RIAs Rally After Worst Quarter in Eleven Years

The Industry Is Now in a Bull Market Following March’s Sell-Off

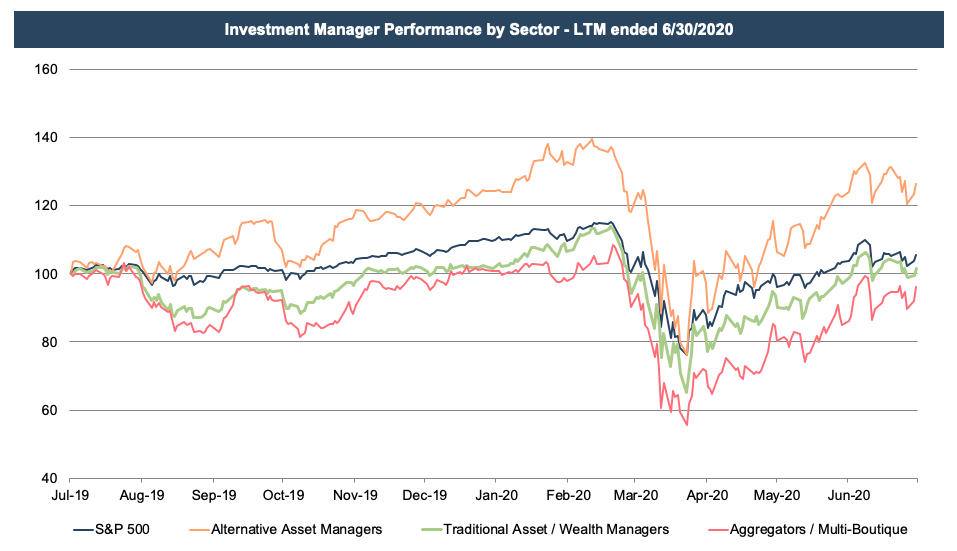

It probably doesn’t feel like it, but most RIA stocks are up over the last year. Over this time, we’ve had two bull markets and one bear market in one of the most volatile twelve-month periods that I can remember. This volatility has been especially beneficial to alternative asset managers since hedge funds are usually well-positioned to take advantage of variability in security prices. The aggregators are the only segment of RIAs that are down over the last year since their models rely on debt financing, which exacerbated their losses during March’s sell-off.

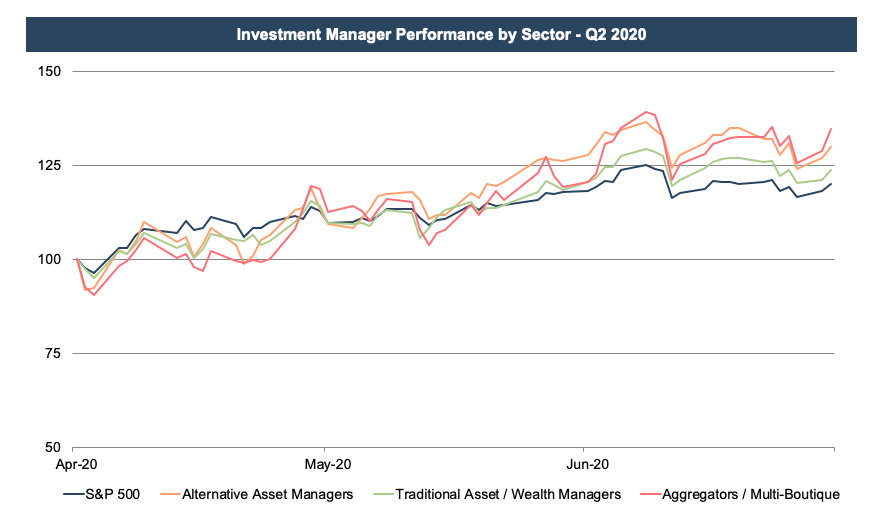

Last quarter showed the positive side to leverage as aggregators bested all other classes of RIAs during generally favorable market conditions in April and May. Other investment managers also fared well since collective AUM and ongoing revenue recovered with the market over the quarter. The primary driver behind the increase was the increase in the market itself, as most of these businesses are primarily invested in equities, and the S&P gained about 20% over the quarter.

