Can Active Management Survive a Bear Market?

Bloomberg recently wrote about the plight of active management, and this is nothing new. What may be different this time is the impact that a bear market could have on a sector already reeling from asset outflows, fee pressure, and increasing competition from passive products. According to Boston Consulting Group, about 90% of additional revenue taken in by money managers since 2006 is simply from rising markets and not new client assets. A bear market would compound these other headwinds, and it’s conceivable that some active managers might not survive it.

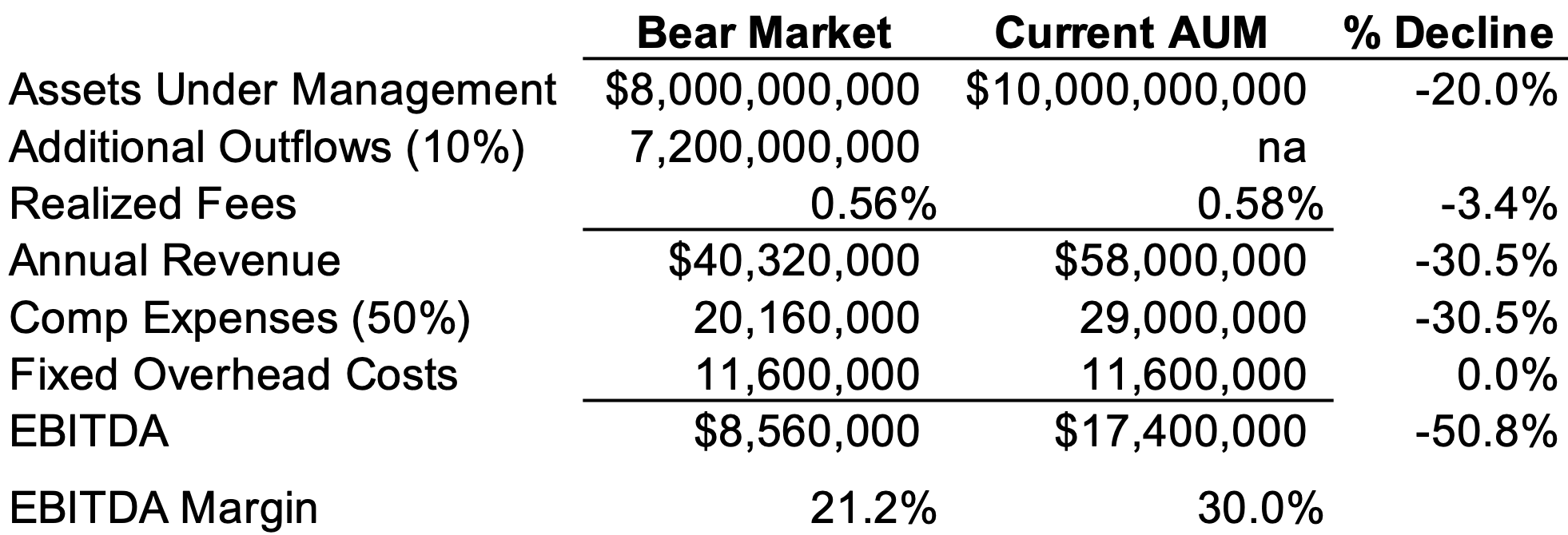

Many studies have shown that most active managers underperform their applicable benchmark in the long run. This has led some investors to question the value proposition of these businesses (alpha in excess of fees charged), particularly as low-cost, passively managed products have become increasingly popular. Passive products now account for half of all assets in US mutual funds and ETFs, up from 27% a decade ago. If you layer in a bear market on top of continued fee pressure and asset outflows, it’s easy to envision how earnings can get crushed:

Firms with lower margins will fare even worse, so this could be a situation where only the strong survive. Firms with more resilient margins and/or investment performance should endure, but many will not. When the dust settles, less competition will likely benefit the remaining firms, but it will take some time (and favorable market conditions) to replenish lost revenue.

