Rising Interest Rates Will Likely Affect More Than Just RIA Stock Prices

Higher RIA Aggregator Bond Yields Could Portend Lower M&A and Transaction Multiples in 2023

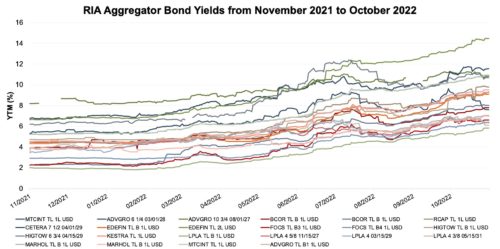

We haven’t blogged about the bond yields of RIA aggregator firms in the past because there hasn’t been much to report. Before this year, yields didn’t move much and generally stayed between 2% and 8%, depending on the term and credit quality of the issuer. That all changed last November when the Federal Reserve and other central banks began raising interest rates to fight mounting inflationary pressures in the global economy. Now RIA aggregator bond yields are in the 6% to 14% range after fairly steady gains throughout this year.

Click here to expand the image above.

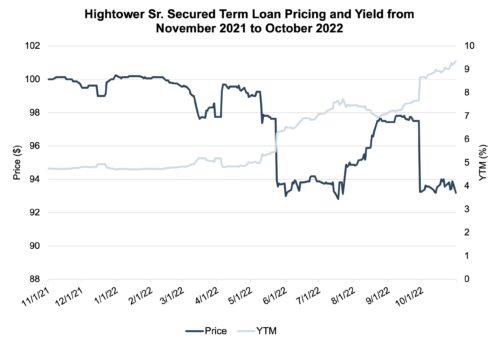

Corresponding bond prices have fallen over this time, and we use a recent Hightower issuance to demonstrate the inverse relationship between bond yields and prices.

Rising interest rates have also affected equity prices, particularly in the RIA sector, which has doubled the market’s loss over the last year.

The driving forces behind the sharp decline in RIA stocks are relatively straightforward. Stock prices are strictly a function of earnings and a multiple (E x P/E = P). Earnings are lower because revenue and AUM have declined in the capital markets, with inflationary pressures driving costs up and margins down. Rising interest rates have pushed up the costs of debt and equity capital resulting in higher discount rates and lower multiples. The cumulative effect of these forces is a ~50% decline in RIA aggregator and investment manager stock pricing since last November.

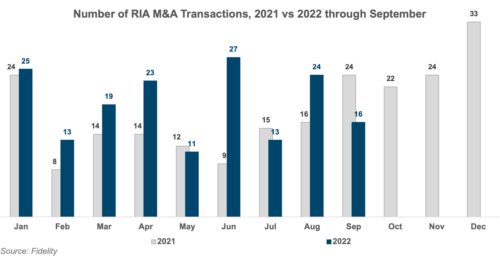

We haven’t seen these pressures play out in the M&A market for investment management firms.

That could change in the coming quarters as M&A activity is often a lagging economic indicator, as deals can take months or even years to close after their announcement. The adverse effects of rising interest rates, higher inflation, and lower earnings also impact closely held RIAs, so they’re also vulnerable to reduced valuations and transaction multiples as prospective buyers anticipate lower cash flows on a diminished AUM base.

Deal volume could also suffer in 2023 as much of it is driven by RIA aggregators, who are reeling from higher financing costs and lower valuations. CI Financials CEO Kurt McAlpine noted that their pace of acquisitions has “absolutely slowed down” in a recent earnings call. The combination of rising debt costs and lower expected returns in the RIA space could cause the other aggregator firms to follow suit, which would likely curtail deal-making in the sector until markets recover. The M&A market for RIA firms tends to be resilient, so we’ll continue following these trends and report back.

RIA Valuation Insights

RIA Valuation Insights