The recent uptick is promising, but it should be evaluated in the proper context. Pre-COVID, the industry was already facing numerous headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. The 11-year bull market run masked these issues (at least ostensibly) as AUM balances largely rose with equities over this time. Finally faced with a market headwind, the bull market for the RIA industry came to a grinding halt in March before rallying again in April and May.

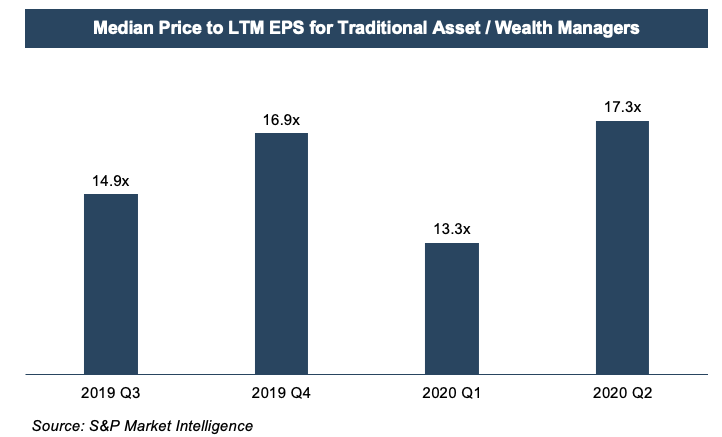

As valuation analysts, we’re typically more concerned with how earnings multiples have changed over this time since we often apply these cap factors to our subject company’s profitability metrics (after any necessary adjustments) to derive an indicated value. These multiples show a similar rise in Q2 after a sharp decline in the first quarter.

There are a number of explanations for this variation. Earnings multiples are primarily a function of risk and growth, and risk has waned since March’s run-up and growth prospects have recovered. Specifically, future earnings are likely to increase with the recent rally, so the multiple has picked up as well since March’s bottom. Conversely, the decline in Q1 reflected the market’s anticipation of lower earnings with falling AUM and management fees. The multiple usually follows ongoing revenue, which is simply a funtion of current AUM and effective fee percentages, as discussed in a recent post.

Implications for Your RIA

During such volatile market conditions, the value of your RIA largely depends on the valuation date or date of measurement. In all likelihood, the value declined with the market in the first quarter before recovering most of that loss in the second. We’ve been doing a lot of valuation updates amidst this volatility, and there are several factors we observe in determining an appropriate amount of appreciation or impairment.

One is the overall market for RIA stocks, which was down 20% in the first quarter (see chart above) before gaining just as much in the second to end up back in the same spot as year-end. The P/E multiple is another reference point, which has followed a similar path. We apply this multiple to a subject RIA’s earnings, so we also have to assess how much that company’s annual AUM, revenue, and cash flow have increased or diminished since the last appraisal, while being careful not to count good or bad news twice.

We also evaluate how our subject company is performing relative to the industry as a whole. Fixed income managers, for instance, held up reasonably well compared to their equity counterparts in the first quarter. We also look at how much of a subject company’s change in AUM is due to market conditions versus new business development net of lost accounts. Investment performance and the pipeline for new customers are also key differentiators that we keep a close eye on.

Improving Outlook

The outlook for RIAs depends on a number of factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. The one commonality is that RIAs are all impacted by the market.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth manager valuations are tied to the demand from consolidators while traditional asset managers are more vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations with cheap financing.

On balance, the outlook for RIAs has generally improved with market conditions over the last couple of months. AUM has risen with the market over this time, and it’s likely that industry-wide revenue and earnings have as well though year-end is still a high water mark for many RIAs. July has been kind so far, but who knows where the back half of 2020 will take us in a wild year for RIA valuations and overall market conditions.

RIA Valuation Insights

RIA Valuation Insights