Common Valuation Misconceptions About Your RIA

Old Rules of Thumb, Recent Headlines, and the Endowment Effect

Photo Credit: Zillow Gone Wild (https://www.instagram.com/zillowgonewild)

As a financial analyst, a CFA charter holder, and a generally reasonable person, I know that Zillow isn’t accurate; but as a homeowner, I can’t help myself. When I am walking around my neighborhood, I always have the Zillow App open, and am speculating about how the “Z-estimate” for my house compares to my neighbors’. And, of course, my house always is better. Why? Because I own it. It’s called the endowment effect. I (as a homeowner) am emotionally biased to believe that something (my house) is valued higher than the market would ascribe, simply because I already own it.

And you, the owner of an RIA, may believe your firm is valued higher than the market value too, and old rules of thumb and recent industry headlines amplify the problem.

Old Rules of Thumb: Your RIA is Worth 2% of AUM

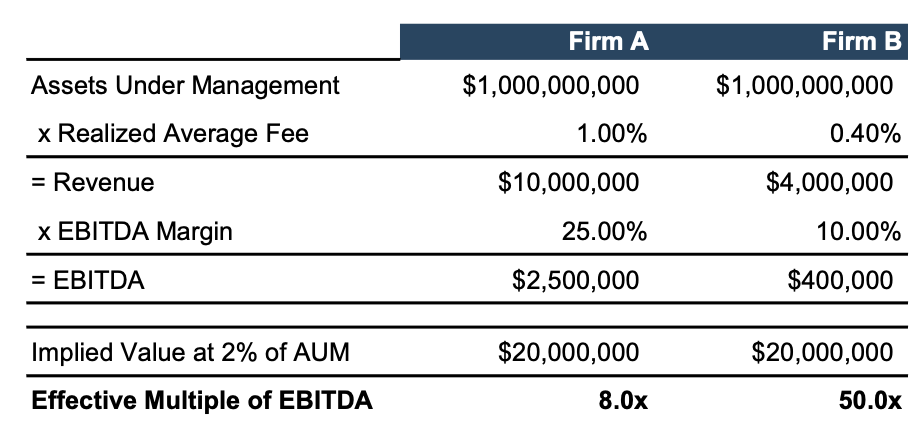

We have cautioned the use of AUM and Revenue-based multiples before, and an example has proven to be the best way to communicate the unreliability of such metrics. Consider, Firm A and Firm B, which both have the same AUM. Firm A has a higher realized fee than Firm B (100 bps vs 40 bps) and also operates more efficiently (25% EBITDA margin vs 10% EBITDA margin). The result is that Firm A generates $2.5 million in EBITDA versus Firm B’s $400 thousand despite both firms having the same AUM.

The “2% of AUM” rule of thumb implies an EBITDA multiple of 8.0x for Firm A—a multiple that may or may not be reasonable for Firm A given current market conditions and Firm A’s risk and growth profile, but which is nevertheless within the historical range of what might be considered reasonable. The same “2% of AUM” rule of thumb applied to Firm B implies an EBITDA multiple of 50.0x—a multiple which is unlikely to be considered reasonable in any market conditions.

Recent Headlines: Your RIA is Worth 10x EBITDA

Deal activity in the investment management space has been increasing over the last decade as consolidation has increased and outside investors realized the attractiveness of a recurring revenue stream paired with minimal capital investment. But the headlines touting impressive deal multiples really seemed to pick-up in 2019 with Goldman’s acquisition of United Capital. However, most of the acquisitions that warrant headlines are of larger investment managers, which due to their sheer scale, are less risky and therefore warrant a higher multiple.

Mixing old rules of thumb, with recent headlines, and the endowment effect typically results in over valuing, which stems from an underestimation of non-systematic risk.

Underestimating Non-Systematic Risk

Most investment managers understand that their firm, like any publicly traded company in their clients’ portfolios, is exposed to systematic and non-systematic risks. And most seem to understand that investment management firms are subject to certain industry-wide risks such as the move from passive to active investment products and fee compression. But many investment management firms also have significant “firm-specific risks” that make their firm riskier than a much larger investment management firm. Many small to mid-sized investment management firms suffer from client concentrations, aging client bases, unclear succession plans, a lack of scale, and minimal asset growth (absent market appreciation).

Unfortunately, understanding the value of your RIA is not as easy as applying a multiple to your AUM or run-rate EBITDA. Value is a factor of cash flow, growth, and risk. We’ve written a lot about investment management firm valuations:

- RIA Margins – How Does Your Firm’s Margin Affect Its Value?

- What Are RIA Valuations Today

- Valuing RIAs

But, don’t hesitate to give us a call if we can be of assistance.

RIA Valuation Insights

RIA Valuation Insights