Q2 2019 RIA Market Update

Asset Management Stocks Find Some Relief After Year-End Rout

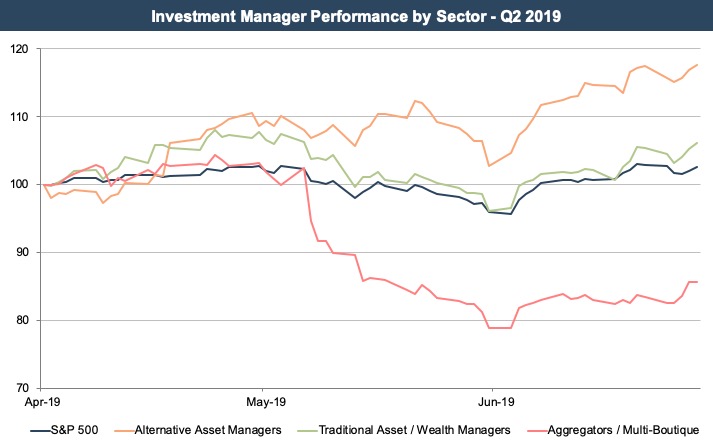

Broad market indices generally increased over the last quarter, and publicly traded asset and wealth manager stocks followed suit.

Publicly traded traditional asset and wealth managers ended the quarter up 6.2%, beating out the S&P 500, which rose 2.6%. Alt managers were the bright spot in the sector, up nearly 18%. Aggregators and multi-boutique model firms did not fare well, despite all the hype about consolidation pressures in the industry and the high-profile deals in the aggregator space. These businesses ended the quarter down more than 14%.

Ordinarily, we’d expect investment manager stocks to outperform the S&P in a stock market rally, for the simple reason that higher AUM leads to higher revenue and an even greater increase in profitability with the help of operating leverage.

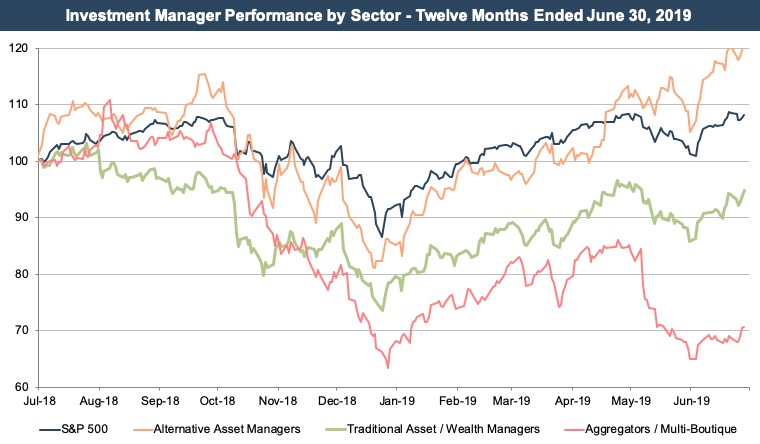

This was the case during the second quarter when multiples continued to recover from December lows, and profitability remained steady to improving. As a result, asset and wealth management stocks saw positive performance relative to the S&P 500 during the second quarter, as shown in the chart above. Expand the chart over the last year, however, and the story for traditional asset and wealth managers looks less upbeat.

Over the last year, traditional asset and wealth managers have trailed the market significantly. While the S&P 500 is up 8% over the last year, asset and wealth manager stocks are down 5%.

While the S&P 500 is up 8% over the last year, asset and wealth manager stocks are down 5%.

The asset and wealth management industry is facing numerous headwinds, chief among them being ongoing pressure for lower fees. Traditional asset and wealth managers feel this pressure acutely, which has likely contributed to their relative underperformance over the last year. Alt managers, which have been the sector’s sole bright spot during this time, are more insulated from fee pressure due to the lack of passive alternatives to drive fees down.

The aggregator and multi-boutique index has declined over 30% during the last twelve months. Several firms in this category have contributed to this decline, but the largest driver has been Focus Financial’s major pullback from its lofty IPO price.

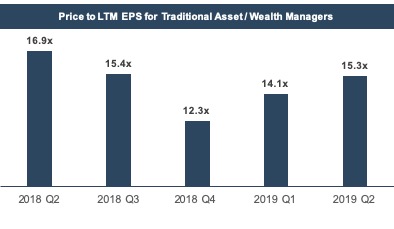

The performance of asset and wealth management stocks over the quarter was supported by an improving price to earnings multiple. Multiples for publicly traded asset managers fell considerably near the end of 2018 as the broader equity markets pulled back. While there has been some rebound so far in 2019, multiples remain below the typical historical range.

Implications for Your RIA

The multiple expansion in the public markets combined with the expectation for stable-to-improving earnings, given the movement in broad market indices, suggests an improving outlook for privately held RIAs. If the public markets have relaxed a bit in pricing the industry headwinds, resulting in a higher multiple, then it is reasonable to assume that the same trend will have some impact on the pricing of privately held RIAs as well.

But the public markets are just one reference point that informs the valuation of privately held RIAs, and developments in the public markets may not directly translate to privately held RIAs. Depending on the growth and risk prospects of a particular closely held RIA relative to publicly traded asset and wealth managers, the privately held RIA can warrant a much higher, or much lower, multiple.

These factors all contribute to the less-than-perfect comparability between publicly traded companies and most privately held RIAs.

In our experience, the issues of comparability between small, privately held businesses and publicly traded companies are frequently driven by key person risk/lack of management depth, smaller scale, and less product and client diversification. These factors all contribute to the less-than-perfect comparability between publicly traded companies and most privately held RIAs. Still, publicly traded companies provide a useful indication of investor sentiment for the asset class, and thus, should be given at least some consideration.

Improving Outlook

The outlook for RIAs depends on a number of factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. The one commonality, though, is that RIAs are all impacted by the market. Their product is, after all, the market.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations.

On balance, the outlook for RIAs appears to have improved since the end of 2018. The market has recovered following the Q4 correction, and multiples have trended upwards, although they remain below historical norms.

More attractive valuations could entice more M&A, coming off the heels of a record year in asset manager deal making. We’ll keep an eye on all of it during what will likely be a very interesting year for RIA valuations.

RIA Valuation Insights

RIA Valuation Insights