The Story for Active Managers

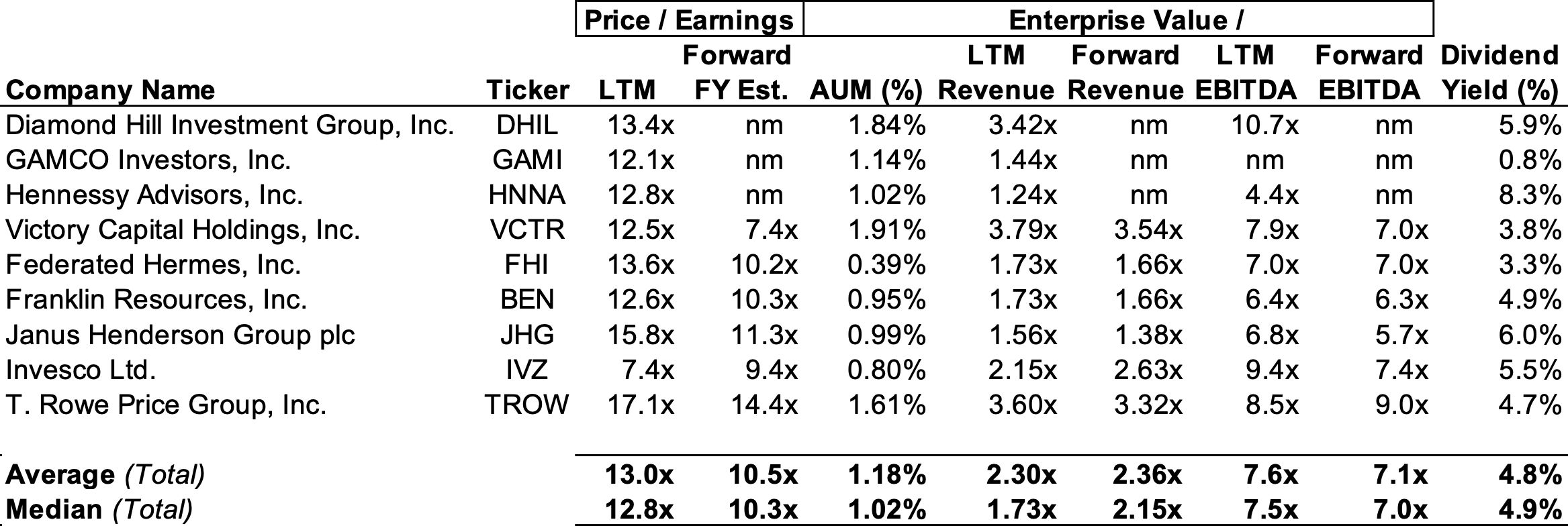

Don’t interpret this as our being particularly bearish on active management. Almost every asset management firm, public or private, is more valuable today than in 2008. The explanation for that is simple: rising markets lead to higher AUM, management fees, and earnings, so many of these businesses are worth 2-3x what they were fifteen years ago as profitability has more than doubled over this time. As appraisers, we’re more concerned with the multiple (i.e., valuation) applied to these earnings since that’s what we take from the market and relate to our client company’s performance to derive value. Here’s how the market priced some of these businesses at the end of last quarter:

Click here to expand the image above

Notwithstanding the run-up in their market caps since the 2008-09 financial crisis, earnings multiples for asset management firms have mostly contracted, particularly recently. There are a number of rational explanations for this — fee compression, flight to passive strategies, ETF competition, fund outflows, maturing industry, etc. This seems contradictory for a business with a strong recurring revenue model and relatively high margin potential through continued gains in AUM, but the risk of continued outflows remains high.

Still, it’s hard to imagine a scenario where active management completely goes away. If all marketable securities are passively managed, no one is paying attention to their values, and significant mispricing would occur. This would undoubtedly attract active managers to take advantage of such mispricing to collect fees for delivering alpha to their clients. We may instead be facing a situation where active managers have to continue cutting fees and managing costs to stave off continued outflows.

The Outlook for Active Managers

Moving forward, we expect some active managers to improve their competitive positioning but aren’t ignoring what the market is telling us about the outlook for these businesses – it’s probably going to get worse before it gets better. Solid performance can buck this trend for any asset manager, but consistently delivering alpha is a tall order. Since most firms underperform the market after fees, perhaps it’s not surprising that the sector has struggled so much recently. Still, this has almost always been the case, so the industry’s current woes are more likely attributable to fee compression (or fear of fee compression) and surging demand for passive products. A bear market could help (relative) performance as many asset managers outperform during times of financial stress, but that would also strain revenue and profit margins. Attractive valuations could spur deal-making and consolidation, which could alleviate some of these pressures. We’ve seen some of this, but suspect more is on the way. Either way, we’ll continue to monitor these pricing trends and let you know how this all shakes out.

RIA Valuation Insights

RIA Valuation Insights