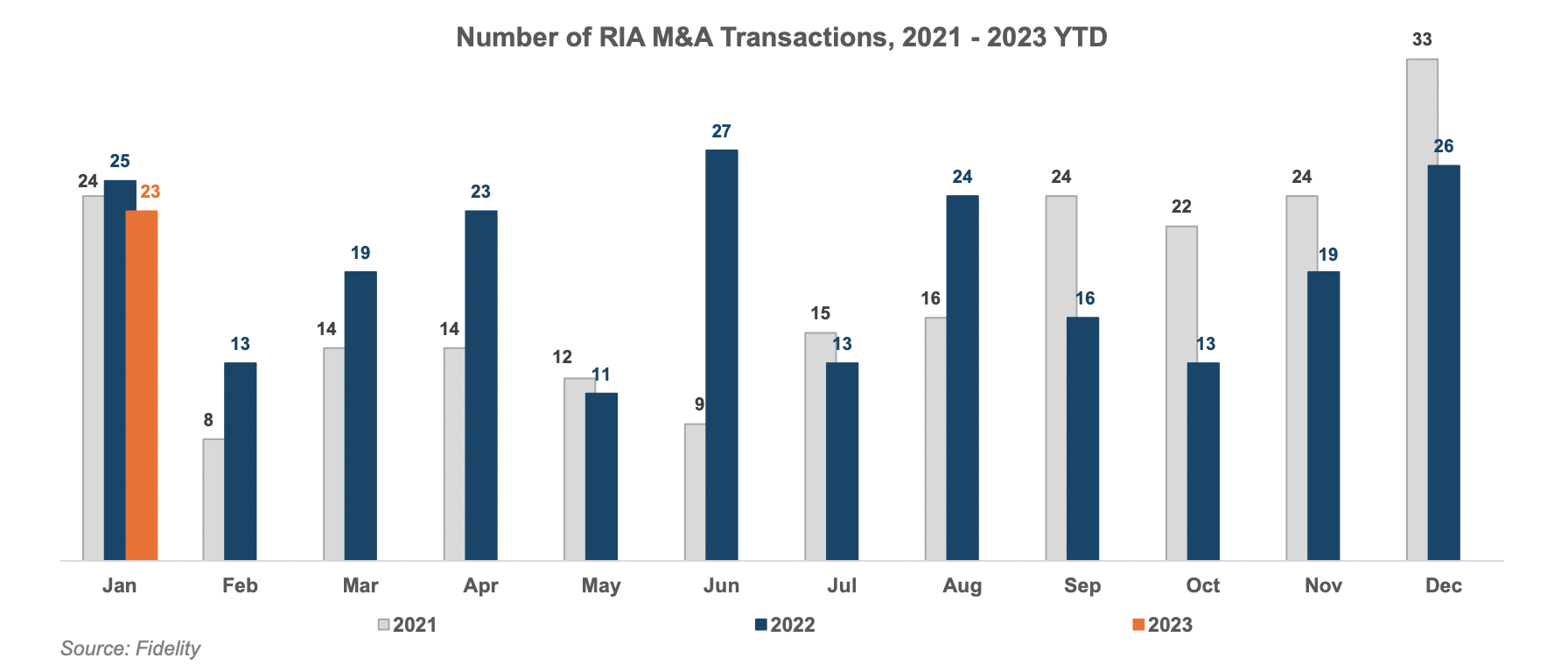

Now, the data suggests that deal activity is beginning to lose momentum. While 2022 narrowly broke 2021 records in terms of deal count (229 deals in 2022 vs. 215 in 2021, according to Fidelity data), the outperformance was concentrated in the first half of the year. According to Fidelity’s monthly wealth management M&A report, the number of reported deals has consistently fallen short of the prior year’s comparable since September. There were 23 reported deals in January of this year—roughly in line with the 25 deals reported in January 2022—but the aggregate AUM transacted fell by 36% year-over-year—a steeper decline than we’d expect from market movement alone.

So, is the slowdown here to stay? What does this mean for the future of deal activity? Here are a few predictions for the year ahead:

- We wouldn’t be surprised to see M&A cool down in 2023, but only relative to the tough comps set in 2021 and 2022. While market conditions are challenging and sentiment about M&A activity is beginning to shift, recent years have seen the development of significant consolidation infrastructure in the form of various acquirer models, dedicated deal teams, and outside capital, which we expect will result in deal activity remaining elevated relative to longer-term historical levels.

- Deal terms will evolve to adjust to new market realities. In market downturns, buyers tend to anchor on past performance, while sellers look to the future. We expect to see more deal consideration pushed into earnouts to bridge widening expectation gaps between buyers and sellers.

- While internal succession doesn’t generate the same headlines as consolidation, we expect it will remain a preferred way for owners to exit, particularly if pricing and terms in external transactions become less favorable to sellers. Internal succession allows owners to hand-pick successors and avoid dealing with a new party. But, for one reason or another, many firms struggle to develop and implement an internal succession plan. A lack of an internal succession plan will continue to bring sellers to market and support deal activity.

- Minority transactions will increase. With valuations down and competition for deals easing, we expect more sellers will pursue minority transactions, either as a stop-gap measure to take money off the table now while retaining upside if market conditions improve or as an adjunct to an internal succession plan.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and related services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights