Your RIA May Qualify for the QBI Deduction, But Don’t Get Your Hopes Up

The Tax Cuts and Jobs Act (TCJA) introduces the Qualified Business Income (QBI) deduction as a partial offset to the bill’s reduction in the relative tax efficiency of pass-through entities (S corporations, limited liability companies, and partnerships) versus C corporations. Still, many RIAs will not be eligible for the deduction, and those that do will have a lot to keep in mind as it pertains to reasonable compensation levels and investment income. We’ll try to sort it all out for you in this week’s post.

On balance, the TCJA has been very bullish for the RIA industry. A significant reduction in C corporation tax rates has helped precipitate a steady rise in the stock market over the last several months, so AUM balances are on the rise. Operating leverage in the business model compounds this effect, expanding margins as earnings growth outpaces gains in AUM and fee income. RIA market caps have responded accordingly:

However, not all aspects of the bill are favorable to the industry. The relative tax efficiency of the pass-through structure has been reduced by the bill as personal tax rates have not declined nearly as much as rates for C corporations, and most RIAs are LLCs or S corps (therefore, taxed only at the shareholder/personal level). For RIAs with low dividend payouts (which is somewhat rare in our experience), it may actually make more economic sense to be structured as a C corp in the wake of the tax bill. At least one alt manager has already done so already.

RIA’s Exclusion

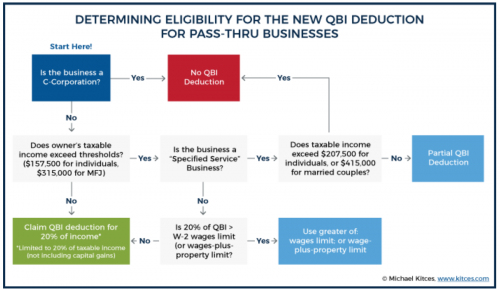

To compensate for the narrowing S corp tax advantage, the TCJA introduced the Qualified Business Income (QBI) deduction that allows certain S shareholders to deduct 20% of their pass-through income. Oddly enough, the QBI deduction is not available to RIAs (above a certain income limit, discussed later). Congress decided to exclude certain “specified service trade or business,” defined as “any trade business which involves the performance of services that consist of investing and investment management, trading, or dealing in securities.”

It’s not abundantly clear to us why the investment management exclusion (and the limitation on the deductibility of financial planning fees) was specifically included in the bill. Perhaps this exclusion was an offset for carried interest miraculously avoiding a tax hike from the TCJA. Maybe Congress didn’t feel any sympathy for an industry that has performed so well since the Financial Crisis and enjoys relatively high levels of compensation. Whatever the reason, it’s in there, but like many features of the TCJA, it includes a loophole.

QBI Eligibility

Despite the exclusion, the QBI deduction remains available to RIA shareholders for whom total income is less than $315,000 for married couples or $157,500 for individuals and is partially available for married couples and individuals up to $415,000 and $207,500, respectively. Industry consultant Michael Kitces helps us keep this all straight:

If you’re the owner of an investment management firm and make over $207,500 as an individual or $415,000 if you’re married, the QBI deduction is not for you. While a good problem to have, it means many RIA owners will not be eligible for the deduction. If you find yourself in this category and do not distribute a high percentage of your earnings (that would still be subject to double taxation for C corporations), you might want to consider a C election. Otherwise, the S or LLC status probably makes the most economic sense even with the relative reduction in tax efficiency.

Nuances to Consider

Even if you’re at or below the income threshold, there are still a few nuances you need to consider in determining eligibility. One potential hurdle is the prohibition of “reasonable compensation” being classified as QBI, so certain RIA owners will now be incentivized to pay (or at least determine) a market rate for his or her salary and bonuses. We know firsthand that this is easier said than done and could require consultation with an industry advisor (like ourselves) or compensation expert to make such a determination. It’s also important to keep in mind that the income must also be domestic and not attributable to securities investments to qualify as QBI (even though REIT income not attributable to capital gains or qualified dividends is allowable).

Regardless of eligibility, the QBI and its random countenances are not likely to be a game changer for your RIA. It is, however, worth understanding these features if you can take advantage of (one of the few) benefits from the TCJA on pass-through entities like S Corps and LLCs. Otherwise, you can take comfort in not having to keep track of all this.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights